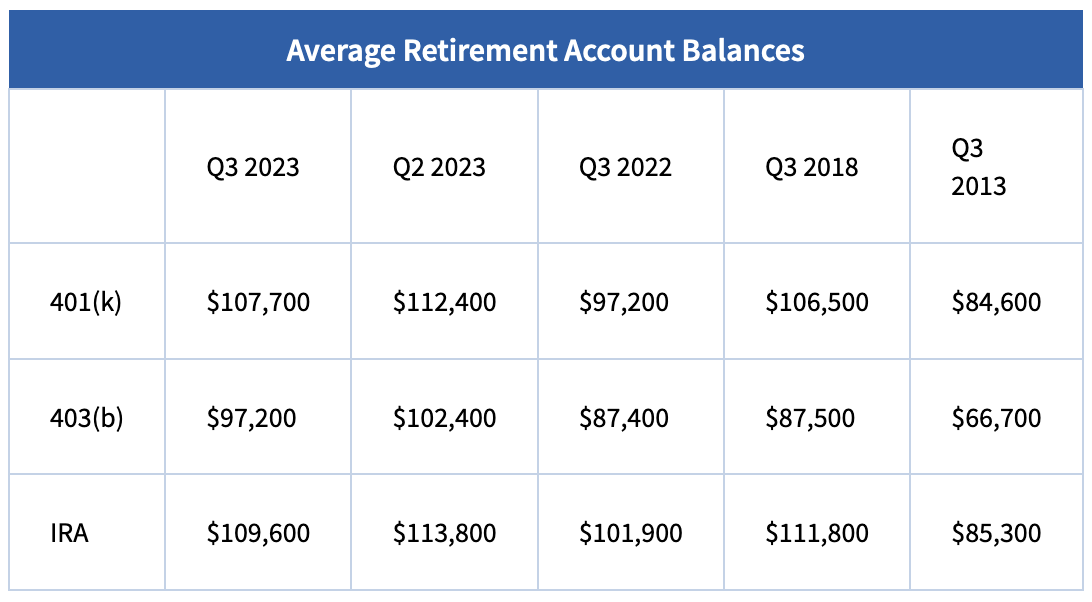

Fidelity Investments, the largest provider of 401(k) plans, just reported that the average 401(k) account balance barely budged in the 5 years since the 3rd quarter of 2018. They increased by only $1,200 from $106,500 to $107,700… less than 1.2% total.

To make matters worse, inflation was a whopping 21% during the same period. (Here’s a great inflation calculator.) That means those average 401(k) accounts needed to be at nearly $129,000 – just to keep up with inflation!

Okay, but what if you waited longer, say 10 years, like the “experts” say you should. On the surface, that looks better. The average 401(k) was $84,600 10 years ago and is now $107,700 (a 27.3% gain). But inflation over that period was 30.45%, so the average 401(k) would have to be at $110,357 today to keep up with inflation.

In 2022, the average 401(k) balance plunged 22.9%, according to Fidelity Investments. As I write, the market has been rallying, but you’d need an increase of almost 30% to get back to where you were… and another 3.5% increase to keep even with inflation in 2023, let alone have a gain. It’s pretty nasty news if 2022 was the year you had planned to retire.

And the typical IRA hasn’t fared any better over the last ten years, according to Fidelity:

[Read more…] “Average 401(k) Balances Have Barely Budged in 5 Years”

[Read more…] “Average 401(k) Balances Have Barely Budged in 5 Years”