Taking Control of Their Money

Bank On Yourself puts Fort Worth couple on path to their goals

Like many people David Shelton contributed to his 401(k) plan at work, and was frustrated to see the stock market, and his portfolio, “swinging like a roller coaster.” But there was more to his decision to find a new way of saving

money.

“I work in a smaller company and had ‘over-contributed’ to my 401(k),” said Shelton, vice-president of a Fort Worth, Texas, healthcare company. “They sent me a check back for several thousand dollars because my contribution exceeded the amount allowed.

I realized that I had very limited control of my money, I could not put in as much as I wanted, I needed company permission to ‘borrow’ if necessary, and only for certain circumstances. It’s my money and I didn’t want to have to ask someone else for permission to use it.”

Through a weekly e-magazine at his work he heard about Bank On Yourself, the New York Times Bestseller by financial security expert Pamela Yellen. Shelton ordered the book, read it in a couple of days, and through the Bank On Yourself website was referred to Professional, Teresa Kuhn.

That was 15 months ago and Shelton and Mary, his wife of 25 years, now feel they have control over their savings.

Bank On Yourself uses specially designed dividend-paying whole life insurance policies to create secure savings plans. The policy grows by a guaranteed and pre-set amount every year. The growth is exponential, meaning it gets more efficient every year the policy is held, providing peak growth at the time most people need it most — retirement.

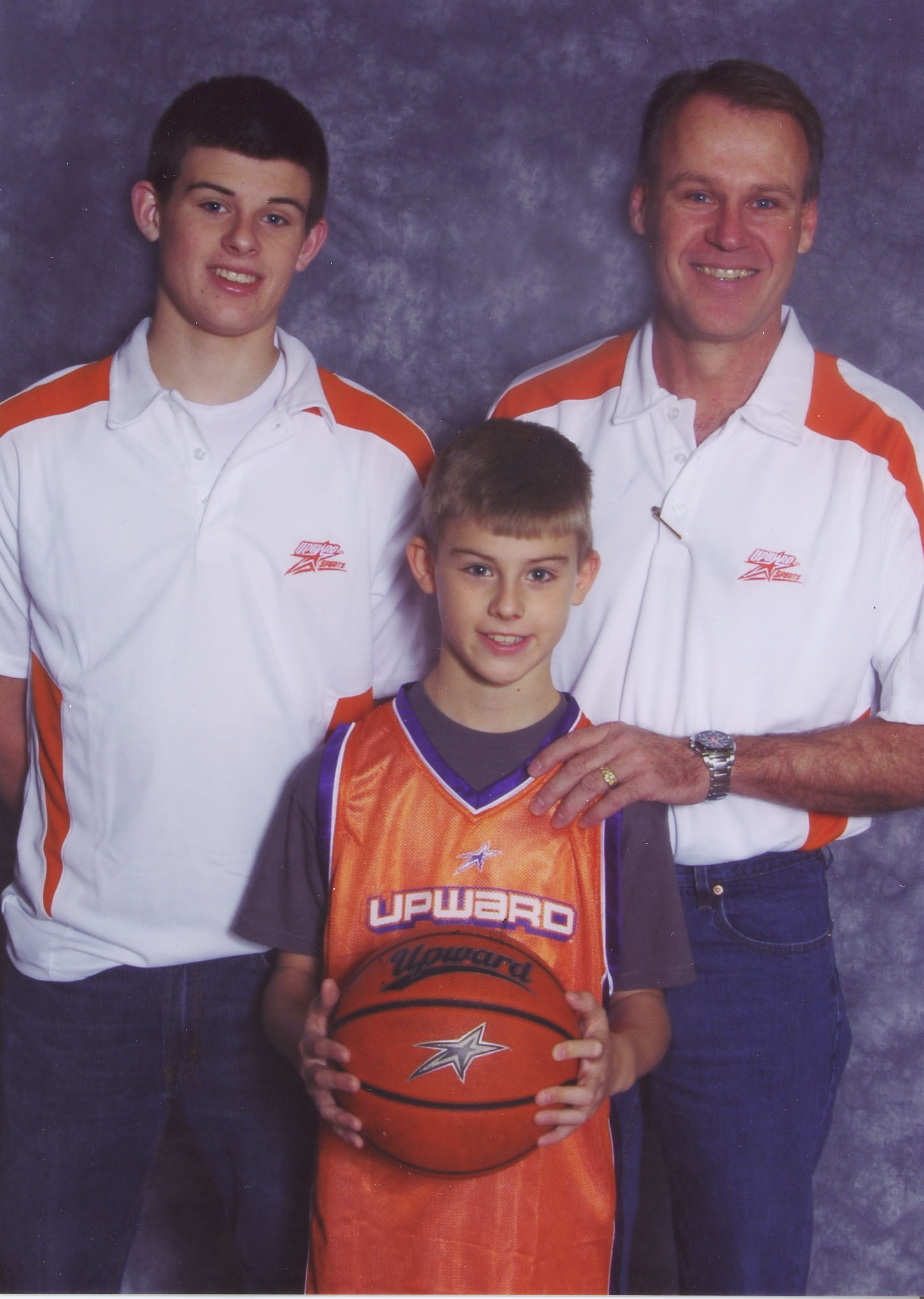

Saving for retirement was the Shelton’s primary goal; getting out of debt was a secondary goal. The Sheltons have a daughter, 20, and sons ages 10 and 15. They wanted a way to pay for their sons’ private school education in one installment to take advantage of a discount. Through Bank On Yourself they are planning for all these expenses, and financed a new car through the policy.

“Because we had been in the plan only 12 months, our borrowing capacity was limited,” he says. “However, we are able to borrow against our cash value to quickly pay off the balance of the vehicle we purchased. We’ll have a clear title in 1.5 years – much faster than would have been possible otherwise.”

Kuhn, their Bank On Yourself Professional, worked with them to help structure a Bank On Yourself policy that meets their needs. They are paying themselves back the money they borrowed for the vehicle instead of paying it to a bank, and are making plans to pay for their sons’ private schooling as their next strategy.

Before putting their savings into a Bank On Yourself policy, they felt they were investing in risk with little control over their money. Today the opposite is true.

Now we are working a long-term savings plan, while still having the flexibility to put our money to work today”