Two-thirds of Americans intend to make a financial New Year’s resolution for 2023, but only 20% are confident they’ll be able to keep their resolution.

That’s according to a new survey from The Ascent, a Motley Fool service. It’s not surprising why. It’s been a very challenging year, and everybody’s got a case of the financial “icks.”

In a year that many would just as soon forget, a few of the “low lights” include…

- Inflation hit a 40-year high

- Americans have gotten themselves into a savings crunch with mounting piles of debt

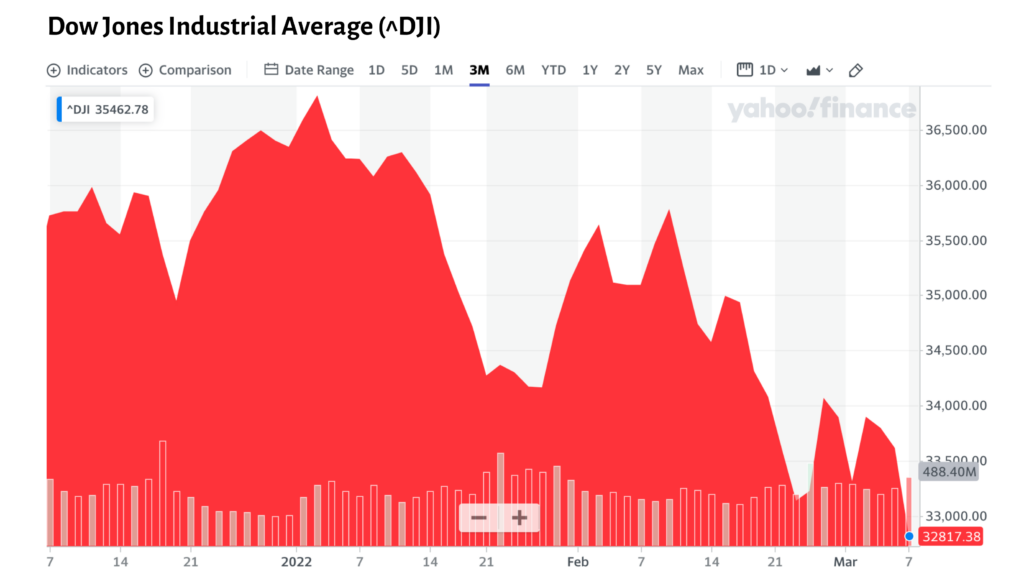

- The Federal Reserve continues raising interest rates at a dizzying pace, and market volatility has spiked as investors try to second-guess the Fed’s next move

- The stock market entered its longest bear market since the 2007-2008 crash

- The once-hot housing market has fallen off a cliff

- The crypto bubble has popped

- The war in Ukraine has gone on longer than anyone expected, impacting supply chains and more

A Majority of People Worry about Money Daily, and Many Lose Sleep Because of It

[Read more…] “The Secret to Eliminating Your Financial “Icks” in 2023″