They say a picture is worth a thousand words.

If you’ve been having a sinking feeling in the pit of your stomach that you’ve been treading water in your financial plan for what seems like forever, these three graphic “snapshots” reveal the ugly truth.

These snapshots clearly illustrate the fatal flaws in the conventional wisdom that’s been shoved down our throats for so long about saving and investing.

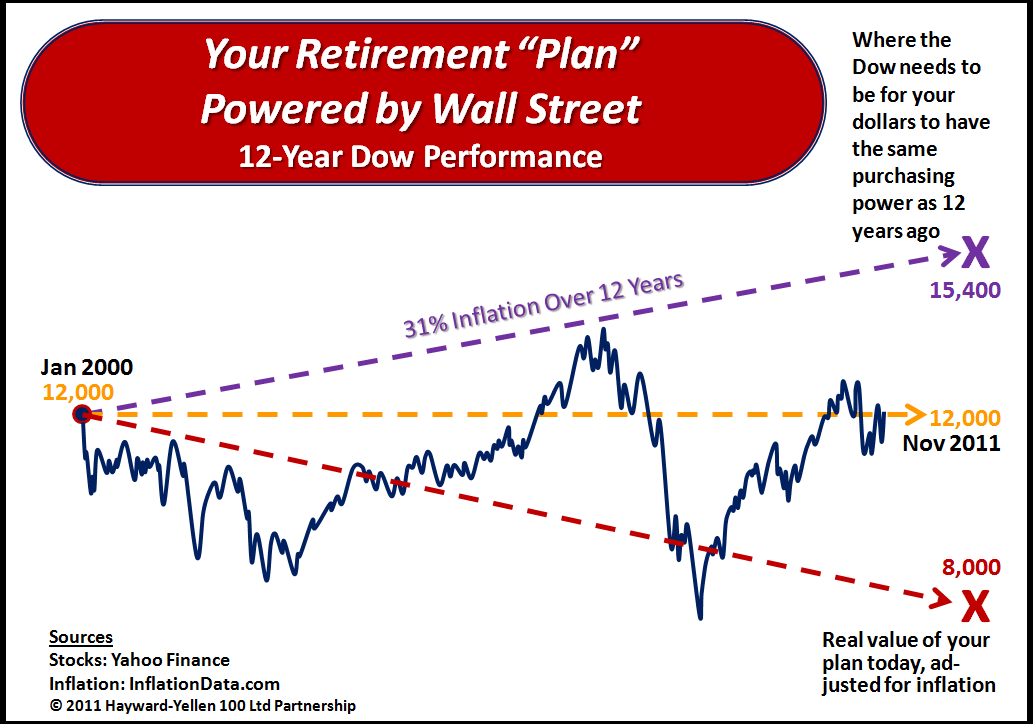

This is your retirement plan powered by Wall Street

A quick look at this snapshot tells you everything you need to know…

Let me ask you a question…

Where is it written that you must suffer a lost decade – or more – growing your nest egg?

Isn’t that what Wall Street wants us to believe?

The fact of the matter is that the only guarantee Wall Street gives you is that they’ll get paid whether you win or lose!

