Many people will say they’re proud to be citizens and pay their taxes. But, they will probably admit, they could be just as proud while paying half the taxes.

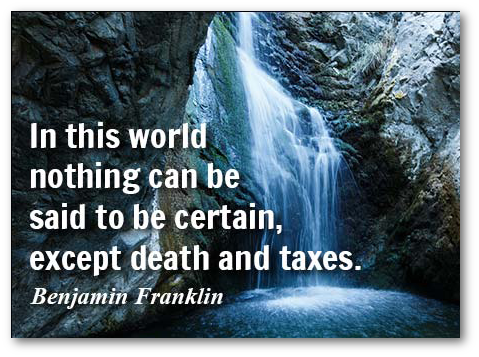

And so we consider the tax consequences of virtually everything we do. We worry about the so-called “marriage tax,” the death tax, sales tax, value-added tax, flat tax, progressive tax. And perhaps the most taxing issue of all is the Internal Revenue Service. No other branch of government inspires as much fear as the IRS.

Straight Talk About the Tax Advantages of Life Insurance

Taxation of life insurance premiums

Generally, life insurance premiums are not tax deductible. You pay premiums with after-tax dollars, the same type of after-tax dollars you use to pay for the other necessities of life, such as shelter and Oreo cookies.

Tax advantages of life insurance living benefits

This is where it really gets good:

1 Cash Value: If you have permanent life insurance—the kind that builds cash value (as opposed to term life insurance, which has no cash value)—that cash value grows tax-deferred until the policy is surrendered or you let it lapse. (So you don’t want that to happen!) If you do surrender your policy and the amount you get back—your cash value—is more than you’ve paid in premiums all those years, then you pay tax on the difference.

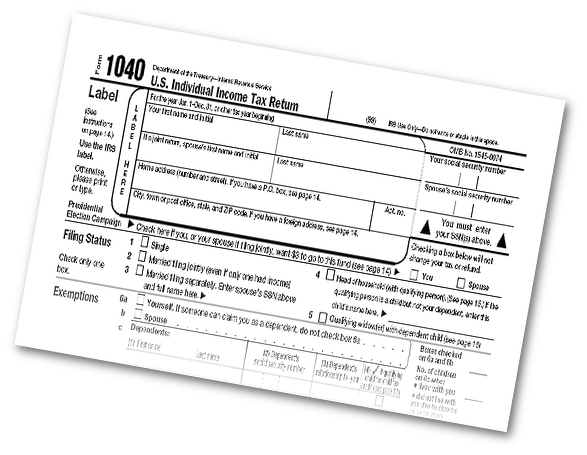

An example makes that real simple: Say you’ve paid a total of $64,000 in premiums over the years for your $250,000 whole life insurance policy. Meanwhile, your cash value has grown to where it’s now $78,000. You surrender your policy for some reason.

You’ve paid $64,000, and you get $78,000 when you tell the company you’re calling it quits. That’s $14,000 in “income,” isn’t it? Nice! Only now, Uncle Sam wants his share. You’ll have to add that $14,000 to your ordinary income and pay income tax on it when you do your taxes next April.

On the one hand, that’s only fair—you did have the income, after all. But on the other hand, you don’t want to have to pay the tax. So read on!

2 Policy Dividends: If your policy pays a dividend (and companies recommended by Bank On Yourself Professionals have paid dividends every year, for more than a century), those dividends are not taxable, until the total of all the dividends you’ve received exceeds the amount of the premiums paid for the policy.

But if you let the dividends accumulate at interest, you’ll pay tax on the interest each year, the same as you would on interest you earn on your passbook savings account at the bank—you know, the interest you need a magnifying glass to see.

But if you let the dividends accumulate at interest, you’ll pay tax on the interest each year, the same as you would on interest you earn on your passbook savings account at the bank—you know, the interest you need a magnifying glass to see.

3 Policy Loans and Withdrawals: As we said earlier, you can borrow against the cash value of your life insurance policy. If you borrow $50,000 of your cash value, you don’t pay tax on the money you borrowed. (Same as if you borrow from the bank to buy a car. You don’t have to pay tax on the money you borrowed.)

Not only that, but you can withdraw cash from your cash value tax free until you’ve withdrawn as much as you paid in premiums. After that, your withdrawals become taxable income.

Naturally it makes sense that if you owe on a loan when you pass away, the amount your beneficiary receives will be reduced by the amount of your outstanding loan balance. And, of course, you can’t withdraw the same dollar twice: If you withdraw money from your policy, that will reduce both the death benefit and the cash value available for use.

