You can win one of six valuable prizes by participating in our “Test Your Money and Investing IQ” blog contest – just enter your answer in the comments box below by midnight Monday, November 14.

At a dinner party recently, I sat next to a retired business owner and we got into a conversation about money and finances.

In response to one of his questions, I mentioned an important principle of finance, at which point he turned to me and said, “I’m a CPA and an MBA and I’ve never heard of that!”

Actually, it’s fairly common that I meet highly educated people who are unaware of some of the really critical basics of how money and finances work.

Funny thing is that I think many of our subscribers know these principles, even if they don’t have alphabet soup after their names.

Applying a little logic and common sense (which is admittedly in short supply in our society today) is usually all that’s needed.

And to prove my point, I’m holding a contest to see how many of our subscribers can answer the questions below correctly.

If you answer even one of these questions correctly and/or insightfully, you can win a prize.

I know that people deepen their understanding more when they participate and articulate their thoughts, so I decided to “ethically bribe” you to take a shot at it by holding a contest.

Here’s all you have to do to enter the contest…

Just type in your answer to any one or more of the five questions below, no later than Monday, November 14, at midnight. If you want, you can comment on someone else’s answer to qualify to win.

After the contest ends, our team will pick the best entry (best because it’s correct, insightful, entertaining or a combination of those). That person will win a $100 Amazon Gift Certificate. And two runners-up will be chosen to receive their choice of a $25 Dining Gift Certificate, or a personally autographed copy of my best-selling book.

Three more winners will be chosen at random – all entries containing at least one correct answer will be entered into a random drawing for another $100 Amazon Gift Certificate and two prizes of your choice of a $25 Dining Gift Certificate or autographed book. (Sorry – U.S. residents only.)

Although there are five questions, you don’t have to answer all of them to qualify.

So test your money IQ now by answering as many of these five questions as you want:

If you finance a $30,000 car through a finance company, your actual cost for the car is the money you spend on it, plus the interest you pay, less the value of your trade-in at the end of your loan repayment period.

If you finance a $30,000 car through a finance company, your actual cost for the car is the money you spend on it, plus the interest you pay, less the value of your trade-in at the end of your loan repayment period.

Question: If you pay cash for a car, what’s your actual cost for the car?

If you have a $20 stock and it goes up by 40%, how much money did you make on that stock? (Hint: This is about a key financial principle, not a math question.)

If you have a $20 stock and it goes up by 40%, how much money did you make on that stock? (Hint: This is about a key financial principle, not a math question.)

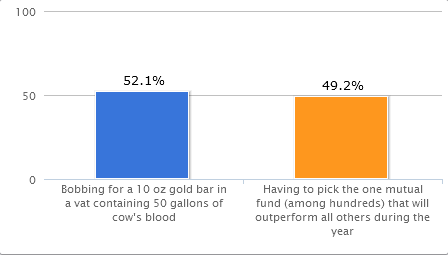

According to Morningstar, Inc., the top-performing mutual fund for the last decade (ending December 31, 2009) enjoyed an 18% annual return.

According to Morningstar, Inc., the top-performing mutual fund for the last decade (ending December 31, 2009) enjoyed an 18% annual return.

However, the typical investor in that fund wasn’t so fortunate.

Question: What was the annual return of the typical investor in that top-performing fund? And why was their return so different from the return reported by the fund?

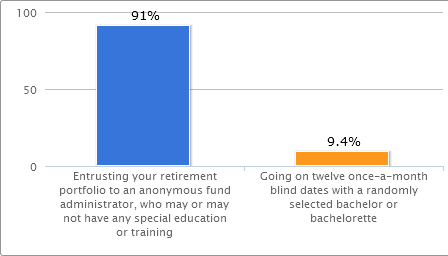

What percentage of mutual funds, financial representatives and investment advisory services underperform the overall market? And why?

What percentage of mutual funds, financial representatives and investment advisory services underperform the overall market? And why?

You could have $10,000 in a mutual fund that reports an average annual return of 25% for four years… and at the end of the fourth year end up with only the $10,000 you started with.

You could have $10,000 in a mutual fund that reports an average annual return of 25% for four years… and at the end of the fourth year end up with only the $10,000 you started with.

How is that possible?

So there you have it – just answer one or more of these questions, or comment on someone else’s answer, no later than midnight, Monday, November 14, to get in the running to win one of the six prizes!

We’ll announce all the winners in a blog post later this month.

So scroll down to the comments box below and start typing! (Note – all comments are moderated, so there will be some delay before your comment appears.)

Former teacher Ed Ingle and his wife decided to take a policy loan to do some home improvements soon after starting a Bank On Yourself policy, “Just to see how this whole loan thing worked. It was so easy that now we laugh at the idea of trying to understand the process. There is no process. It’s our money!”

Former teacher Ed Ingle and his wife decided to take a policy loan to do some home improvements soon after starting a Bank On Yourself policy, “Just to see how this whole loan thing worked. It was so easy that now we laugh at the idea of trying to understand the process. There is no process. It’s our money!”

With more than 500 responses in so far to

With more than 500 responses in so far to