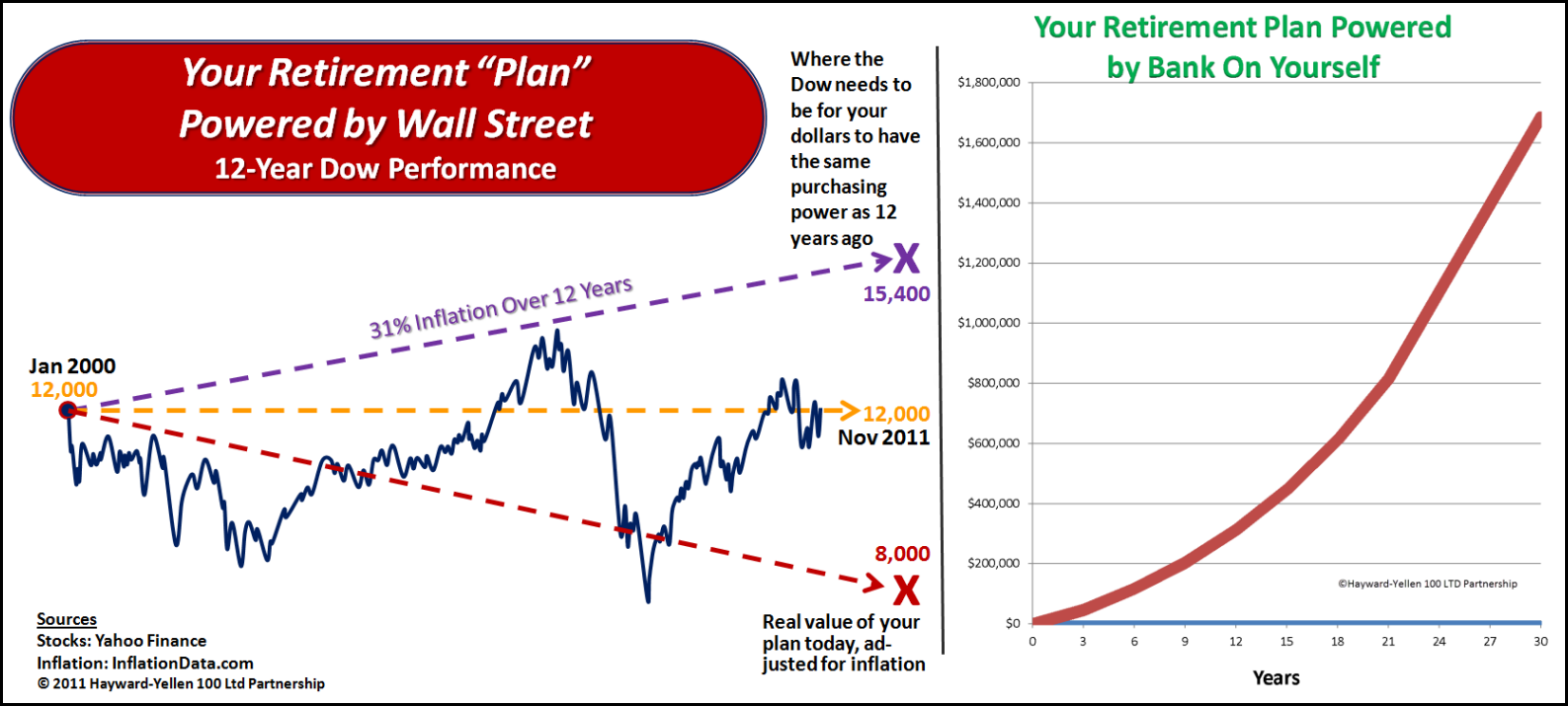

It’s also why they desperately don’t want you to know about the peace of mind, guarantees, and predictability you get when your retirement plan is powered by Bank On Yourself.

Once again, a picture is worth a thousand words, so let’s compare the growth in a Bank On Yourself plan side-by-side with what the Wall Street Casino offers:

The chart on the right above shows the growth pattern in a typical Bank On Yourself-type policy. The growth is exponential (in the mathematical sense of the word). That means the growth curve gets steeper every year you have the policy – with no luck, skill or guesswork required to make that happen.

And while these plans grow more slowly at the start (there’s no such thing as a magic pill!), the growth is at its peak at the time you need it most – retirement.

The chart above is based on the actual growth I’ve received in one of my own policies so far, along with the projected growth based on the current dividend scale.

Dividends aren’t guaranteed, but the companies preferred by the Bank On Yourself Professionals have paid them every single year for more than 100 years.

Keep in mind that no two Bank On Yourself plans are alike…

Each is custom tailored to your unique situation, goals and dreams. To find out what your bottom-line, guaranteed numbers and results would be if you added Bank On Yourself to your financial plan, request a free, no-obligation Analysis now, if you haven’t already done so.

REQUEST YOUR

FREE ANALYSIS!

If you’re wondering where you’ll find the money to fund your plan, keep in mind the Bank On Yourself Professionals are masters at helping people find money they didn’t know they had to fund a plan. Here are the eight most common places they look.

