The words in blue have been added to help clarify parts of the letter that might be confusing to someone stepping into the middle of a long chain of correspondence.)

Hi Allan,

I hope I can be helpful in addressing your questions. After reviewing the email exchanges that you provided between you and Professional John Smith*, I think I understand where the confusion arises.

In simplest terms, it appears John provided you illustrations in a sincere effort to address your queries, but he must not have fully understood just what you were asking. John’s illustrations don’t address your main question regarding how to optimally apply the Bank On Yourself method to recapture the money you (as a presumed policyholder) spend on big ticket items.

In fact, I’m not entirely certain what John’s illustrations intend to illustrate, but since they raised additional questions in your mind, let me first try to address those. Life insurance companies don’t ever illustrate the effect of loans on the guaranteed side. So, let’s focus on the non-guaranteed side, which is allowed to illustrate the effect of loans. It will be helpful to have the email you sent John on the evening of October 9 in front of you (from the correspondence you sent me), as well as the two illustrations.

Your concern is that you paid $12,000 more in the illustration showing loans than you paid in the illustration showing no loans, but cannot see where you have gained back all of that $12,000.

The answer to this question comes in two parts:

Part One:

Of that $12,000, only $8,084 (the number you wrote on one of the illustrations) is premium you’re putting in over and above the interest the insurance company is charging you for the two loans.

The additional cash value that shows up in year 12 on Page 11 of the illustration showing you taking loans is $9,832 (per your own calculations) . It was generated from the additional premium you paid in years 6 and 10 (totaling $8,084), plus $1,748 that you earned on that additional $8,084 that you paid ($9,832 – $8,084 = $1,748).

I think most people would agree that $1,748 is an excellent return on the $8,084. And that continues to compound past year 12. In fact, it compounds impressively for the life of the policy.

You jotted down the name of the Bank On Yourself policy design expert who created your illustration, so I had a conversation with him about the growth over time of that $8,084 of extra premium in your policy, because it is such an integral part of this method. He found that the $8,084 of additional premium you paid shows up as a cash value increase of $31,151 when [your wife] is age 90 (and there’s a good chance she will live that long). If [she] lives to age 100, the increase in cash value is $45,198.

Part Two:

To calculate that cost, you simply deduct the additional, optional premium you paid of $8,084 from the $12,000 total additional money you paid, which is a difference of $3,916. That $3,916 represents the total actual interest you paid to the company for the two loans you paid back over eight years.Now let’s talk about your actual borrowing costs for those two cars. And to compare apples to apples, we have to assume you’re buying those two cars one way or another.

However, you actually recouped that $3,916, because you continued to receive the exact same dividend that you would have received had you not taken any loans. That you recouped that amount becomes clear when you compare an illustration that shows you withdrawing the money (so it earns no dividends) against one where you’re borrowing the money.

And the proof that you receive the same dividend is found by comparing Page 7 of the two illustrations you have side-by-side and looking at the column labeled “Annual Dividend,” where you see you received the exact same—or better—dividends, when you borrowed from the policy as when you did not. (This occurs with a non-direct recognition company —like the company used for your illustrations —which does not “recognize” you’ve taken loans when crediting dividends.)

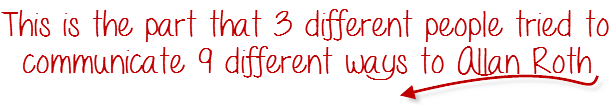

“Part Two” is the part that Allan Roth repeatedly ignored, because his “argument” and “logic” only work if he compares using the policy to finance a car, against not buying a car at all.

It’s really quite easy to see how Roth’s $12,000 grows to $13,748. Roth’s total payment of $12,000 ($8,084 in premium plus $3,916 in loan interest) results in a total increase by Year 12 of $13,748, calculated as follows:

$9,832 – Cash value increase

+$3,916 – Full dividend (not reduced, even though he has a policy loan)

$13,748 – Total growth on $12,000

– $12,000 – Total paid

$1,748 – Profit (increase)

Roth actually gains $1,748 on the additional premium and loan interest he pays in.

