The results of our “guess what the Stock Market will close at on the day after the election” contest are in!

We had almost 150 entries (I’m surprised there weren’t more – it was an easy way to win up to $500!).

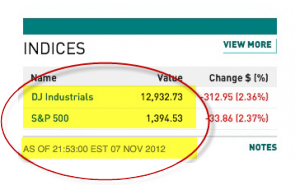

Most people who entered guessed high – often way high. And the range of guesses was enormous; the Dow closed at 12,932.70, but the guesses ranged from 10,000 to 16,000! Which points out the sheer unpredictability of the stock market, which has barely budged for the past 13 years. (Ready to say goodbye to the roller coaster ups and downs of stocks and other volatile investments? Request your FREE Analysis and find out how much your financial picture could improve if you added Bank On Yourself to your financial plan.)

And the winners were…

- Bill Liebler – who was within about 12 points of where the Dow closed – won a $250 Amazon Gift Certificate. I interviewed Bill in my New York Times best-selling book in chapters 7 and 10. Among other things, Bill uses Bank On Yourself to fund his daughter’s college education. To learn more about why Bill thinks Bank On Yourself beats using a 529 plan, UGMA or other government sponsored plan, check out this article and video.

- And Jim Vana was the other winner of a $250 Amazon Gift Certificate for coming the closest (within 1 1/2 points) of where the S&P 500 closed.

And thanks to all who participated!

Here were the simple contest rules…

1. Post your guess of what the Dow and/or S&P will close at, on Wednesday, November 7, the day after the election, in the comments box below.

2. The person who comes closest to guessing where the Dow actually closes will win a $250.00 Amazon.com Gift Certificate, and the person who comes closest to guessing where the S&P 500 closes will win a $250.00 Amazon.com Gift Certificate. You can take a guess on both indexes and win $500.00 if both of your entries come closest.

3. In the event of a tie, the winners will split the prizes(s)

4. Only one entry per person is allowed and be sure to include a correct email address, so we can send your Gift Certificate to you if you win (your email address will not be published).

5. Only U.S. residents over age 18 qualify to win

6. Your entry must be posted in the comments box at the bottom of this blog post by midnight, Wednesday, October 24, 2012 to qualify

Note: We’d also love to hear if you’re in the stock market or out of it now – and why – so feel free to add a comment about that when you post your entry in the comments box below, along with your guess for what the Dow and/or S&P 500 will close at on Wednesday, November 7.

Please note that all comments are moderated, which means there will be some delay before your entry/comment appears.

Are you tired of playing guessing games when growing your nest egg?

Keep in mind that Bank On Yourself is based on an asset that has grown by a guaranteed and predictable amount for more than 160 years – no matter what was happening in the stock and real estate markets. The growth is much greater then you can get today in a CD, money market account or annuity – but without the risk of stocks, real estate, gold, commodities and other volatile investments.

REQUEST YOUR

FREE ANALYSIS!

So if you want to stop rolling the dice on your financial future and find out what the guaranteed value of a plan custom tailored for you would be on the day you want to tap into it – and at every point along the way – request your FREE Analysis now to find out!

Well lets see….I will guess that the stock market likes OBama(can’t figure that one) and dislikes Romney soooo:

Dow Jones will be:12785.61 and the S&P will be at 1324.50.

Yes I don’t understand two things about the market…1) How can this market be so high when all finances in this country are so bad)

Obama to lose and stocks down.

Dow 12725.00

S&P 1312.00

Only 10% in stock market

Dow will close at 13,555

Dow==13200, S & P==1400

Post election. Dow 13,672, SP 1472, with all the turmoil I mostly out of the market.

S&P

1225

Dow 13,731.10

S&P 1,493.49

NOTE: I’m still in the stock market, but mostly out of the US dollar – holding very little in the US. I’m thinking about completely liquidating everything, but the “tax hit” is steep. If the market peaks and my portfolio recovers somewhat, then I may revisit the liquidation idea.

