With so much uncertainty in the economy and the stock market, people have been asking us how the Bank On Yourself method will hold up under various economic scenarios. So, I thought you may find it helpful to have the answers to these seven commonly asked questions…

- How safe is my money in a Bank On Yourself-type dividend-paying whole life policy?

- What do the companies recommended by Bank On Yourself Professionals invest in to protect and grow my money even in volatile times?

- How would a decline in the dollar affect this strategy?

- How will Bank On Yourself policies hold up if we have high inflation?

- How will Bank On Yourself be affected if deflation becomes a problem?

- Will I miss out if I put money in a Bank On Yourself policy and the stock market booms?

- What if I lose my job and can’t pay my premiums?

Here are the answers to these timely questions:

1. How safe is my money in a Bank On Yourself-type dividend-paying whole life policy?

The companies recommended by Bank On Yourself Professionals are among the financially strongest life insurance groups in the world. They are, in essence, owned by the policy owners, which lets them focus on the long-term best interests of the policy owners, rather then the short-term demands of Wall Street.

The Professionals use companies that have paid dividends every single year for more than 100 years, including during the Great Depression.

Life insurance companies are strictly regulated and have four layers of protection:

- They are audited regularly by the state insurance commissioner’s office (sometimes by dozens of states), to ensure they maintain sufficient reserves to pay future claims and are on solid financial ground

- If a company gets into financial difficulty, the state insurance commissioner’s office can take over and run the company in the interests of policy holders. Historically, a failed insurer’s business is then taken over by another company

- Most insurance companies are audited regularly by several independent rating companies

- Additional policy owner protections may be available on a state-by-state basis

2. What do the companies recommended by Bank On Yourself Professionals invest in to protect and grow my money even in volatile times?

- The majority of their portfolio is invested in investment-grade fixed-income assets

- Less than 1-2% is invested in U.S. Treasury or other government debt

- Their bond portfolios are well diversified across many industries and companies, with no investment representing more than 1% of assets

- Due to their financial strength and reserves, they have the ability to hold on to any assets that may decline in value for many years until they recover

- They had virtually no exposure to the risky investments that caused the market meltdown of 2008

- They are masters at under-promising and over-delivering and have NEVER missed paying an annual dividend to policyowners for more than 100 years, including during the Great Depression!

Every plan is different. Yours would be custom tailored to your unique situation, goals and dreams. To get a referral to a Professional who can show you what your bottom-line numbers and results could be with Bank On Yourself, request a free Analysis here.

REQUEST YOURFREE ANALYSIS!

3. How would a decline in the dollar affect this strategy?

No one knows for sure what direction the dollar will go. The current economic environment can change any time, and it can turn on a dime, as it has in the past. We are a global economy, and the actions of other nations impact us, as well.

In an article from MoneyCentral when the dollar was taking a beating in 2009, it was reported that central banks in numerous Asian countries were “actively buying dollars to check its fall against their currencies.”

Why do you think they would do that?

The reason given is that their exporters “can’t handle a drop in profitability and competitiveness,” if the dollar drops too far. Their prosperity has been in part due to a strong dollar, and “they aren’t going to give up all that easily.”

And when the dollar was weak in 2011, Bloomberg.com reported, “a weak dollar may be one of the bright spots in the U.S. economy, and it could be the gift that keeps giving.” The article spelled out several ways the U.S. benefits from a declining dollar.

The point being that it’s not a black-and-white issue and no one can accurately predict what will happen, except that it probably won’t be what you imagine.

Since you must “park” your money SOMEPLACE, you would be hard pressed to find a safer, more advantageous place to put your dollars – in good times or bad – than in a Bank On Yourself-type policy. These policies have survived and even thrived for over 160 years in virtually every economic situation imaginable!

As long as your money is sitting safe and liquid in a dividend-paying whole life policy, it doesn’t take away any of your options, does it?

If you still think you have a better solution than Bank On Yourself, why not test it out by taking the $100,000 Challenge? If you’re right, you could pocket an easy $100K.

4. How will Bank On Yourself policies hold up if we have high inflation?

The insurance companies recommended by Bank On Yourself Professionals have much of their assets in long-term investment-grade fixed-income assets like corporate bonds. When inflation drives up interest rates, bond interest rates typically increase, which can increase policy dividends as well. This is precisely what has happened during high inflation periods in the past.

It’s interesting to note that since 1920, according to Federal Reserve Economic Data, corporate bond yields have almost always been higher than inflation.

In addition:

- Bank On Yourself gives you an advantage over traditional investments, where you may not only lose the purchasing power of your money, you could also lose some or all of your hard-earned dollars, if the value of your investment tanks.

- One value of having money in a whole life policy is that you HAVE the money, it is guaranteed to continue to grow, and it will be available for you to use when you need or want it.

- Bank On Yourself policies are designed to become more efficient every single year. The growth of both your cash value and the death benefit is guaranteed AND exponential, which in itself gives you some protection against inflation on both accounts.

Compare that with the term insurance policies so many financial “gurus” recommend – your death benefit stays level, which means it loses real value every single year.