And we need to point out that tax laws could change. Typically, when tax laws change, existing arrangements are “grandfathered in.”

[Download a free Report here that reveals how a little-known type of high early cash value, low commission whole life policy lets you fire your banker, bypass Wall Street and take control of your own financial future. You’ll also get a free chapter from Pamela Yellen’s New York Times best-selling book on this subject.]

4 Death Benefit: Perhaps the biggest tax break is that the death benefit of a life insurance policy is paid to your beneficiary income tax free. Doesn’t matter if it’s a paltry $100,000 or a hefty $5,000,000. It’s income tax-free. (You do have to die for them to get the money, of course, but then, you were going to do that anyway … just not right away.)

Can you see what a tremendous wealth-transferring opportunity this is? A great way to give significant sums of money (think legacy) to your children, grandchildren, or favorite charities is to make them beneficiaries of your life insurance policies.

Get instant access to the FREE 18-page Special Report that reveals how super-charged dividend paying whole life insurance lets you bypass Wall Street, fire your banker, and take control of your financial future.

It’s really straightforward: Grandpa or grandpa passes away, and the darling grandchildren (maybe even great-grandchildren) find their wealth increased—but not their income tax!

Your beneficiary might be a charitable organization. Charities absolutely love being beneficiaries of life insurance policies. Your lodge, your church, temple, or synagogue, an organization researching a cure for a disease or malady, or one committed to saving whales—you can leave your legacy to any one (or several) of your favorite charities.

No income tax due on life insurance death benefits! How marvelous is that?

So, one of the benefits of owning life insurance is that you can create a legacy for your beneficiaries—your favorite charity, your favorite niece, and so forth. An even greater advantage is that your favorite niece won’t have to share the money with her least-favorite Uncle (Sam) in the form of income tax.

Get instant access to the FREE 18-page Special Report that reveals how super-charged dividend paying whole life insurance lets you bypass Wall Street, fire your banker, and take control of your financial future.

How to Get Money out of a Whole Life Insurance Policy Tax-Free

Here’s how to make the current tax laws work to your advantage:

- Borrow against your cash value any time you need money, but pay your loan back. Think of it as paying yourself back. That way the money is there to be used again and again. And there are no taxes due on loan proceeds.

Need money for a new car or a dream vacation? Want to add a room or buy business equipment? Borrow from yourself, not your banker, up to the limits determined by your cash value, which acts as collateral.

When you borrow, if you have the right kind of whole life insurance policy, the money you borrow will continue to grow, just as though you never touched a dime of it! (The technical name for the right kind of policy is a non-direct recognition policy.)

Many parents help finance their children’s college educations this way. There are sound reasons to borrow against your policy, rather than saving up in a government-controlled 529 plan. Learn more about that in this article.

Just don’t borrow more than you can pay back. Why? You want your cash value to be there to help keep up your lifestyle in retirement!

- As you plan for retirement, when your loans are paid back, your insurance agent can help you manage your cash value in retirement. He or she will show you how to:

a. Make systematic withdrawals during retirement, to augment your retirement income. You’ll stop making withdrawals when you have withdrawn as much as you originally paid in premiums. In this way, no income tax will be due, under current tax law.

b. Then you switch to loans. Loans are tax free, if you pay them back. And no tax is due if you have loans outstanding when you pass away. Why? Because the first thing the insurance company will do when notified of your death is draw off just enough from the death benefit to pay the loan back.

So in summary, you retire and take periodic tax-free withdrawals, down to your basis—in essence, withdrawing all the premiums you paid in previously. Then you switch to tax-free loans, and live off the loan proceeds. When you pass away, the company pays back the loan for you and gives the remaining death benefit to your beneficiaries. A Bank On Yourself Professional can show you in writing exactly how this works.

Hundreds of thousands of individuals and families have set up plans using this strategy, and their only regret is that they didn’t know about this strategy sooner. Now is the time for you to get a free analysis and recommendations for your situation from a Bank On Yourself Professional.

REQUEST YOURFREE ANALYSIS!

Summing It All Up

A properly-designed dividend-paying whole life insurance policy provides a combination of guarantees, growth, and tax advantages you won’t find in any other financial product. And a Bank On Yourself-style policy gives you the ultimate combination of guarantees, growth, and tax advantages. Take the $100,000 Challenge, and if we’re wrong, we’ll pay you a cool 100 Grand.

Continue to the Table of Contents for the No-Nonsense Life Insurance Guide