A recent comment made by a reader of this blog inspired this post. I’ve never gone into detail on the question of how the rate of return on a Bank On Yourself policy compares with investing in stock market and mutual funds.

And is it really true that if you simply hold on long enough, investing in stocks and mutual funds will out-perform just about anything else?

So, I’ve decided to lay those questions to rest – once and for all – right here. Here’s the comment by a reader who calls himself “Tob” that sparked this post:

This is a ridiculous attempt to compare whole life insurance to the “stock market” after the worst decade. I can show you how investing blows the pants off whole life using investing basics. Balanced Funds. How many funds do you want that have produce 10% per year compounding average to convince you?”

So, has “Tob” really found that elusive investment that gives you a 10% average return, and still lets you sleep at night?

We’ll get to the answer to that question in a moment.

First, let me address the question,

“What the heck is the rate of return on a typical Bank On Yourself policy?”

And the answer is that you would have to get a 7 – 8% annual return in a taxable account to equal the average net return in a typical and properly designed Bank On Yourself-type policy (assuming you’re in the 35% tax bracket).

Keep in mind that you receive a guaranteed and predictable cash value increase every single year – in both good times and bad.

In addition, you have the potential to receive dividends. While not guaranteed, the companies used by Bank On Yourself Professionals have paid dividends every year for more than 100 years.

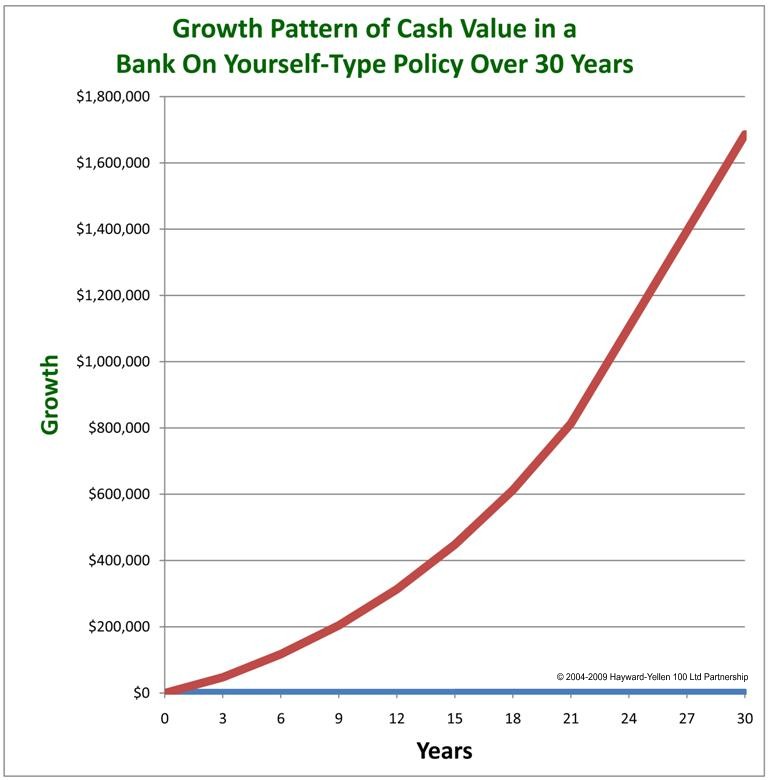

The growth in a whole life insurance policy is not only guaranteed, it’s exponential.

The chart below shows you the exponential nature of the growth in a properly designed Bank On Yourself policy. These policies are designed to get better (more efficient) every single year, simply because you stick with it, rather than jumping from one investment to another. Notice how this gives you some built-in protection against inflation:

This chart is based on one of my own Bank On Yourself policies, showing the actual growth I’ve received so far in the policy, and the projected future growth, based on the current dividend scale (dividends are not guaranteed and are subject to change).

However, no two Bank On Yourself plans are alike – each one is custom tailored to the client’s unique situation. To find out how much your financial picture could improve if you added Bank On Yourself to your financial plan, and to get a referral to a Bank On Yourself Professional (a life insurance agent with advanced training in this method), request a free, no-obligation Analysis.

Unlike stocks, real estate, and other traditional investments, both your annual guaranteed cash value increase and any dividends you may receive are locked in, once credited to your policy. They do not vanish due to a market correction or crash.

Imagine if you still had every penny of gains you’d received on your investments!

How much brighter do you think your financial picture might look right now?

To give you an idea of just how much of a difference having your gains locked in can make, here’s a fascinating little quiz…

Do you think it’s possible to invest $50,000, get a 25% average annual return on your money every year for four years… and end up with only the $50,000 you started with?

If you answered “no,” you’re in for a real surprise!

Let’s assume your money increases by 100% the first year, and then goes down by 50% in the second year. But you do really well in the third year, because your money increases by 100% again. Unfortunately, however, you take a 50% hit in the fourth year.

If you add those four annual percentages together and divide by four, you have a 25% annual return.

Not bad, huh?

But let’s see how much money you actually have in your account…

You started with $50,000 and your 100% increase in the first year doubled your money to $100,000. Then you lost 50% in year two, giving you a balance of $50,000.

You did great in year three, when your 100% increase doubled your balance to $100,000. But the 50% decline in the fourth year leaves you with… the same $50,000 you started with four years earlier!

So what good did getting a 25% average annual return do you?

That and a quarter won’t even buy you a cup of coffee, let alone a mocha latte!

You have nothing to show for this roller-coaster ride other than heartburn and a stomach ache.

