ChatGPT has been making headlines since it launched last year and gained 1 million users in the first week.

If you’re not familiar with ChatGPT, it’s an artificial intelligence computer program that generates human-like answers to almost any question you ask.

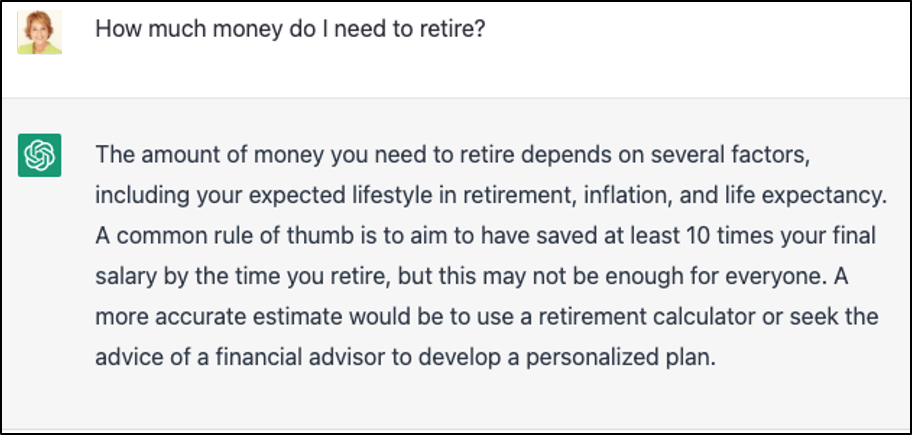

So I decided to conduct a little experiment and ask it a simple question:

How much do I need to retire?”

Here’s what the “robot” told me:

[Read more…] “Why “10 Times Your Income” Isn’t a Smart Retirement Goal”

[Read more…] “Why “10 Times Your Income” Isn’t a Smart Retirement Goal”