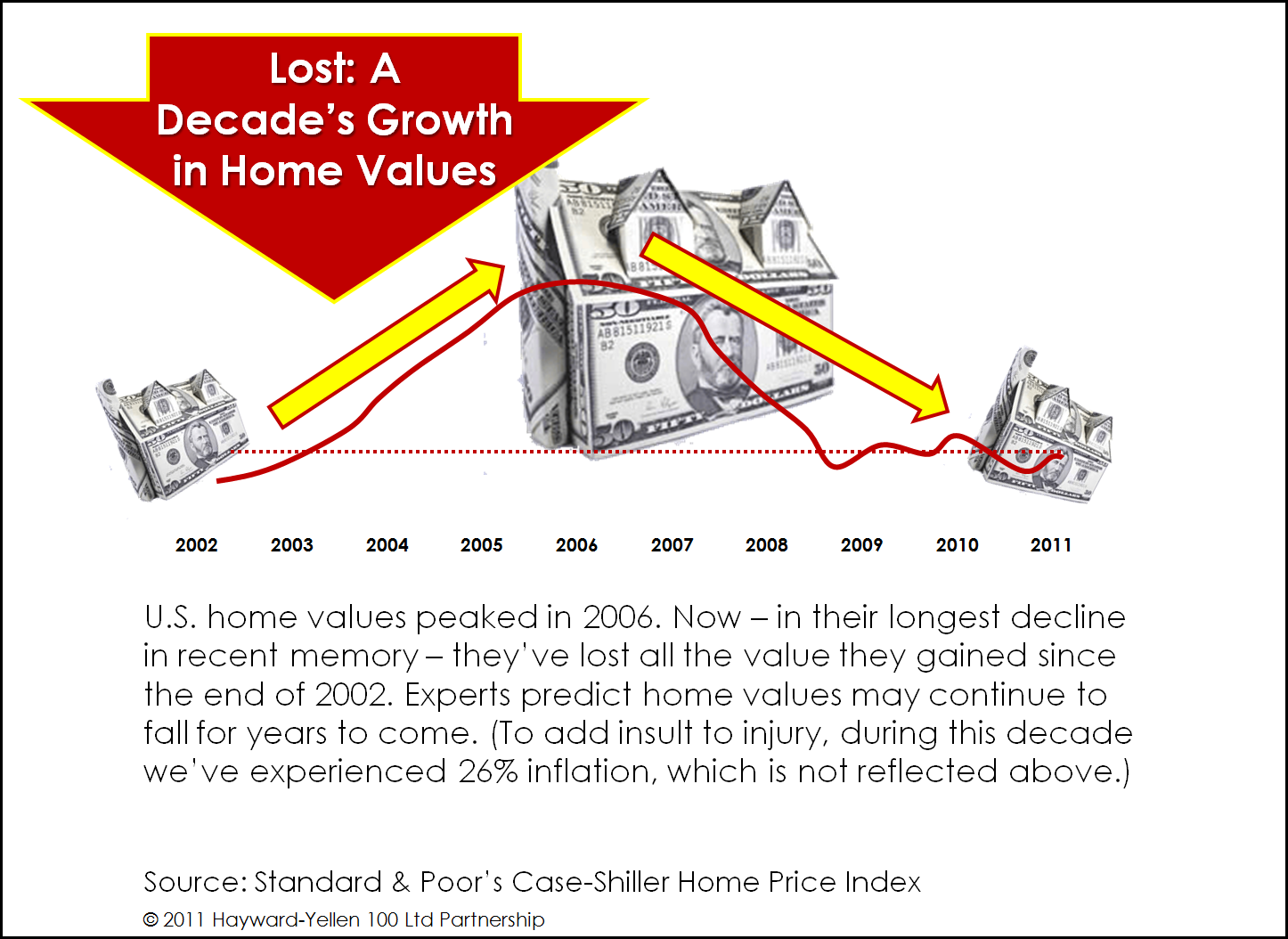

So now let’s take a look at another bit of conventional financial wisdom gone awry…

We were taught we could count on the equity in our homes to be a major part of our retirement nest-egg. A lot of people who thought they were doing the right thing made extra mortgage payments, so they could have the “security” of knowing their home was paid off in full when they retired.

They plowed money they could have put into safe savings into their homes instead – which got them a ZERO rate of return on their hard-earned dollars AND locked up their money in a depreciating asset.

And here’s a snapshot of where that got them…

News Flash! There’s a better way! Did you know that you can save up enough cash value in a Bank On Yourself policy to be able to write a check to pay off your mortgage in full, any time you choose to do that?

My husband and I could do that TODAY – if we chose to. But we made the smart decision to leave that money in our Bank On Yourself plans where it is working much harder for us.

How much harder is that money working for us? This blog post I wrote on the rate of return of a Bank On Yourself plan reveals why you’d need to get a 7-8% return in a tax-deferred account, like a 401(k) or IRA, to equal the return of a typical Bank On Yourself plan.

And that’s without the risk or volatility of traditional investments!