Example: If you buy a $250,000 20-year term policy at age forty, and inflation averages only 4% a year during that time, your policy would lose 56% of its value. Your family would get less than half of what you signed on and paid for!

Plus, you’ll have nothing at all to show for the premiums you paid, unless you happen to die during the term of the policy (and studies shows only 1% of term policies ever pay a claim).

- Your premium in a Bank On Yourself-type whole life policy is fixed for life – it will never increase. So if inflation does become a factor, you’ll be paying premiums with ever cheaper dollars

Grow Your Wealth Safely Every Year – Even when Markets Tumble

Would you like to see what your bottom-line guaranteed numbers and results would look like if you added a custom-tailored Bank On Yourself policy to your financial plan? Simply request a free, no-obligation Analysis to find out. You’ll also get a referral to a Bank On Yourself Professional who can answer all your questions.

REQUEST YOUR

FREE ANALYSIS!

5. How will Bank On Yourself be affected if deflation becomes a problem?

In a deflationary environment, income is king. So, investors would be struggling to find safe, dependable sources of income. Which means top-quality corporate bonds which provide that income – and which make up a major portion of an insurers portfolio – would boom.

Bonds do well in a deflationary environment because as interest rates decline, the higher interest being credited on existing bonds become more valuable. The companies used by Bank On Yourself Professionals are some of the financially strongest life insurance groups in the world.

They have the reserves to be able to hold bonds until maturity, if necessary. So (older) bonds with a higher interest rate help offset (new) bonds that may be purchased at a lower interest rate.

Key Point: It’s important to remember that the guaranteed cash values will continue to grow – and the growth gets better every year.

6. Will I miss out if I put money in a Bank On Yourself-type policy and the stock market booms?

If you crave the adrenaline rush you get from the volatile roller coaster ride of stocks and other investments, the safe and predictable growth of Bank On Yourself may bore you silly.

We live in an instant gratification society and some people are looking for a quick fix or magic bullet – they want something they can put under their pillow before they go to sleep at night and wake up rich in the morning.

Well, other than a winning lottery ticket, for most of us, it ain’t gonna’ happen. How many more investment bubbles have to burst before we (really) learn that lesson?