But this is the kind of smoke and mirrors the Wall Street illusionists have been using to pull the wool over your eyes for decades!

You take all the risk, and they get the rewards, whether you make money or not!

But the myths and lies perpetuated by the Wall Street propaganda machine don’t stop there. Here are three shocking facts about the long-term returns people are really getting in the stock market:

Shocking Fact #1:

A recent study1 revealed that, for the past 190 years, American stocks have averaged a REAL annual return of only 1.4 percent!

Are you wondering how that could possibly be?

As the study’s author pointed out, the popular charts of stocks, bonds, bills and inflation that line the walls of brokerage offices assume full reinvestment of dividends, no commissions and no taxes.

Is that how you invest?

This study didn’t even adjust for commissions and taxes, because they vary so widely. It only accounted for inflation and the fact that investors typically don’t reinvest all their dividends.

Is a paltry 1.4 percent real return worth the risk and sleepless nights to you?

And remember, that figure doesn’t even take into account commissions or taxes!

Shocking Fact #2:

For the last forty years, ordinary long-term treasury bonds have outpaced investing in the stock market.2

Long-term treasury bonds are what grandma buys so she can sleep at night!

Which means the only rewards investors have received for taking the extra risk of stocks and mutual funds for the past four decades are sleepless nights and broken retirement dreams!

Shocking Fact #3:

The typical equity mutual fund investor has only earned 3.49% annually for the past 20 years, beating inflation for that period by only a hair. Asset allocation and fixed income investors haven’t even managed to outpace inflation for the last twenty years!3

So, what about that 10% annual return “Tob” was talking about?

In your dreams, my friend!

A so-called “balanced fund” is a mutual fund that “buys a combination of stocks and bonds to provide income and capital appreciation, while avoiding excessive risk.”

However, these funds have averaged only a 2.74% annual return for the last ten years, lagging inflation. The 15-year average is a little better – 4.85%. And the 20-year average has been 6.18% (see Wall Street smoke and mirrors revelation above), however, the fees charged by mutual fund companies for this type of fund are around 1.3% What’s left barely outpaced inflation during that period.

Oh yeah – in 2008, the average balanced fund lost 28%, according to Morningstar.

Woohoo! Where can I get me some of that stuff!?!

Let me let you in on a little secret…

One of the many advantages of a properly structured Bank On Yourself-type policy is that you can borrow the equity in your policy, use it to invest elsewhere, and your money in the policy continues growing as though you hadn’t touched a dime of it! (Note – not all companies offer this feature.)

I explain exactly how and why this happens on pages 68-69 of my best-selling book.

So, if you found a great investment, you could borrow money from your policy to put into that investment.

Result: You could be receiving the 7 – 8% after-tax equivalent return I talked about at the beginning of this post… PLUS the return of the investment you put the money into!

This allows you to have your money working for you in two ways at the same time!

Chapters 8 and 11 of my book give real-life examples of people doing just that, from the Arizona couple using the money in their Bank On Yourself policy to fund a horse breeding business, to the surgeon who used his equity to purchase shares in a very profitable surgical center.

The bottom line is that the rate of return on a Bank On Yourself policy will put just about any traditional investment to shame, and it will do that without the risk or volatility of stocks, real estate, gold, commodities and other investments.

Haven’t we learned that return of our money is at least as important as the return on our money?

Financial security comes from knowing you have a solid financial foundation and that you have a nice chunk of your savings in a plan that only goes in one direction – UP.

So, if you haven’t started to Bank On Yourself, why not find out what it could do for you and your family?

REQUEST YOUR

FREE ANALYSIS!

Take the first step now by requesting your free Analysis. You have nothing to lose and everything to gain.

1. “Stock market’s real return? Paltry,” by Anthony Mirhaydari, MSN Money, February 1, 2010

2. “Bonds Why Bother?” by Robert Arnott, Journal of Indexes, May/June 2009 Issue

3. DALBAR’s 2012 Quantitative Analysis of Investor Behavior

Hi Pamela,

I’m shocked! Yet it makes total sense. Great post!

Giulietta, inspirational rebel

Great response Pamela! Thanks for the update and interesting comparison….

I’m ready, tell me which insurance company, how much and lets go. Don

When you request a Free, no-obligation Analysis, you’ll get a referral to a Bank On Yourself Professional who will show you how a custom-tailored plan can help you reach your goals and dreams.

They’ll help you determine how much to fund your plan with and help you find the seed money to do it

I read the best comparison on a blogsite last night. Unfortunately I didn’t save the site but…

The poster made the most valid point for these comparative arguments; that is, Bank on Yourself (and other self funded banking strategies) are SAVINGS AND FINANCING plans NOT investment plans, and to try and make comparisons between savings and investments is like trying to compare apples and oranges.

While numbers can undoubtedly be crafted to support either case, as they say accounting 101; “figures can lie and liars can figure”. That’s not a finger at anyone, just a figure of speech.

I believe that the Bank on Yourself program is a sound strategy for accumulating wealth as an alternative to 1) traditional savings accounts, and 2) recapturing finance costs be they interest, points, fees, or opportunity costs should one pay cash.

I also believe that there is a place for higher risk, higher yield strategies in almost anyone’s financial portfolio.

One needs to keep in mind their own overall goals when choosing to build any strategy.

I would only offer this to those who feel so strongly in favor of stocks… Imagine if you had planned to retire in 2008. What would your average stock or mutual fund portfolio have been worth.