TIRED OF WATCHING YOUR FINANCIAL PLAN GO NOWHERE?

Find out how the Bank On Yourself method can give you the financial security and predictability you want and deserve. It’s NEVER had a losing year in 160 years! Take the first step right now by requesting a FREE Bank On Yourself Analysis.

Wondering where you’ll find the funds to start a plan? Don’t worry! You’ll receive a referral to one of only 200 financial representatives in the country who have met the rigorous requirements to be a Bank On Yourself Professional and can show you ways to find money you didn’t know you had to fund a plan.

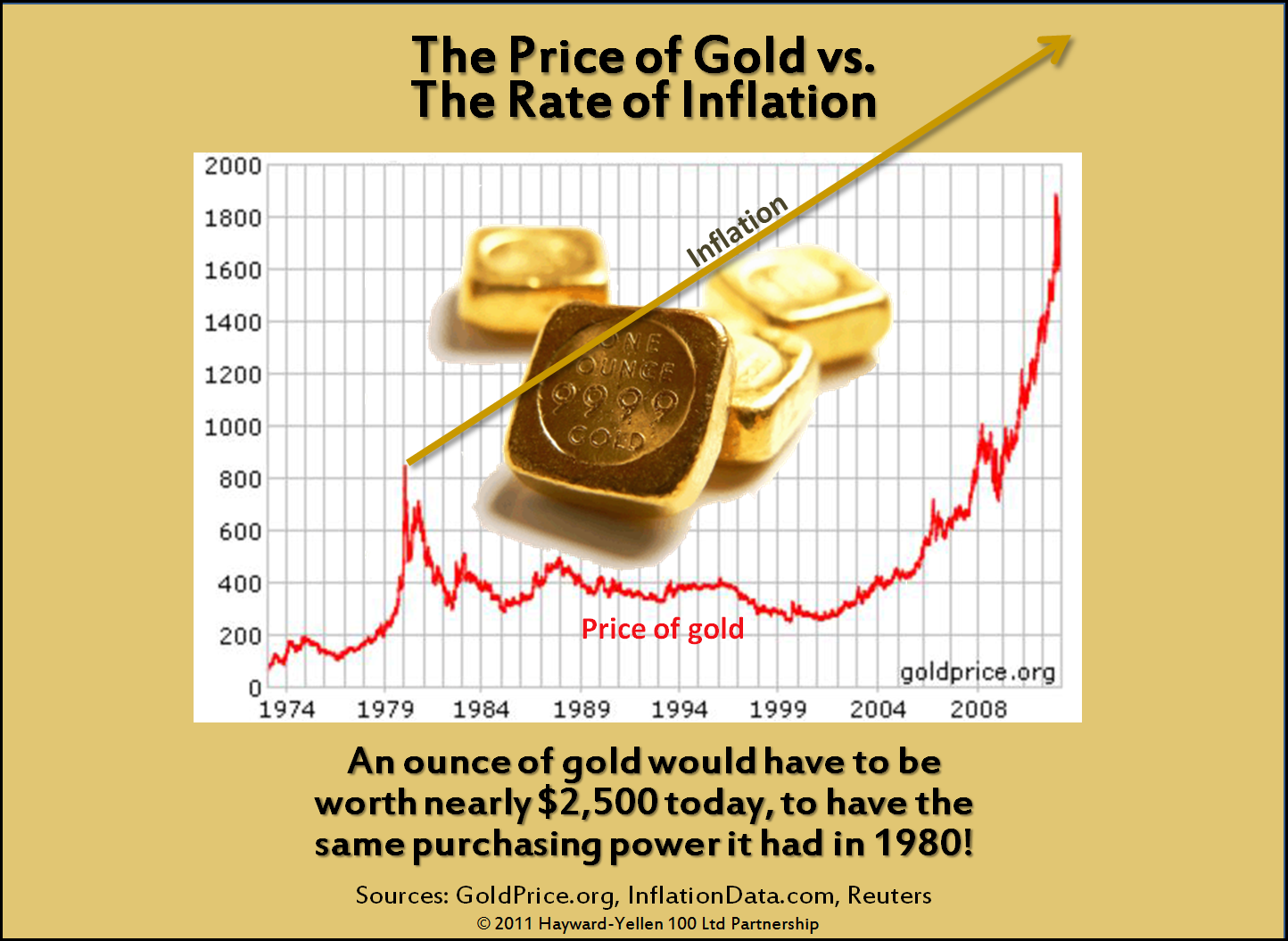

Now let’s take a look at the promise of gold. Again, a picture is worth a thousand words…

I’ve found most people who are buying gold today have no clue about the volatile history of that metal. And those who forget (or are ignorant of) the past are condemned to repeat it.

