If you or someone you love is suffering from a critical or terminal illness, or if you’ve been in a terrible accident and the life insurance company has said, “We’re sorry, but we are unable to issue you a life insurance policy at this time,” you have our sincere sympathy.

Even with a Serious Illness, You May Still Have Options for Life Insurance Coverage

Do not throw in the towel. You still may have several options.

Do not throw in the towel. You still may have several options.

First, let’s talk about the nature of your sickness or injury.

Is your condition only temporary? If so, you should be able to buy insurance later at rates closer to “normal” than you might think.

Even if you have cancer, you can usually get life insurance one to three years after you complete your treatment. If you’ve had bone cancer or leukemia, the wait could be longer—up to 10 years.

But what if your condition is permanent—or terminal?

Expanding or converting an existing policy

Get instant access to the FREE 18-page Special Report that reveals how super-charged dividend paying whole life insurance lets you bypass Wall Street, fire your banker, and take control of your financial future.

If you have an existing policy, ask the insurance company if you can expand your coverage without additional underwriting. That means the company would increase your coverage (to some specific maximum amount) without regard to your present health situation. That would be very good, wouldn’t it?

Being able to increase your coverage isn’t as likely if you have a term policy rather than a whole life policy, but it’s worth asking about. Call the company directly. The phone number should be on your policy, or you can Google the company. Ask for the Policy Services or Customer Service Department.

If you have a term policy that you cannot expand, you may still be able to convert it to a whole life policy without underwriting. This is to your advantage, because unlike a term policy, a whole life policy will not expire as long as the premiums are paid. Find out if your policy is convertible.

Get instant access to the FREE 18-page Special Report that reveals how super-charged dividend paying whole life insurance lets you bypass Wall Street, fire your banker, and take control of your financial future.

Different insurance companies have different policies regarding an illness

Here’s something else to remember in your quest to provide a financial safety net for your family. Just because you have been turned down by one company, doesn’t mean you’ll be turned down by all companies. Different insurance companies view various health maladies differently.

But you don’t want your insurance file to give you the stigma of having been turned down frequently. That will make other insurance companies gun shy.

Here’s what to do to avoid that:

Before you actually complete an application, call a company you’d like to apply to. This time, ask for the Underwriting Department. In fact, even if an insurance agent assures you that the company will write the policy, if you have any doubts, check with the underwriters first, yourself.

Don’t hold back information when you talk with the underwriter! If you fudge to get the underwriter to say yes on the phone (“It was only stage one cancer,” when it was really stage four), what will you say when you complete the application?

Don’t hold back information when you talk with the underwriter! If you fudge to get the underwriter to say yes on the phone (“It was only stage one cancer,” when it was really stage four), what will you say when you complete the application?

If you fudge on the application, it’s not called “fudge.” It’s called fraud. And the company will find out; if not immediately, then during their investigation after you’ve passed away. If the company can show that you committed insurance fraud, your policy won’t pay a dime of death benefits to your family. So be honest from the get-go.

How to Find an Insurance Company That Will Work with You

How should you go about finding insurance companies that write policies on people with bad health?

Here are four steps many people in your situation have found helpful.

- Do a Google search for “cancer survivor life insurance” (even if cancer isn’t your issue). Note the names of companies that show up in your search result.

- Now do a second search. This time, replace the word “cancer” with your condition. If you get some search results, try these companies first.

- If nothing comes up, call the companies you found during your “cancer” search. Why them? Because these are companies willing to write life insurance on people who are in less than perfect health.

- Call the insurance commissioner in your state. Ask if they have a list of companies for you to contact. Depending on the state you live in, the insurance commissioner may have a list of companies for you to call.

“Guaranteed issue” life insurance

If none of these options work for you, there is still a life insurance option available. Ask your insurance agent about guaranteed issue life insurance.

Guaranteed issue life insurance won’t be cheap. And no death benefit will paid during the first two years of the policy. If you die during that time, your beneficiary will receive a refund of premiums paid. In effect, you gave the company an interest-free loan.

After two years, if you’re still hanging in there, the death benefit will be paid upon your death. This coverage can provide enough money to cover your expenses for a funeral and burial, and perhaps more.

A few not-so-good options for coverage

Be wary of accidental death and mortgage unemployment insurance. Accidental death coverage only pays if your death came as the direct result of an accident, and often within a limited period of time after the accident.

Unemployment insurance usually isn’t an option.

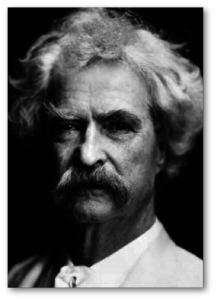

Remember how Mark Twain said, “A banker is like a man who loans you his umbrella, but wants it back when it starts to rain“? In the same way, you typically cannot take out unemployment insurance unless you’re employed. If you’ve already left your job due to your serious illness, you’re not a candidate for unemployment insurance.

Remember how Mark Twain said, “A banker is like a man who loans you his umbrella, but wants it back when it starts to rain“? In the same way, you typically cannot take out unemployment insurance unless you’re employed. If you’ve already left your job due to your serious illness, you’re not a candidate for unemployment insurance.

Besides, mortgage unemployment insurance typically provides only the minimum necessary to keep your home out of foreclosure. And polices frequently pay only for a limited time—as short as six months.

A better option

Could you join an organization that offers group term insurance? Many of these policies have the same restrictions as “guarantee issue,” but some don’t. If you are well enough, get a job for a company that offers group term life insurance. These policies usually don’t have the same limitations as guaranteed issue.

As we have seen, if you are recovering from a serious malady that would otherwise make you uninsurable, you still have options. And even if your condition is such that you’re not expected to recover, there are a few inventive ways you may be able to get life insurance.

Download a free Report here that reveals how a little-known type of high early cash value, low commission whole life policy lets you fire your banker, bypass Wall Street and take control of your own financial future. You’ll also get a free chapter from Pamela Yellen’s New York Times best-selling book on this subject.

Continue to the Table of Contents for the No-Nonsense Life Insurance Guide