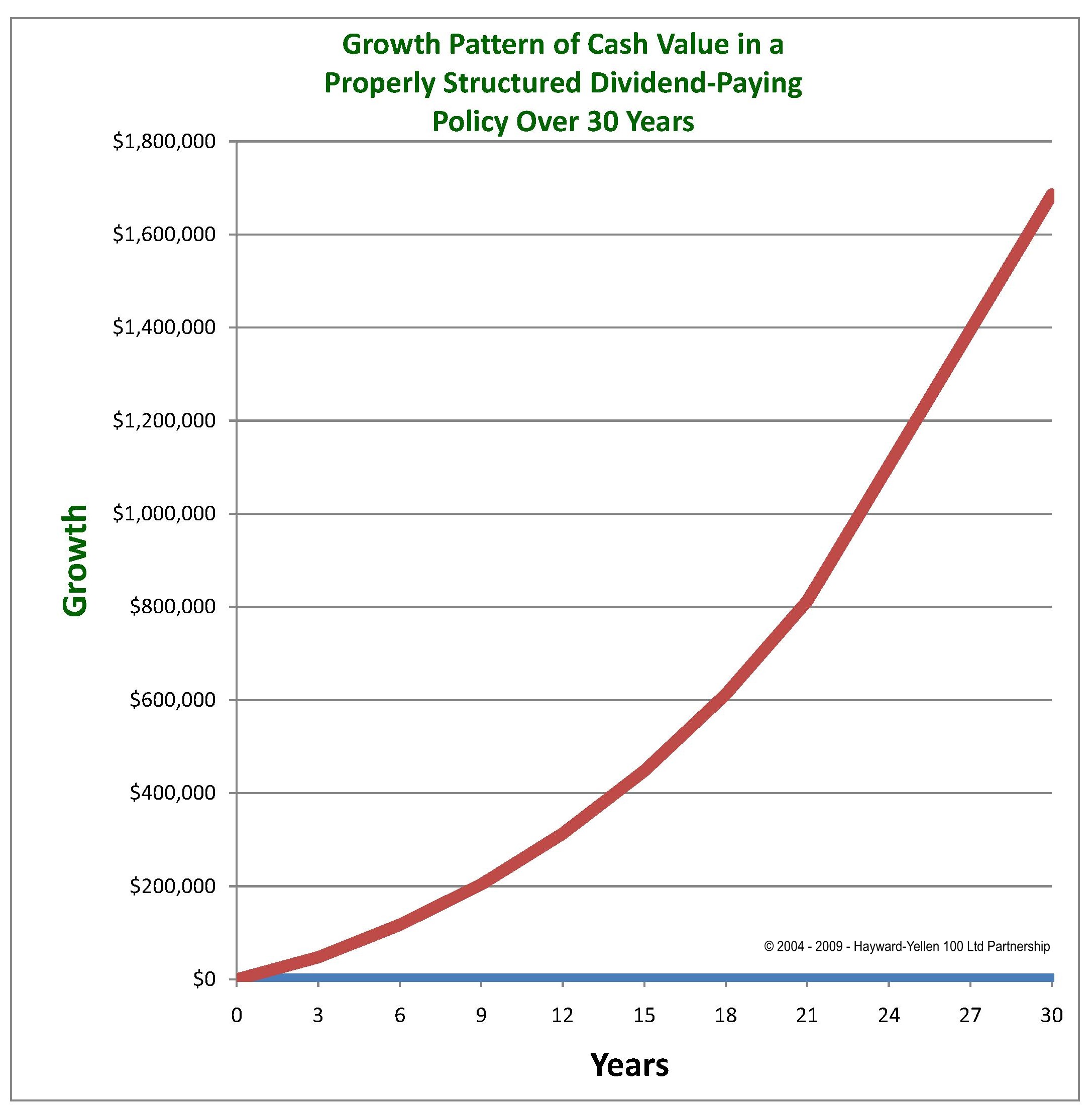

The chart below shows the growth curve in a typical Bank On Yourself–type policy. It’s based on the actual growth I’ve received in one of my own polices so far, along with the projected growth based on the current dividend scale.

Dividends aren’t guaranteed, but the companies recommended by Bank On Yourself Professionals have paid them every single year for more than 100 years.

Once credited to your plan, both your guaranteed annual increase and any dividends you received are locked in. They don’t vanish due to a market correction. Your principal is locked in, too.

On the other hand, the stock market has endured long periods during which it went nowhere and lengthy periods of extreme volatility. There’s also the fact that the market can (and does) tank when you least expect it, ruining your best laid plans for a secure financial future.

When you Bank On Yourself, there may be times when you feel “left out” – like when your friends start bragging about the killing they’re making in the latest “hot” investment that everyone’s jumping on – real estate, tech or oil stocks, commodities, currency, gold, ostrich farms – you name it.

But Bank On Yourself is all about building a solid financial foundation and a secure future. You’re not going to see those thrilling spikes, but you’re also not going to have those unpredictable, heart-stopping losses that inevitably follow.

And that’s when you’ll thank your lucky stars for your Bank On Yourself plan

Besides, if an investment opportunity comes up that you want to take advantage of, you can do that by borrowing against the equity or cash value in your Bank On Yourself policy. My best-selling book is loaded with examples of people who did just that. And at least you’ll know you’ll get the same guaranteed annual increase and dividends on the money you borrowed, even if the “hot” investment doesn’t pan out.

Note: Not all companies offer a policy that has this feature, which is another reason to work with a Bank On Yourself Professional who knows how to properly structure your plan for maximum growth and knows which companies offer the policies that maximize the power of this concept. You’ll get a referral to one of only 200 financial representatives in the U.S. who have met the rigorous requirements when you request a free Analysis.

REQUEST YOURFREE ANALYSIS!

No two policies are alike, because each is custom tailored to the client’s unique situation and goals, so your numbers and results will look different. But you’ll be able to see what your growth would look like before you make a decision about whether to move forward! You’ll find out when you request a free Analysis here.

7. What if I lose my job and can’t pay my premiums?

The design of a Bank On Yourself-type policy gives you great flexibility and built in options that enable you to make adjustments to keep pace with your changing financial situation.

For starters, typically at least 50% of your premium will be directed into a “Paid Up Additions Rider” (PUAR), with the rest going towards your “base” premium. The PUAR is the little-known option that significantly supercharges the growth of your cash value. You could have significantly more cash value, especially in the early years, when your policy includes this rider.

The kind of policies most financial “gurus” and financial representatives talk about grow much more slowly because they do not include this rider.

Because paying the premium that goes into your Paid Up Additions Rider is optional, in a pinch, you can cut back on or stop paying that premium. Some companies will even allow you to catch up on that premium later, as your financial situation improves.

You can also use your cash value and dividends to pay your base premium, when cash flow is tight.

However, in the first year or so, if you are unable to pay your base premium and you don’t have enough cash value to cover it, your policy could lapse, and you wouldn’t get back every dollar you put in.

Do you suffer from “paralysis by analysis”?

I hear from people every day who tell me they want to add Bank On Yourself to their financial plan, but they haven’t quite been able to make the leap yet.

They worry about what direction the economy is going. They want to see what the political climate will be. They want to have some kind of certainty in an uncertain world.

You’ve probably heard of “The Serenity Prayer” and this excerpt from it, which seems particularly appropriate today:

There are some things we simply can’t control. Not taking action is actually deciding to let chaos and uncertainty rule our lives.

There may never be a “perfect” time to take the steps that can enable you to take back control of your financial future.

Bank On Yourself isn’t a magic pill, as I’ve said many times. I don’t believe there are any magic pills.

But what I do know is that Bank On Yourself provides a long-term solution to a number of long-term challenges. And the only regret expressed by most people who use it is that they didn’t know about it sooner.

How to Find Out Your Guaranteed Bottom-Line Numbers

If you haven’t already started to Bank On Yourself, request your free Analysis now – and start taking back control of your financial future today.

There’s no cost or obligation and you have nothing to lose and a world of financial peace of mind to gain.

REQUEST YOUR

FREE ANALYSIS!