I can tell you mine was severely impacted and caused me to rethink my retirement goal of December 2008!

Had I been diversified through both “investments” and a BOY program, retirement would be a reality for me today…

I have a BOYS policy already, but I feel that even when Pamela tries to be forthcoming about the program it comes off as being a scam and looks suspicious. She acts like she is giving a list of a performance, but it is not real info.

I need real info. BOYS is just as much speculation as anything else unless someone can give you some firm numbers. So far no one including Pamela Yellen can give you firm numbers.

I don’t think that BOYS has enough to back it up as it would like to.

Bank On Yourself is not based on speculation. The only moving piece in a Bank On Yourself policy that is NOT guaranteed is the dividend.

However, your policy is with a company that has never missed paying a dividend for over 100 years!

I have asked your Bank On Yourself Professional to get in touch with you to go over your numbers and results with you.

what r u selling ???

So, what does a person do if they have a lot of debt and can’t afford to try out your Bank on Yourself program?

Please read chapter 8 in my best-selling book for examples of people in similar situations who, with the help of their Bank On Yourself Professionals were able to find the money to start their plans.

Hi,

I bought your book and was impressed, but I have some concerns.

I wondered. How can these insurance companies give these kinds of returns?

Don’t they take our money and invest it themselves in stocks and bonds and other investments?

Are they able to beat the market more then us because of a tremendous money pool.

They must have to outpace their obligations with earnings to keep from going under.

How do they make their money? If more and more people jump on this program won’t that pyramid its profit potential down, and won’t the government step in with more and more unfavorable tax penalties for us?

The companies used by Bank On Yourself Professionals invest primarily in high-quality, fixed-income assets such as long-term government and corporate bonds. Because of the legal requirements the companies have to maintain sufficient reserves to pay future claims, they have the ability to hold on to their assets for very long periods of time – even until maturity, if necessary.

They have been doing this successfully for more than a century and they invest “prudently” – a word that does not seem to be in many people’s vocabularies any more.

For further answers to your questions, see the comment made on this blog by someone who is using Bank On Yourself to reach their goals and dreams.

I really want to do the “Bank on Yourself” but am trying to pay down Mortgage debt on 10 properties 1st….The return on Paying down principal in the early years seems to be very very powerful… Then I’d love to fund a whole life policy.

mike

What Pam Yellen is selling is a way for insurance people to grow their business and to steer clients their way. Just google Pam Yellen and you will see for yourself.

I have made no secret of the fact that I have been a business-building consultant to financial representatives. When I was fortunate to finally stumble across Bank On Yourself, after investigating over 450 different financial products and vehicles, it became my mission to educate the American public about this misunderstood and unfairly maligned way to grow wealth safely and predictably.

Unlike the financial “gurus” who recommend you invest in stocks, mutual funds, real estate, gold, commodities, and other traditional investments, I can make a very important claim that they cannot: not one person lost a single penny in their Bank On Yourself policy during the financial crisis, and their policies have ALL continued growing safely and predictably. Just as they have done every year for over 100 years.

I have a file cabinet bulging with letters from grateful folks who tell me that their only regret is that they didn’t know about Bank On Yourself sooner.

This is for Dave who posted above on March 19th at 4:15 am.

Hi Dave. Interesting post, but let’s bring your bubble back to center. Instead of commenting directly, consider this.

If we consider life insurance, especially term, we are betting a monthly premium that the insured person (usually ourselves) will die that month. If we win the bet and die, the insurance company pays the face value of the policy to the beneficiaries of the policy. If we lose the bet and live, we get to bet again next month! Needless to say, we lose that bet a lot or I wouldn’t be writing this post. Now multiply that premium by millions of people and millions of policies. That huge number is just direct income to the insurance industry. What you typed about investing that money and making it work for them is also true… except the pyramid part… are you aware that pyramids are illegal? The reason they are illegal is because not everyone in the pyramid gets something of value for the money they invested. This isn’t a secret club. More people joining won’t “saturate” the market. On the contrary, the more people who get a BOY plan, the better it is for the life insurance companies who offer these kinds of plans. With my BOY plans, I get an amplification of the money I invested and eventually I’ll have a tax-free income for life. All done in a completely legal and ethical way. I already KNOW how much I’ll have every month 20 years out! Guaranteed!

You are correct about one thing though. I’m not able to invest in the things my BOY insurance company invests in, but… because they do… one day… when the next recession comes or the next depression comes… I’ll be in a financial position where I won’t have to participate in it.

BOY amazed me, once I understood 3 things:

1) When I take a loan out, my dividends (if they’re paid by the company) keep coming in as if the money is still in my cash account. That’s because dividends are based on the policy’s face value, not the balance in the cash account like a bank bases interest payments upon.

2) Since I pay into my BOY plans with “after-tax money,” all the dividends I receive are considered, “surplus premiums” by the IRS and as such are not taxed.

3) By using my BOY accounts correctly and with the advice of my consultant, I have the ability to increase those dividends as much as I want and can!

I hope this helps.

Mark

Hi Pam –

I’ve been with BOY when I first heard of it 5 years ago. I have watched the policy grow each and every year. At the time, my broker, it was explained to me, and I quickly expanded the use well beyond what my broker was even able to tell me.

Periodically, I question it and want to see if it is really working, but the PUA’s are doing wonders and the value is there. I need to borrow the money for other reasons early, but with the fact that our account is set up so that the value remains, even though funds have been withdrawn, is a definite bonus.

