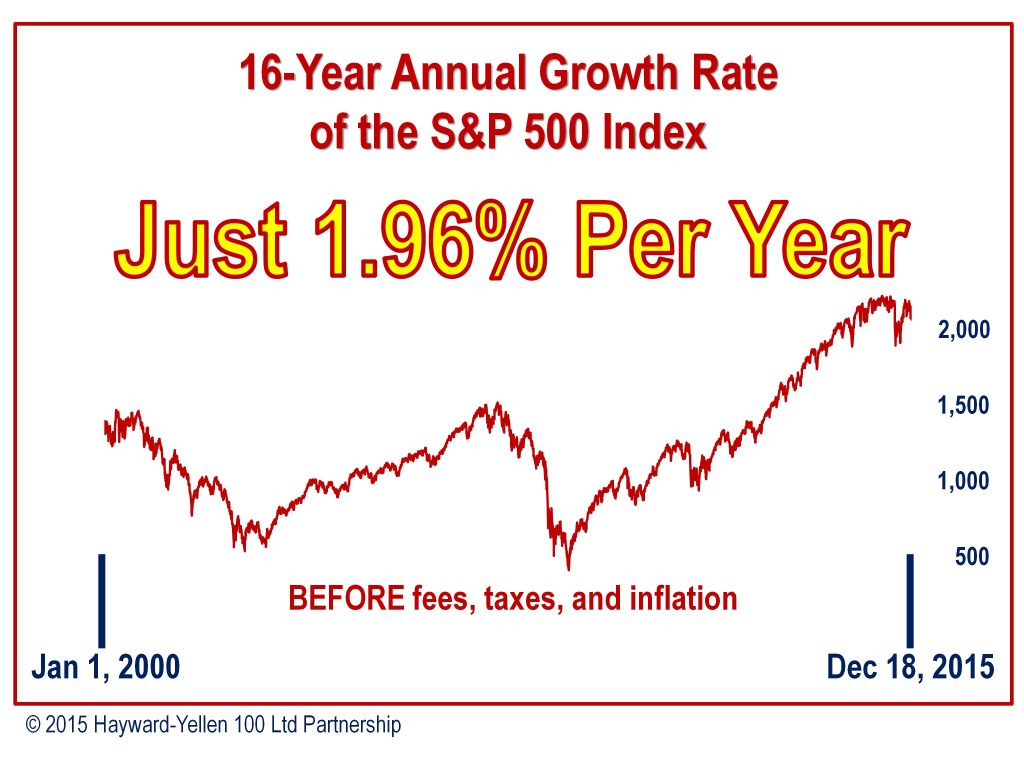

Take a quick guess – what do you think the average annual return of the S&P 500 Index has been since the start of the century almost 16 years ago?

Especially in light of the recent bull market, one of the biggest in history.

So what percent do you think the index has grown on average each year? Maybe 4%? 8%? 12%?

C’mon – humor me and take your best guess…

Okay… so over the last nearly 16 years, since January 1, 2000, the S&P 500 (which represents the broad market) has had an annual growth rate of only 1.96% per year. (Note: We are referring to the Compound Annual Growth Rate or “CAGR”.)

Did you guess that it was more than that? Most people do.

And sadly, that 1.96% per year annual growth rate was more than cancelled out by the 2.3% average annual rate of inflation during that same time period! Oops!

So, was that return worth the risk you took? Was it worth your sleepless nights?

It Gets Worse, Because You Didn’t Actually Get that 1.96% Annual Growth Rate – Here’s Why…

For starters, in order to participate in the returns of the S&P 500 (or any other index), you have to buy a financial product, like an S&P 500 Index mutual fund or an Exchange Traded Fund.

And those financial products have fees, typically totaling at least 1% per year.

So when you subtract that from the 1.96% annual growth rate, well… now you’re down to less than 1%.

So when you subtract that from the 1.96% annual growth rate, well… now you’re down to less than 1%.

Which means, when you factor in inflation, you’ve actually been going backwards for the past 16 years. All that risk for so little reward.

Several stock market lap dogs have complained that I didn’t include the dividends that you would receive, if you invested in a mutual fund or ETF that tracks the S&P 500 Index.

They have a point – your annual growth rate would be nearly double – or around 4% per year.

But Of Course, They Neglect to Mention the Fees You’ll Pay, Inflation and Taxes

So let’s subtract the annual fees you’ll pay that are going to total at least 1%, especially if you’re investing inside a 401(k) or IRA.

Now we’re down to 3% per year. Then when we subtract the 2.3% average annual inflation rate we’ve had, you’re down to a .7% annual growth rate.

Whoohoo! Can you honestly say that getting an inflation-adjusted growth rate of less than 1% per year… for the last 16 years… has been worth the stress and worry… the sleepless nights… and the wondering when the next market crash will wipe away 50% or more of your life’s savings – AGAIN?!?

And we haven’t even talked about the HUGE bite that taxes are going to take, when you go to take an income, if you’re investing in a tax-deferred account, like a 401(k), 403(b) or IRA. Uh-oh…

What if History Repeats Itself Over the NEXT 16 Years?

