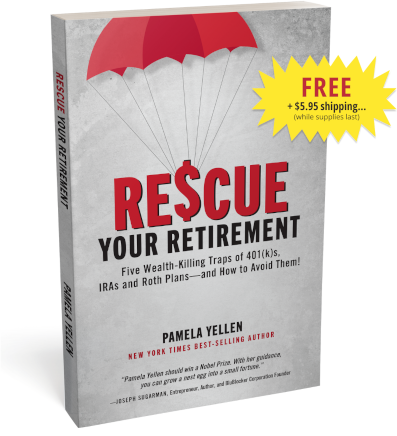

Original price was: $14.95.$0.00Current price is: $0.00.

Five Wealth-Killing Traps of 401(k)s, IRAs and Roth Plans—and How to Avoid Them

This eye-opening book reveals why your life in retirement will likely last longer than you think it will, cost far more than you’ve planned for, and why you need to take a different approach to avoid outliving your money.

I’m so convinced this concise book could keep your retirement dreams from turning into retirement nightmares that I’m giving it to you for free—while supplies last. All I ask is that you pay a small shipping and handling fee of $5.95, since the post office doesn’t give us free shipping. (Limit one per household; available to US addresses only)

Description

Retirement Dream or Retirement Nightmare?

It’s a fact: Conventional retirement plans—think 401(k)s, IRAs, 403(b)s, Keogh and Roth plans—have failed to deliver financial security and peace of mind to most of us. Want proof?

- The average 65-year-old is going to outlive their savings by almost a decade, according to the World Economic Forum

- The typical household nearing retirement has only about $185,000 in their combined retirement accounts—enough to provide them at most $800 per month, according to an analysis of the Federal Reserve Survey of Consumer Finances. And most folks have little or no retirement savings outside of these plans and their home equity

- Even healthy 65-year-old couples face an average of $560,000+ in out-of-pocket health care costs not covered by Medicare

- A growing chorus of experts call the 401(k) a failed experiment

Not that long ago, 80% of workers enjoyed a company pension plan that promised them a retirement check every month for as long as they lived. Today, less than 15% of workers have that perk.

And the rest of us? We’ve been forced to rely on government-controlled, do-it-yourself, Wall Street-based hope-and-pray plans—with disastrous results.

Is It Too Late to Rescue Your Retirement?

In this eye-opening book, financial security expert, consumer advocate, and New York Times best-selling author Pamela Yellen reveals …

- How high fees, the stock market roller coaster, and tax time-bombs are devouring your hard-earned retirement dollars

- How lack of control and access to your savings can ruin your best-laid plans

- Why you’ll likely spend more years in retirement than you think you will, why those years will cost you far more than you’ve planned for—and why you need to take a different approach to avoid outliving your money

Most important, in this concise book, you’ll discover what you can do differently—starting today—to rescue your retirement and enjoy the financial security and peace of mind that have escaped you until now!

Here Are Some of the Dirty Little Secrets of Conventional Retirement Plans Revealed in the New 2nd Edition of this Book:

- Why your 401(k) employer match isn’t really “free money” at all (page 11-12)

- Why you’re likely to end up in a higher tax bracket in retirement – and a little-known way to (legally) pay zero taxes on the income you take in retirement (pages 53-56)

- Why you need to plan for your money to last until at least age 95 to 100 – and how to guarantee your money lasts as long as you do no matter how long you live (pages 14, 66-68)

- How even seemingly low annual fees you pay in your 401(k) or IRA can devour 30-50% of your account value over time (pages 57-61)

- 3 reasons you should NEVER let your employer choose where to invest your 401(k) funds. 90% of employers today automatically choose where your money is invested unless you specifically tell them otherwise. (pages 36-38)

- Why the typical 65-year-old couple retiring today will likely need over $565,000 – just to cover out-of-pocket medical expenses Medicare doesn’t pay (pages 15-16)

- 3 reasons the man who invented the 401(k) says it’s become “a monster that should be destroyed,” and the surprising place he now puts most of his own money (pages 10-11)

- How to legally avoid paying taxes on up to 85% of your Social Security benefit (this strategy can also reduce your Medicare premiums by up to two-thirds) (pages 55-56)

- The little-known way to access significant dollars to pay for care you will need if you develop a debilitating or chronic illness (pages 64-66)

- And much, much more!

Additional information

| Maximum Purchase: | 1 per household |

|---|---|

| Edition Date: | 2024 |

| Paperback: | 76 pages |

| Publisher: | Strategic Education Technologies, LLC |

| Refund Policy: | Books may be returned for any reason within 30 days for a refund, less shipping & handling. |

| Shipping: | Total shipping and handling rates: – 1 copy $4.95 All orders are shipped within 3 business days. Orders ship via USPS Media Mail. Available to U.S. addresses only. |