Thank you for this report. Thanks. Dr. F. Frye

All these people who complain about their retirement funds suddenly being worth less because of all their stock devaluations are guilty of not following the rule of rebalancing, which is almost as bad as putting all of your eggs into one basket i.e. Enron. Also I agree about the hard numbers. BOY should be able to show what would have happened if you put $10000 into BOY vs. if you put the same into the stock market and see where you are at the end of 30 years. That’s what it comes down to!

It would be nice if just “following the rule of rebalancing” would be sufficient. It’s not.

And you seem to be missing the point. When you Bank On Yourself, you know without question the minimum guaranteed value your policy will have when you’re ready to retire, along with the minimum guaranteed income you can take from your policy at that point and for how long.

Any type of projection you make about investing in the stock market is a guess! You could put $10,000 into the stock market and in 30 years have less than you started with, after adjusting just for inflation and fees. If it’s a taxable account, all bets are off, as most people believe that taxes are likely to go up over the long term.

Your comment is more proof of how successful Wall Street has been at brainwashing the American Public.

And that’s what it comes down to!

Anyone who takes advantage of a free, no-obligation Analysis, can know the minimum guaranteed cash value of their policy at any given point.

For an example of this, please see another comment to this post left by one of the hundreds of thousands of happy Bank On Yourself clients. Please note in particular Mark’s comment that, “I already KNOW how much I’ll have every month 20 years out! Guaranteed!”

If the income is guaranteed each month where does that income come from? Is it based off of stock investments or some other source of income generating source?

I’ve answered that question here…

Pamela – Please state the true rate of return on these policies just as you state the return of the ENTIRE stock market over time. That means stating what ALL whole life policies return on average (2.6%). Instead, you always state the most positive rates of the WL policies and the lowest returns on stocks. That is misleading.

Plus, that rate of return isn’t entirely accurate since you will NEVER have access to all of the cash value in your policy. If you do access 100% of that cash value, the policy will lapse and you will cause a taxable event. Money must remain in the policy to continue to pay the cost of the insurance. So, if I have a policy that now has 100k in it, and it had a rate of return of even 3% in order to result in that amount, did I really get that return since I can’t get to all of my money? If I need 100% of that money, I can’t get it. Just my beneficiary will get the remaining money through the death benefit when I die. That’s a good thing, but it won’t help me during retirement when I’m alive.

Here is a statistic I would like to see. What is the percentage of people who start a BOY plan who are still funding it 5, and even 10 years later?

I don’t think anyone is trying to pull off a scam here. I just think there are some serious things to consider when looking into a BOY plan. You need to have a serious commitment to it AND the available cash to fund it. It’s not magic.

MOST of the statistics I have quoted are NOT about the return of the ENTIRE stock market. And I do not discuss the return of ALL whole life policies, because as I’ve explained thousands of times, the Bank On Yourself-type policy is NOT structured in the traditional way, and has a much higher internal rate of return.

Furthermore, the rate of return that I quoted in my blog post IS based on your using the cash value to finance things! Which pretty well negates your argument.

You are correct, however, that you cannot borrow 100% of your cash value. The reason that the insurance company holds back a percentage of it is to ensure there’s enough of a buffer so that the policy does NOT lapse if you miss some premium payments.

Regarding your question about what percentage of people who start a Bank On Yourself policy are still funding it years later – the answer is about 95%. That’s because they see very quickly how the cash value grows, and experience the exhilaration that comes with using your cash values to become your own source of financing. It’s also because the Bank On Yourself Professionals coach their clients on a continual basis, so that they do not forget the reasons they started their plan in the first place.

Once again the FACTS are not shared and opinion, conjecture and ignorance is shown.I can not believe how many inaccuracies you have on these posts.

Lets find out where people can be misled by your statements.

You State – And I do not discuss the return of ALL whole life policies, because as I’ve explained thousands of times, the Bank On Yourself-type policy is NOT structured in the traditional way, and has a much higher internal rate of return.

My Reply – WHOLE LIFE policies, if they have the same rating, Ultra Preferred or Preferred or Standard or lower, all have close to the same rate of return in their rating class. It does not matter how MUCH money you squeeze in the policy with PUAs, it will only change the rate of return by maybe .25-.5 basis points. That means that a policy which is shown on an illustration to achieve a 5% ROR, by using the bank of yourself(infinite banking) methodology you may get an extra .5% because of the PUAs. I dont know where youre learning this stuff from but its misleading. If you dont believe MY FACTs go to any insurance company which has a whole life policy and have them run an illustration for you. Please find out the facts before these statements are made.

You State – You are correct, however, that you cannot borrow 100% of your cash value. The reason that the insurance company holds back a percentage of it is to ensure there’s enough of a buffer so that the policy does NOT lapse if you miss some premium payments.

My REPLY – Please revisit this with your local friendly insurance company and ask them the question. I am sure you will find out otherwise as to what you have stated. They do not hold back a percentage so to protect the consumer. They hold back a percentage to protect their interests in giving you the loan. Once again the FACTS are different than what you know.

My, my, my – you ARE sure of yourself, aren’t you? Some companies who sell policies consistent with the Bank On Yourself concept have software that very clearly illustrates the Internal Rate of Return (IRR).

The typical properly-designed Bank On Yourself policy has an average of a 22.69% higher return than a traditional policy, NOT what you stated in your post. But then, you believe the cash values are used as collateral for policy loans, which is also incorrect.

This conversation is over, sorry.