We explained this over and over again to Roth. The Professional explained it. Pamela Yellen explained it. And the insurance company explained it. But Roth insists on ignoring “Part Two” and comparing buying cars using his policy to not buying the cars at all. Why? Because that’s the only way his argument will work!

It seems pretty clear to us. To have the most money in your pocket, don’t buy a car! Take the bus. But if you are going to buy a car, nothing is more financially savvy than banking on yourself, using a Bank On Yourself policy loan.

So What’s the Real Cost of Buying a Car?

There’s one more critical factor we must take into account —and that’s the cost of money, or the “lost opportunity cost,” which I’m sure you’re familiar with.

What’s the real cost of a $30,000 car? It’s never just $30,000. It’s $30,000, plus the interest you pay on a loan, OR it’s $30,000 plus the interest or investment income you lose on your money by directly paying cash, instead of keeping it invested.

If you took the $30,000 to buy a car from a savings account, the bank wouldn’t continue paying you interest on the money you withdrew. And if you finance it through a finance company, you lose all the interest you paid.

By using your policy to finance the car instead, you continue to receive the same dividend on the money you borrowed. And the interest you paid is recouped through the un-reduced dividend, as I explained in detail above.

Now to address the original question you posed to John about the “how to get back every penny” benefit derived from following the Bank On Yourself method. To clarify, I am not —and nor is Bank On Yourself, the company —a licensed insurance agent/agency. I don’t sell policies and my company never generates illustrations. When prospective policyholders do receive a formal illustration, it is generated by the insurance agent or by a separate company that trains and supports the Bank On Yourself Professionals.

I expand on the “get back every penny” concept at length in my book as a process of avoiding the traps of the conventional ways of making major purchases by first saving up for them in a carefully crafted dividend paying whole life policy. By then repaying your loans to the policy, they are available for you to use for subsequent purchases and/or to fund your retirement —without the volatility or unpredictability of traditional investment vehicles.

[My book] contrasts the Bank On Yourself method with conventional financing methods. Example: If you finance a car through a dealer, at the end of the loan payback period you have your car, worth whatever its trade-in value is. If you lease it, you turn your car back in at the end of the lease and have nothing to show for your payments.

If you use the method described in my book, at the end of the loan repayment period you have your car, and the money you paid for your car is back in your policy, available for you to use again. (And your policy continued earning you the same growth the whole time, even on the dollars that weren’t there.)

The Bigger Picture

This is a concept that encompasses human behavior, savings habits, lifestyle changes, understanding the difference between saving and investing, and a way of having more control over your money and finances. It was never intended to be reduced to an illustration.

This method gives you a key additional advantage unique to life insurance —the death benefit. While no amount of money can truly compensate for the loss of a loved one, the fact remains that if you move your focus on the illustrations one column to the right of the cash values column, you can see how much the death benefit is growing as well. You could choose to completely ignore the value of the death benefit, but it is a valuable benefit no other financial product besides life insurance can provide.

It appears that, in your personal quest for an alternative to Wall Street, you’ve focused all your attention on this one marketing sound bite (“get back every penny”), while speeding right past the mission and scope of the entire book and method.

It might be analogous to me having a Ph.D. in Education scrutinize your book, “How a Second Grader Beats Wall Street”, and evaluate the book’s claimed benefits available to all 8- year-olds. I suspect that wasn’t your intention, either.

Read in its entirety, our book makes clear what we promise, and states consistently that Bank On Yourself is not a “magic bullet.”

In the end, the proof is evident in the results. People who read my book, meet with a Bank On Yourself authorized agent, and then become policyholders are overwhelmingly satisfied with their decision and the financial flexibility and security they achieve.

Sorry about the length of the letter. You clearly invested some time into this, so I wanted to extend you the courtesy of a detailed response. If you have additional questions, I’m happy to answer them. Thank you for giving me the opportunity to reply.

Regards,

Pamela Yellen, President Bank On Yourself

*To protect the privacy of the Bank On Yourself Professional who assisted Mr. Roth, we are calling him John Smith in this reprint. That is not his real name.