A whopping 93% of those we’ve surveyed believe there will be another major stock market crash in the next 5 to 10 years – or even sooner. Maybe you’re in that camp, too.

And what if the next market crash happens right before – or right after – you retire? The last two crashes each vaporized 50% or more of investors’ money.

If you have a significant portion of your retirement savings in the stock market, how would another 50% or more plunge in the value of your nest-egg affect your retirement security?

There’s a Better Way – One That Lets You Grow Your Nest-Egg Safely and Predictably EVERY Year – Even When the Market is Crashing

It’s called Bank On Yourself, and it’s never had a losing year in its 160-plus-year history. It enjoys an unbeatable combination of advantages, which includes guaranteed growth, safety, control, liquidity and some juicy tax benefits.

This is the time of the year when we begin to reflect on our past accomplishments… and what we want to be different and better in the future. Will continuing to do what you’ve been doing get you there?

Take control of your Financial Future Today

Take the first step toward taking back control of your financial future today by requesting a free, no-obligation Bank On Yourself Analysis right here.

Your Analysis will reveal the guaranteed minimum value of your plan on the day you want to tap into it… and at every point along the way. You’ll also discover how you can add hundreds of thousands of dollars to your lifetime wealth simply by using a Bank On Yourself plan to make major purchases, like cars, vacations, business expenses or even a college education.

You have nothing to lose… and a world of financial peace of mind to gain. So request your free Analysis here now.

REQUEST YOURFREE ANALYSIS!

“…C’mon – humor me and take your best guess…”

No need to guess, that actual annual RoR for an S&P500 investment (VFINX) from 1/1/2000 through 12/9/2015 is 3.99%.

Figures for VFINX on morningstar.com, as of today (12/18/2015):

1 year return: 3.47%

3 year return (annualized): 14.81%

5 year return (annualized): 12.62%

10 year return (annualized): 7.01%

The VFINX is a mutual fund, not the S&P 500 Index. And investors should be more interested in the Compound Annual Growth Rate (CAGR), than the average annual gain, for the reasons explained here:

http://www.investopedia.com/terms/c/cagr.asp

The growth rate we quoted was actually the CAGR, which smooths out your investment growth over a period of time, providing a clearer picture of your true growth.

I noticed you “updated” the chart. Is that because the S&P was down since the 8th? Are you going to update it again since the S&P is back up again?

Glad you’re paying attention! I updated it as of December 18th, 2015, because that was the cut-off date to send updates to my latest book to my publisher. It’s coming out in paperback in a few months.

But your comment points out a fatal flaw with pinning your hopes for a secure financial future on the Wall Street Casino. It’s ALL paper wealth, NOT real wealth. And it can (and has and will) come crashing down just when you need the money.

Can YOU tell me what your retirement account will be worth on the day you plan to tap into it? Of course not! But when you use the Bank On Yourself method, you can know the minimum guaranteed value of your plan on the day you want to tap into it…and at any point along the way. Your plan can never go backwards, and both your principal AND growth are locked in. The don’t vanish when the market crashes.

I’ll take that any day over the “hope and pray” plan Wall Street offers.

Hey, John! The S+P 500 is now almost back where it was on December 18. Now what!?! Should I update it again? Or maybe I should update it every day?

How sad it is that most people are betting their retirement financial security on a roll of the dice in the Wall Street Casino.

This can only turn out badly.

My wife’s 401(k) has done well over the last 19-years. It’s invested in stock funds. Thankfully, her company uses low-cost index funds (I realize a lot of of companies don’t do that). We have been blessed. I can’t imagine doing better in an insurance product.

Do you have any examples of what the Bank on Yourself strategy has done?

We sure do- how does a 9.94% annual return since 1969 in real life – with NO market risk – sound?

That’s what your wife would have to get in her 401(k) to equal the actual results of a typical Bank On Yourself plan. See the proof here:

/10-percent-annual-return-without-market-risk.html

UPDATE January 21, 2016:

We just updated these results as of the close of the market yesterday, and it’s not pretty.

Since January 1, 2000 (over 16 years ago), the compound annual growth rate of the S&P 500 index has been only1.48%. Inflation during the period averaged 2.15% per year, which means the index has had negative nominal returns.

Don’t forget to also deduct an average of (at least) 1% for fees. And if you are investing in a tax-deferred account like a 401(k) or IRA, you will give up another big chunk to taxes.

For the benefit of the Wall Street lap dogs (investment advisors who are running scared these days) who love to complain about me, we also updated the growth rate if you include the dividends of the S&P 500 since January 1, 2000 (using the total return index).

That now stands at an annual growth rate of 3.44%. Subtract the 2.15% annual inflation rate and the 1% minimum annual fee. and that leaves you with a .29% annual return. In case you need clarification, that’s less than a third of one percent per year.

And you still have the taxes to pay

Plus investors must live in daily fear about whether this is the start of the BIG crash that everyone knows is coming at some point..

WOW! Where do I sign up for this deal?????