[…] whole life policy grows by a guaranteed and pre-set amount every year. In addition, the growth is exponential, meaning it gets better (more efficient) every single year you have the policy, simply because you […]

[…] whole life policy grows by a guaranteed and pre-set amount every year. In addition, the growth is exponential, meaning it gets better (more efficient) every single year you have the policy, simply because you […]

[…] whole life policy grows by a guaranteed and pre-set amount every year. In addition, the growth is exponential, meaning it gets better (more efficient) every single year you have the policy, simply because you […]

[…] whole life policy grows by a guaranteed and pre-set amount every year. In addition, the growth is exponential, meaning it gets better (more efficient) every single year you have the policy, simply because you […]

[…] whole life policy grows by a guaranteed and pre-set amount every year. In addition, the growth is exponential, meaning it gets better (more efficient) every single year you have the policy, simply because you […]

Hi Pam,

The BOY method impressed me so much when I learned it a year ago that I got my license and have been mentored by the advisor who told me about it. As an engineer by schooling I tried every method that Excel would allow compare BOY to the traditional by term and invest the difference approach.

One thing I think that Pam left out in her comparison is the “investor’s” cost of comparable term insurance.

If two individuals have $10,000 a year to save:

You place your $10k in a whole life policy.

An investor who buys an equivalent amount of term life insurance and disability to cover his insurance needs would spend ~$600 on insurance and have only $9,400 to “invest” in the first year.

Assuming you both started at age 30 by age 60 the investor would be spending ~$8,600 each year for comparable insurance and saving only $1400, if he could even get it.

By comparison you would each have roughly $650k in cash value/investments and 1.5M in insurance, but the investor would require 8.5% return each year. Plus he had to deal with the ups and downs of the market. This doesn’t even include investment annual fees and load fees!!!

Hi Pamela,

You go girl! I sell properly structured permanent life insurance just the way you and your advisors do and I’m so sick of the lies perpetuated by Wall Street!

Thank you so much for writing this book and actually replying to these advisors who continue to feed the public the “average rate of return” mumbo jumbo. Averages lie and all people need to do to find and confirm that truth is to look at their investment statements. Determine how much they put in and how much there is NOW. Then they can calculate their REAL rate of return. The truth will set you free.

With warm aloha,

Jenn

I’ve read alot…can you clear how the loan works, borrow 10k then how much interest do you have to pay back? I read that some months you can skip and not make a payment.. But does the interest (simple?) continue.? Then on death the unpaid loans plus unpaid interest is deducted from value of policy, true?

Looks great…I went to BBB and your company had a A+ rating but I didn’t learn much; not sure BBB did a good check on your company..Lamy NM?

The interest on policy loans is variable, and is typically lower than market rates. Yes, you can skip payments, and yes, the interest would continue to accrue. Any unpaid loans and interest would be deducted from the death benefit.

What Insurance providers do you presently endorse?

I am an educator, not a licensed financial professional. Therefore it is illegal for me to recommend any specific companies.

When you request a free Analysis, you’ll be referred to one of the 200 Bank On Yourself Professionals who will recommend a company appropriate for your unique situation and encourage you to do your due diligence before taking out a policy.

I was not looking for a recommendation. I just wanted to see if I am presently affiliated with any of the insurance companies utilized in your program.

If you’re a financial representative, you can learn more about the Bank On Yourself Professional program here.

Cash value is just a fictional notion..we do not get to keep the cash value..am i right..it’s only the death benefit which our heir’s get ?

Have you actually read ANYthing I’ve been saying?!?

I’ve addressed this all over the place. This is NOT true of DIVIDEND-PAYING whole life insurance and I PROVE that with copies of my own policy statements. Sheesh! But I’ll bet you’re too lazy to click on that link and get the facts.

Pamela, you are doing a very good thing here by telling folks the truth about Wall Street’s baloney. The truth is, you can’t compare anything to “buy term and invest the difference,” because you can’t possibly know your future market gains.

Averages are meaningless, and those who don’t understand that are the LAST people who should be in the market.

It’s funny… Wall Street tells you that past performance is no indicator of future gains, and then they go on to tell you that you can expect “X” because the market has returned “Y” over a handpicked number of years. My God… how stupid do they think we are?

Just so your readers know, I’m a Registered Investment Advisor, and I know what I’m talking about. AND I’m not necessarily advocating whole life insurance. That’s a personal decision that each person needs to make for themselves.

However, you make a much more balance argument — and you tell a whole lot more truth — than most folks will ever get from a stock and mutual fund salesperson.

Marc – I couldn’t have said it better myself!

How do you think the crunch that Europe is in will affect the Life Insurance Companies and their investments? I don’t like the way the DOW and SP etc. is doing now. How will wall street affect the policies cash value and dividends? What happens to the customers money if the Ins. Co. goes broke? I am now speaking with one of your advisors. Haven’t been able to speak with him since the crisis.

Good questions. I’ve answered them here.

This is addresses what Todd from Mar 19th and Dean from Mar 24th stated. Pamela is not “selling” insurance. She is telling people how to take back control of their finances and if she was selling insurance so what? Most people are miserably under insured and do not have a clue how much life insurance they should have. It is one of the most irresponsible things to do to your family by not carrying as much insurance as you can possibly afford. We are required to carry home insurance if we have a mortgage and we don’t question that, we are required to carry liability insurance if we OWN our car and liability, collision and other types of full coverage if we FINANCE our cars and we don’t question that yet we are not required to carry life insurance. Guess what happens if the the bread winner doesn’t come home? The auto insurance probably will lapse as well as the home insurance not to mention foreclosure on the house. No one need to question this…I have seen it. I am a retired Marine and had to go to those houses where these were the very things that threatened the surviving families. Even during this time of DECLARED WAR in Iraq and Afghanistan the number one killer of Marines are automobiles. The same automobiles that readers of this blog are driving on the same roads as the readers of this blog. Consider that one carefully.