And keep this in mind – Bank On Yourself doesn’t have to be an either/or proposition, because you can use the money in your plan to make purchases or to take advantage of opportunities and investments. (It’s your money, after all!) Your policy continues growing as though you never touched it. (Work with a Bank On Yourself Professional to make sure your policy is from a company that offers this feature.)

Having your money in something that’s safe and liquid doesn’t take away your options!

This is the time of year when people often take stock of where they are today, and where they’d rather be in the future.

If you still believe that Wall Street holds the key to your financial security, and if you believe the economic challenges we’ve been facing that have caused the unprecedented volatility in the market are over with… then keep doing what you’ve been doing and hope it all works out.

But if you’re determined that the next ten years are going to be a lot better than the last ten or more, then today is the day to take the first step towards a financial future you can predict and count on by requesting your FREE Analysis, if you haven’t already done so.

When you do, you’ll find out if you qualify for a Bank On Yourself plan. It can take up to 60 days for your policy to be approved. So you can see why you need to start today to hit the ground running in 2012.

REQUEST YOUR

FREE ANALYSIS!Request your free Analysis now… and find out how much your financial picture could improve by adding Bank On Yourself to your financial plan.

Hello, my name is Julia Hik. Thank you for writing the book! I have been working with Stephen Devlin from BC Canada. I have prayed for him as I have spent lots of money after reading Rich Dad Poor Dad to find this secret. Again, thank you for the book your sales here in BC will be going up. Love it Julia!

WOW…nice chart! If the data is correct….we are in for a very NASTY fall these next 2 to 4 months ahead!

What you just did was make a “Data Fan”, which is a very helpful visual tool for market traders…specifically technical traders.

And from what I see….there is a major resistance line of 12,000 that was tested and failed with a 50% retracement from its last up wave!

Thats not it…..According to Elliot Wave Theory….The five wave cycle just ended this last couple months on this data and is in a three wave fractal down…..if the retracement is held and data is correct……….FOLKS WE ARE LOOKING AT A POSSIBLE 1000 to 3000 point drop in the coming months!YIKES!!!

Of course I mean in this data which shows purchasing power! so it will be in 9000 to 10000 range!

Great post – very powerful pictures – wow!

The first chart is highly deceptive as it assumes all the dividends for 12 years were thrown away. Long term nearly half the return of the DJIA or the SP500 comes from dividends. Correcting this may reach the same conclusion, but not so dramatically.

By omitting dividemds you participate in the same kind of deception that the “pro-stock” people do.

I just read an excellent article which dove-tails nicely with this one. Basically it talks about a 90% tax we pay by investing in Bank Money Markets and CD’s at less than the rate of inflation. It states in part: “With the manipulated interest rate of 0.5% currently seen with checking accounts and money market funds, the government comes out ahead $34 (3.4%) on every $1,000 borrowed per year. To still end up $34 ahead, after paying a free market interest rate of 5.0% which takes into account the rate of inflation, the government would have to impose a 90% income tax on interest earnings.”

The story can be found at http://danielamerman.com/articles/2011/SaveTaxC.html

I am playing ‘catch me up’ on the information here at your site and want to thank you for all your efforts to help me get a better understanding of ‘things’.

I don’t know if this is the appropriate place to ask this question and I know you are not a financial advisor but I value your opinions and insights so here goes.

I presently have funds in a 401K through my work which I have stopped funding other than to equal the company match and I have monies in -what I have learned is an IRA with a large financial company. It has been suggested that I take out the monies in this second IRA fund and place in an annuity . I have read so many things positive and negative on annuities I really am not sure what is the best move BUT my IRA monies are hemorrhaging badly . Could you please give me your thoughts. Thanks. Ann

Some annuities can be good, but a properly structured Bank On Yourself-type policy has added benefits that annuities don’t have.

That said, every situation is different, and given that the funds are in an IRA, certain rules apply.

I would encourage you to request a free, no-obligation Analysis which would also get you a referral to an Professional who can look at your situation before advising you. (I’m an educator, not a licensed financial representative, so I’m not able to give personal advice, but you’d be in great hands with one of the Professionals. Good luck!)