Dow will close at 12,945.51 and s & p will close at 1,401.35

obama wins dow closes 13000. s&p closes 1400

romney wins dpw close 13500 S&P closes 1450

A lot will depend on who gets elected. Not sure by the contest if it is the day after election close or opening of that next day, but assuming it is day after election close. If R/R win, then I’m probably low, if BO/JB win, then I think mine is correct. I’ve been of the belief that BO will get reelected since so many polls don’t factor in Gary Johnson and I think the Libertarians will get 10-15% of the vote, question is will it be taking from R/R or will it be split given how many young folks that voted for BO are disillusioned by his policies and lack of jobs.

Dow – 12945

S&P – 1355

Hope I win – $500 would go a long ways for Christmas shopping!!

Bill Liebler

13,500

On wednesday November 7, 2012; after the election, my guess is that the Dow will close at 13,785 and the S&P will close at: 1,473.

I am currently in the stock market because my company who I work for had an employee stock purchase plan and a 401k. I had both company stock and 401k plan. I currently putting about 10% to 15% of my income into the stock market and 30% to 40% of my income into a whole life insurance. No savings ,money market, and CD.

Pamela,

DOW will be 14,150 at close of November 7, 2012 trading session.

S&P will be at 1,878 at close of trading on November 7, 2012.

I hope I win.

Thanks,

Rich

DOW (Closing) Guess for 11-7-2012: … 13,991

Dow-13578

S&P-1477

Dow-1367

S&P will be down 36.27%

The DOW will close at 13,820.50 on November 7th the day after the presidental election.

My guess is that Dow will close at 12,750 on Nov 7th, 2012.

Pamela, I submit the DOW will slip below 10,000 the day after the US presidential election. Due to the unfortunate occurrence of citizen majority re-election of our current leader?

Dow 13,548.94, S&P 1,357.34.

DOW 13,629 S&P 1,485

Dow 13698

S&P 1489

This is positive thinking of Romney being elected and thinking they will bounce up with a brighter outlook.

With the advise of my new Bank on Yourself adviser, I moved my existing 401K funds out of the mutual funds and into a bond fund. When a friend of mine mentioned the 205 point drop in the Dow on Friday i just smiled. Not to worry.

Dow 13237 S&P 1399

My guess, and I do mean guess . S&P 1397.00 Dow 12,969.00 Steve

13752 Dow 1475 S&P

Dow = 13489

S&P = 1445

DOW 13,675

SPX 1,475

The Dow will close at 14984 and the S&P will close at 1522.

DOW 11665.25

S&P 1295.25

My estimate is

DOW 1700

S&P

1380

DOW 15,300

S&P 1,550

I think the DOW should be at 12760.12 and S&P should be 1296

Dow = 13,333 and S&P = 1333

The Dow will be at 13,800

Dow – 13,401.35

S & P – 1,356.19

S & P 1300

Dow 13000

1. If a retired person transfers their traditional ira to a roth ira and they do not have a roth ira, but are over 59 1/2, do they have to wait 5 years to access their tax-free gains from that ?

2. If someone can not have a roth ira because of their high income, so they do a non-deductible ira instead, can they then transfer this ira to a roth ira and wait 5 years and age 59 1/2 before they access the tax-free gains?

Dow: 14,017

S&P: 1417

I believe the Dow will close at 12.255, and the S&P 1200

Dow 14343 S&P 1533

BO wins – DOW – 13000

S&P – 1295

MR wins – DOW – 13500

S & P – 1350

Dow 13475

S&P 500 1460

DOW at 13,835 end-of-trading Nov 7

The Dow: 15,543.51

The S&P: 1633.43

Not in the market.

DOW will be at:

13008

S&P will be at:

1366

Dow will be 14445

S&P will be 1457

11,886

Dow will close at 10,000 and S&P will close at 1000.00

Ok Romney is the one!

DOW-13425

S&P 1212

Dow. 13801

S&P. 1461

BO wins

S&P 1201

DOW 11178

Dow = 13543

SP @ 1475—DOW @ 13581

The Dow will close at 14015 and the S&P will close at 1412.

The Dow will close at 13253.