Why would you even consider borrowing the ENTIRE amount of your Bank On Yourself plan? You wouldn’t consider spending ALL of your 401k plan would you? Even if you had to leave some money in a BOY plan you still would have the entire death benefit available to pay off the loan and the rest goes to your family. For instance if you borrowed 95,000 from your plan and still had 5,000 left because you didn’t want it to lapse and you died….your policy would pay off the loan and your family could get 100,000 to 300,000 more….let the Bank on Yourself Professionals tell you what would happen in those instances…I know many people would be pleasantly surprised to find out the answers to those “what if” scenarios….if you had your 401k and took 95,000 out of it and only had 5,000 left guess how much goes to your family…right….5,000 bucks.

Great post!

I think what people tend to forget are the other factors that erode your money. Money isn’t math. $4 + $4 isn’t simply $8. You have to factor in how much Uncle Sam gets. You have to factor how much inflation there is (how long did it take you to get that $4 and how much is it really worth today).

As Pamela indicated, a 10% average return could simply mean you have been losing money since day one.

As you spend down your policy with loans, does the cost of insurance go up reducing the returns in later years?

One of the great advantages of whole life is that every “moving part” in it is fixed and guaranteed, other than the dividend (Bank On Yourself Professionals use companies that have paid dividends every year for over 100 years, though).

Taking policy loans has no effect on the cost of insurance – that’s fixed and pre-set, too.

Remember that your death benefit is the collateral used for loans – if the policy owner dies with a loan outstanding, it will simply be deducted from the death benefit.

And the death benefit in these polices grows exponentially, just like the cash value does.

[…] dividend-paying whole life policy grows by a guaranteed and pre-set amount every year. In addition, the growth is exponential, meaning it gets better (more efficient) every single year you have the policy, simply because you […]

Dear Pamela,

I have read several books that promote Whole Life insurance, including ‘Bank on Yourself”. All of the books have had good information, but each has had some problem. It may be that the projections were not consistant with current realities, or it might be that the wrong product was utilized for a particular purpose.

Yours is closest to perfection, but as an experienced agent who has worked with both Par and Non-Par companies, I do not believe that only the select few companies (whose names I do not have) are capable of blowing away the stock martket and Buy Term and Invest the Difference. Such a presumption is akin to the belief by PFS agents that it is impossible to create a whole life policy as good as term insurance.

I am in the process of writing a book that addresses the excesses that can be found in these books. I am not really interested in the $100,000 challenge, since no projection of any current assumption or participating policy can be assured for the long term.

I commend you for combining two basic principles that I have learned in life from my Grandmother and the life insurance industry. One must save for a ‘rainy day’, and permanent life insurance is a more productive vehicle for accumulation than any other vehicle of comparable safety. The only criticism I have is your statement that only certified BOY agents are worthy of the buyers trust. This puts BOY agents into a cult-like class similar to ALWilliams/PFS agents. And I am sure that is not your intention.

I would freely recommend your book, except for that one issue. Aii-in-all, you are doing good work. God bless you.

Willard R. Brumbaugh, LUTCF

Hi Willard,

It was good to speak with you by phone – as I mentioned, I’ve been following you for a couple of years, so I figured it was time to connect with you.

As we discussed, I believe dividend-paying mutual life insurance companies have a better long-term track record of focusing on the long-term best interest of policyholders, rather than the short-term demands of Wall Street. Companies owned by stock holders too often tend to take more risk by going after short-term gains.

I hope you also understand now why I feel strongly that financial representatives who have the rigorous ongoing training required to be a Bank On Yourself Professional are, in general, better equipped to set-up these policies correctly and coach their clients to use them to maximum advantage over their lifetime.

Many financial representatives learn only enough about this concept to be dangerous. Even an experienced financial representative takes a year of full-time training and experience to become adept at this, experience has shown.

The financial representative who set up my first two Bank On Yourself-type policies insisted he understood everything about this. Yet he structured them both wrong, and they turned into Modified Endowment Contracts, thus losing the tax advantages.

I spent 40 hours(!) on the phone with the insurance company trying to get this fixed. One of their top level executives told me they wished their agents had never heard about this since the agents believed they knew how to do this, but were routinely structuring the policies wrong and it was causing more client complaints than anything else.

A year later I referred my sister to a different financial representative who also insisted he knew everything about this. We only found out years later he structured it incorrectly, and it’s growing MUCH more slowly than it should have. As a result, she’s had to delay her retirement for many years.

And my files are full of other similar stories. That’s what led to the creation of the Bank On Yourself Professional training program. As you are well aware, there is a lot more to this than meets the eye and the Bank On Yourself Professionals make additional discoveries virtually every week.

So, while there may be some financial reps out there who know all the ins and outs, they are few and far between, in my experience, and according to the calls and emails we’ve been getting from consumers who read my book or visit my website.

Bank On Yourself Professionals are even required to have their clients sign off on the understanding that if they allow their policy to lapse, their loans can become taxable, which I know is something you believe needs to be made very clear.

