In today’s crazy world, it’s crucial to remain vigilant against major financial shocks that often catch people unprepared. Here are three shocks many people will face and strategies to help you safeguard your financial future against them.

Shock #1: Your Social Security Benefits Can Be Taxed

Most people don’t realize that it’s common – even for middle-income folks – to pay taxes on Social Security benefits. 48% of Americans already pay taxes on their Social Security benefits, according to the SSA. And because the cutoff isn’t benchmarked to inflation, more and more beneficiaries will soon be subject to the tax.

Doesn’t it bother you that the government may require you to pay taxes on the money you get from Social Security – a system you paid your hard-earned money into for all those years? It’s like double jeopardy!

But most people also aren’t aware that you can reduce – or even eliminate – the taxes you may have to pay on your Social Security benefits.

How is that possible?

Your retirement income from a Bank On Yourself policy is not included in the income totals the IRS uses to determine whether (or how much) your Social Security check is taxed.

And the earlier you start planning for this, the greater the tax savings you will reap throughout your retirement.

That’s just one of the numerous tax advantages you’ll get from the Bank On Yourself strategy! To find out your bottom-line guaranteed numbers and the potential tax savings you could get by adding this strategy to your financial plan, request a free, no-obligation Analysis here now:

REQUEST YOURFREE ANALYSIS!

Shock #2: The Interest Rates You Pay Aren’t Coming Down Soon

Americans are borrowing more than ever on their credit cards, with balances topping $1.08 Trillion for the first time, according to the Federal Reserve Bank. At the same time, an estimated 40% of Americans have drained their pandemic savings to be able to pay for these ballooning bills.

Average credit card interest rates have soared to 24.59%(!), according to Lending Tree – the highest they’ve ever been.

Of course, this assumes you can get approved, and people are increasingly likely to get turned down when they apply – the rejection rate has jumped to almost 22% of applicants!

Meanwhile, delinquencies are at a 12-year high, more people are paying late fees, and if you miss payments, it can cause your interest rate to as much as double!

Even if the Fed does decide to lower interest rates this year, do you really believe that banks, finance, and mortgage companies will give you much of a break anytime soon?

With the Bank On Yourself safe wealth-building strategy…

- You can access the equity in your policy whenever and for whatever you want – no questions asked or nosey applications to fill out.

- You cannot be turned down for a loan.

- You set your own repayment schedule, and if you hit a rough patch, you can skip payments without worrying about collection calls, repossession, or black marks on your credit report.

- Your policy continues growing even on the money you borrowed – if your policy is from one of a handful of companies that offer this amazing feature.

- You get a competitive interest rate way below market rates regardless of your credit rating. And you can recapture the interest you pay!

Shock #3: Black Swan Events Can Scramble Your Best-Laid Plans

By definition, Black Swan events – like pandemics, global wars, hyperinflation, and weather disasters – are unexpected and supposed to be rare. Yet, we’ve been hit with a whole flock lately, causing the markets to freak out. Do you really think the market will never crash again, or you’ll have enough warning to get out if it does?

Read: Black Swan Events to Watch Out For in 2024

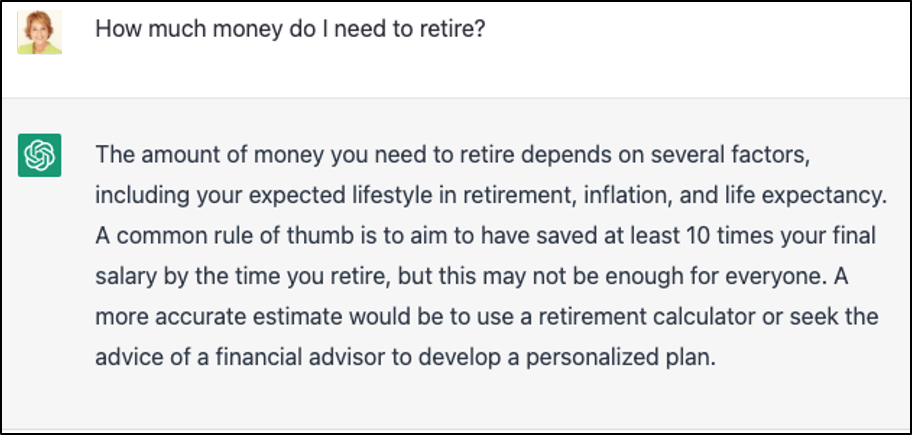

The critical question is: How much does your retirement security depend on the stock market, a beast you can’t predict or control… and that can turn on a dime? If much of your funds are in a conventional retirement plan, the answer is usually “nearly 100%.”

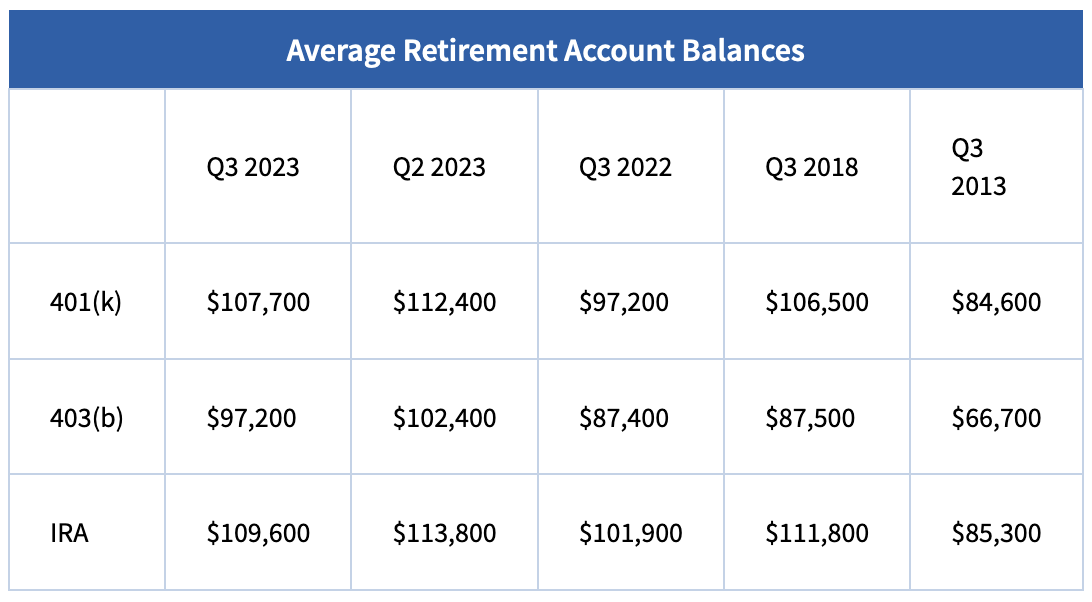

You might take comfort in looking at your 401(k) and IRA account balances after the big stock market rally at the end of 2023 (which was followed by the worst start to a year in over two decades).

But the reality is that you haven’t made a dime until you sell your investments and (hopefully!) lock in your profits. They are paper profits, and while they may make for a temporary high, they aren’t “real” until they are realized.

In contrast, when you look at the annual statement for a Bank On Yourself policy or check your policy values online, the numbers you see represent real money, not just paper wealth. Both your principal and growth are locked in. They don’t go backward, even in a major market crash.

Your money is guaranteed to grow by a larger dollar amount every year, giving you built-in protection from inflation.

You can even know how much money you’d have at any point – guaranteed – before you decide if you want to move forward with this strategy. Just request a FREE, no-obligation Analysis here to find out:

REQUEST YOURFREE ANALYSIS!