The S&P will close at 1343

DOW: 13343

S & P: 1325

Dow – 1368.50

S & P 1,351.19

Dow at 12800. S&P at 1300

Romney/Ryan wins – Dow 13,714 S&P – 1477

On November 7 , 2012, the Dow will close at 14,500 and the S & P 1,375

DOW – 13278.49

S&P 500 – 1416.07

Dow — 14,572

S&P — 1133

… to cover both good and bad news of election results.

oct 2012 prediction after election dow-_ 13,200—–s&p 1450

Dow 14100

S & P 1520

dow 13500

s&p 1350

Dow – 13,152

S&P – 1,410

Dow 13,503

S&P 1,453

DOW: 13675

S AND P: 1375

DOW 13, 045

S&P 1339

My guess is Dow at 13522

S&P 500 at 1439

Not sure who the Presidential winner will be

My guess is:

Dow; 13000

S&P; 1433

Dow: 14019

S & P: 1319

Dow = 13,358.26

S&P 500 = 1415.90

Dow = 13512

S & P = 1462

DOW 14205

S&P 3282

Dow: 13,452

S&P: 1449

My guesstimates are

DOW: 14000

S & P: 1400

DOW; 13,325.43

S&P; 1335.70

DOW; 13,729 S&P;1,446

DOW: 12,900.50

S&P: 1,233.19

DOW 13,316.82

S&P 1,430.32

On Nov. 7, I think the indexes will be:

DOW: 12,920

S&P: 1320

Dow: 13,642.29

S&P: 1,486.17

DOW => 12000

S&P => 1200

DOW -13,671

S&P -1562

Dow………….13330

S&P…………….1432

Dow-13777

S/P-1477

Dow 13,610

S&P 1,478

Dow 13,270

S&P 1427

Dow——13850

S&P……..1500

DOW 11201

S&P 1302

Dow at 14175, S&P at 1487

Dow guess-14,010.51

S&P-1501.06

Dow will be at 11,111.00

S&P will be at 1,111.00

Dow will be 14,002.

S & P will be 1,506.

DOW will close at 13,802

S&P will close at 1472

DOW: 13,700

S&P: 1400

Dow at 12,337

S&P at 1,329

Obama wins, Dow down to 12,850 (gold up $75), S&P close at 1,350. i have stopped participating in the market…no need to!

Dow will close at 13,752 and S&P will close at 1473.

Gonna go LOW!

How about Dow closing at 12794 and the S&P at 1357.

Dow at 13,500

S&P at 1,400

Dow: 13,104.56

S & P: 1,247.53

DOW- 12745

S&P- 1352

Dow: 12,701

S&P 500: 1,365

Enjoy!

Dow 16000

S/P 1600

Dow 12500

S&P 1250

DJIA: 15,500

S&P500: 1,230

Dow 13235

S&P 1390

Dow: 13,742.33

S&P: 1,587.29

Dow: 11,240

DJIA: 14,855

S&P: 1,629

Dow: 12,837 S&P: 1,474

Dow – 12,510

S&P – 1330

Dow: 14,111, S&P: 1477

Dow 12,628 S&P: 1,344

DOW 13,622.55

S&P 1471.55

Dow 13275

S&P 1525

Dow 15000

S/P 1500

Dow: 13093.45 S&P 1446

Dow 13600 S&P 1487

Dow: 14,020

S&P: 1,424

Dow 12666

S/P 1158

Mike M. Says:

Dow: 12912.12

S&P: 1380.13

Dow 13422.62 S&P 1424.55

Matthew C :

Dow: 13479.37

S&P: 1521.73

Dow: 13,890

S&P: 1,540

Dow: 13,405

S&P: 1,249

Dow 13870

S&P 1386

Dow: 13,036

S&P: 1,397

Dow 13226.78

S&P 1496.67

Dow 12998.93

S&P 1398.93

Dow 12,101

S&P 1204.4

DOW 12,969

S&P 500 1396

Dow: 12,771

S&P:1323

Dow 13666

S&P 1366

Dow 13174

S & P 1424

Dow 13205

S&P 1480

Dow 12444

S&P 1327

Dow 13706

S&P 1484

Pamela – thanks for running context- my guess was based on a couple of factors – continued slow down in Europe, fiscal cliff scaring folks, risk of taxes going way up on capital gains, and that I thought Obama would be reelected. I hate being right about that last item, but hey I won $250!!!

Keep on putting money in BOY – it is the way to go