This strategy is a specialty, much like brain surgery is. This is why most people would rather see a specialist, who has done this many, many times and who has had rigorous training and certification in it, than go see a general practitioner.

Learn more about the advanced training the Bank On Yourself Professionals undergo, and I think you’ll understand why I feel so strongly about this.

Sincerely,

Pamela Yellen

I have a BOY account that was put into effect Sept. of 2006. I’ve been told by my advisor not to touch the account for at least the first 5 years. Are you in agreement with this theory? Would it be disastrous to touch the account if I needed the money now? Could you elaborate a little about your belief about this? Thank you. Wayne

Over the years, the thinking about taking policy loans has changed.

A properly designed Bank On Yourself-type policy CAN be used well before the fourth or fifth year. There are examples in my best-selling book of people who have done this.

Once you have enough equity available to cover the cost of something you wish to use it for, you can borrow it. The most important key is to set-up a re-payment plan, paying back more into the policy than the insurance company charges in interest (read chapter 6 of my book for more details on this). You can fill out an automatic withdrawal form to pay back your loan at the same time.

The reason for the caution about taking policy loans early on is that if you don’t pay them back, the policy could lapse. That’s more of a danger in the early years, than later on.

Remember – if you borrow from a bank and don’t pay it back, you’re stealing from the bank. If you borrow from your policy and don’t pay it back, you’re stealing from yourself.

Please contact your Bank On Yourself Professional to help you complete a request to take a loan from your policy, along with an automatic withdrawal form to repay it on a schedule you can live with. It sounds like you may have a pressing need to do so.

[…] Investor Trap #2: You could get the twenty-five percent “average annual return” for years as good as still not have the singular dime or even remove money! This is due to the fume as good as mirrors the Wall Street illusionists have been regulating to lift the nap over your eyes for decades. Don’t take my word for it – we unprotected the mutual comment “rate of return” myth” here: /whats-the-rate-of-return-on-a-bank-on-yourself-plan.html […]

Great information! I’ve been looking for something like this for a while now. Thanks!

[…] Investor Trap #2: You could get a 25 percent “average annual return” for years and still not make a single dime or even lose money! This is due to the smoke and mirrors the Wall Street illusionists have been using to pull the wool over your eyes for decades. Don’t take my word for it – I exposed the mutual fund “rate of return” myth” here: /whats-the-rate-of-return-on-a-bank-on-yourself-plan.html […]

All of these comparisons are very slanted and one sided comparisons. Its easy to paint a picture in a negative light when you show a one time investement over 4 years compared to systematic investment overtime. How does it compare to dollar cost averaging plans which when markets go down capture market share and when the market grows they explode? The assumption that people would stay fully invested in equity markets until the day they retire is also false. A proper plan would have them diversified and properly invested according to their needs and timing. Plus their are products available now that offer guaranteed rates of return on the downside or what the market does on the plus (as high as 5%). It allows all the positives of the market without the negatives of a downturn in retirement. sorry but time tested and true techniques will always endure while schemes come and go. I have had a plan that is diversified, that dollar cost averages in money everymonth whether it’s up or down, and my money is growing and far outperforming a meager 7 or 8 percent. Just my opinion but if you change plans to find the “next big thing” you’re making a common investor mistake which will get you no closer to your goals and dreams.

[…] Investor Trap #2: You could get a 25 percent “average annual return” for years and still not make a single dime or even lose money! This is due to the smoke and mirrors the Wall Street illusionists have been using to pull the wool over your eyes for decades. Don’t take my word for it – I exposed the mutual fund “rate of return” myth” here: /whats-the-rate-of-return-on-a-bank-on-yourself-plan.html […]

Number one challenge a saver has is staying on a plan. permanent life help you with a premium due each monthly. Good right? But through life’s journeys, cash flow is king. Some saving/investment’s let you get of the ride and get back on when the storm clears. How does that work in the BOY (more importantly the early year)?

A great thing about the way Bank On Yourself policies are structured is that they give you a lot of flexibility and you don’t have to pay the Paid Up Additions Rider portion in a pinch (or anytime you don’t want to).

If you get into a serious crunch in the first year and can’t pay any premiums at all, then there is the danger the policy could lapse.

It’s been interesting to talk to Bank On Yourself clients who credit their Bank On Yourself policies with giving them the ability to get through the financial crisis in a much better position than they would have been in without Bank On Yourself.

The poster who said that the slanted comparisons and partial examples give this a sleazy tone is correct. This is, simply, whole life insurance. Either whole life is a good investment or it isn’t. It should be easy to state what a typical whole life plan of the companies used pays. This is the only return that is guaranteed. That is what should be compared to other investments. Yes, you’d have to be an idiot — or more likely the dupe of an insurance salesman — to buy a whole life policy from a company that is not a mutual, dividend-paying plan, but the dividend is not guaranteed. It should be also easy to forthrightly state what percent of the initial premium is eaten up in commission in a typical plan of those described. Maybe the commissions on the riders are less than this — incidentally, what are they typically? Commission information is available and should be revealed to people who are trusting you. That would give your readers a baseline to use when they are talking to your “Advisors” who are merely insurance salesmen out to make a buck by “packaging the truth attractively” as Reagan said of himself.

