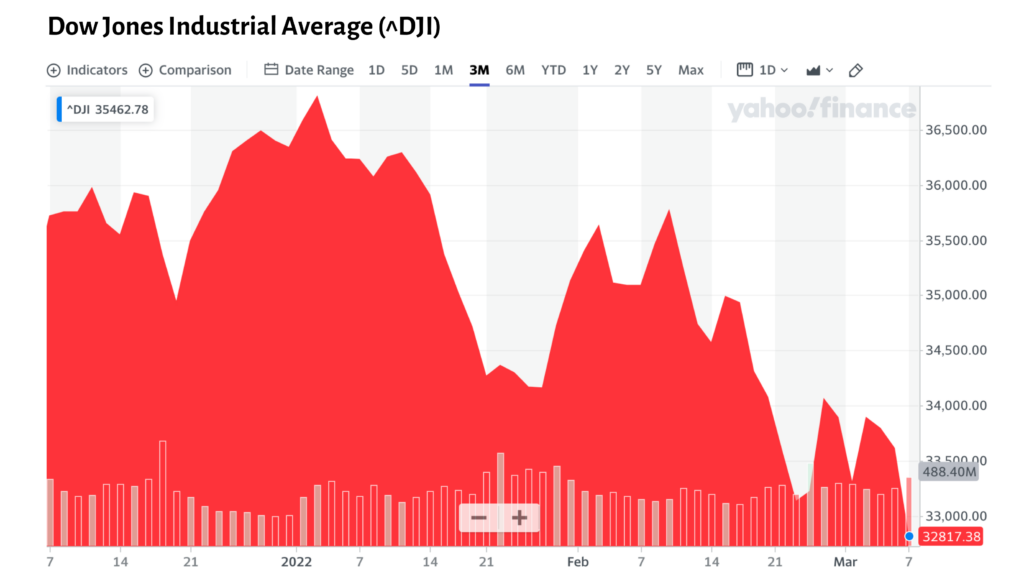

Both the Dow and the S&P 500 were back to where they were more than two years ago, as of May 31st. It’s been a stomach-churning roller coaster ride along the way.

The S&P 500, however, has been on a tear, up 10% this year. Maybe you’ve been looking at your investment and retirement account balances and wondering why you’re not seeing that kind of gain.

That’s because just five technology companies drove 96% of those gains!

According to the Motley Fool, nearly half of the stocks in the index were negative for the year on May 31. (MarketWatch just called the S&P 500 “ridiculous” and questioned whether you should bet your retirement on the fortunes of a small handful of stocks.) [Read more…] “Should You “Ride Out” the Volatile Stock Market?”