The whole bank on yourself concept is basically a fraud. If one digs through the information that you do provide, there are some facts: Fact one: “interest on a BOYS loan is typically 8%.” Lower than some loans, higher than others, which may have their own risks — like home equity LOC. So, the paper value of the policy continues to grow (net of the unexpressed liability of unpaid principle and accumulated interest), but at what rate? Fact two: “The typical return on a whole life policy is the equivalent of a 6-8% return on a taxable investment.” In other words, you are earning 4-5% on your whole life policy (yes, plus unpredictable dividends, if any) while paying back 8 percent. Borrowing does not supercharge your policy, it creates a net loss, according to the scant actual figures you provided of 8% interest paid minus 4% earned on the policy. So the loan costs you 4%. Maybe that is good, compared to credit cards; maybe it is poor compared to paying cash from a saving account, which would have more accessible cash value because there would be no commission and no holdback to maintain the death benefit. But again, if there is no intend to deceive, why not make the same analysis explicitly that I just did? There may be some people who could look at this deal eyes open and still think it was a good deal, but they should do so eyes open and fully informed. Yes, there is no credit check and no loan review on a loan against your whole life cash value, and that may be a good thing, but the same is true of paying cash. And you don’t have to repay cash with interest. You just pay more cash. In fairness, you should point out that while your policy continues to grow on paper — at 4-5% — despite the loan, the reality is that the loan, and the accumulated interest, would be deducted from the cash value or the death benefit, until it is paid back at 8%, at which time the cash value and death benefit will be restored, having grown at 4%.

So, how does BOYS “supercharge” your wealth when the reality is that you are paying 3-4% more in interest to the insurance company than your policy is growing? (Yes disregarding the unpredictable and not guaranteed dividends.) Because the implicit assumption is that you will pay the insurance company (to go, less commission into paid up riders you own) not the 8% it is charging, but the assumedly higher interest rate of alternative types of loans you could have taken out to make the purchase, such as car loans, or credit cards. This is not a supercharged rate of return; it is merely a form of forced savings. One could get the same result by paying cash, and paying your bank account back the principle and high rate of interest you would have had to pay if you had gotten a high cost loan instead. Except that the entire amount of mythical “interest” you are paying yourself back in your bank account would go into savings, not partly into the insurance company and the agent’s commission on the paid up riders.

So let’s do some math.

Car loan 10%, return to you $0.

BOY: 10% payment to equal the cost of the car loan – 8% paid to insurance company = 2% (your money being paid to yourself as forced earnings, NOT a return on investment) + 4% increase in cash value of your policy despite the loan – commission on the paid up rider. Bottom line? The loan cost you a net 4%. You forced yourself to save 2% by pretending to pay the car loan interest rate, minus the commission. (And plus any dividend on the policy, if any.)

Cash: cost equal to loss of interest being earned on cash 1-2%. Paid back at 10% pretend car loan interest. Net 8% forced savings (not a return on investment). No commission, either on the amount you saved OR MORE IMPORTANT, on the original amount you had saved.

Again, you gained nothing by taking a loan against a life insurance policy; you lost about 4% plus the cost of the commission in the paid up rider. This is not money for nothing. The book leaves the impression — I think intentionally — that somehow borrowing against your policy is not merely free, it actually makes the value of the policy grow faster. This sleight of hand may encourage people to spend instead of saving.

Whole life is a good investment or it isn’t. It is a good place to park cash or it isn’t. At the expense of the commission, whole life may be a better place to park your emergency cash reserve.

If you have downplayed any advantage of whole life, it is in providing little information on whatever tax advantages it may have.

You have selectively quoted, and thereby distorted John Bogles’ comment. I have read his book. The point he is making is not that buying and holding diversified stocks and bonds or low cost, no load index mutual funds will only yield less than 2%. He thinks their potential long term return is much more than that. He is warning that people who jump in and out of the market, and who chase last year’s winner who is most likely to be this year loser have far underperformed the market. He is not indicting the market — as you imply — but the behavior of typical investors whom he is trying to educate. Has the behavior of the market been disappointing recently? Yes. Again, the 4-5% return “guaranteed” by an insurance company we hope is better risk than AIG is a good investment, or it isn’t, compared to alternatives.

The “buy term and invest the difference” is something of a straw man. The real, irreplaceable value of term is that it is pure insurance. Cost and commissions are VERY low because it is very competitive and there are excellent websites that allow you to compare rates — almost approaching the conditions lots of sellers, similar products, and perfect information on price that Adam Smith specified for a valid market (one of the few). So a young wage earner can afford to buy enough insurance to replace the wages the family depends on. No way the wage earner could afford enough whole life to do that. Yes, you are renting insurance that you hope to never use.

Just as you only “rent” auto insurance. Let us imagine what whole auto insurance would look like. You might wreck your car. So instead of paying a few hundred to insure you car’s replacement value, you would pay tens of thousands to buy a replacement car and keep it in your garage in case something happened. You might wreck someone else’s car. So instead of paying hundreds for at fault insurance, you buy a car in case you hit someone. It might be a Mercedes. Say $100,000. You might hit two Mercedes, say $200,000. (Sorry, there is no way you can pre-buy to replace the life of someone you might kill).

So the issue is not, “Buy term and invest the difference.” The issue is, buy term, and invest whatever funds you have left in whatever you think is the best investment. If that is whole life, so be it. But whole life is not really life insurance. It is really an investment like any other, to be considered on its merits as any other, including its performance record, its potential to earn unpredictable dividends, and any possible tax advantages.

Too bad you don’t provide more real information on its actual performance, advantages, and disadvantages. If you had done so, you might have gotten me to rethink whole life.

You obviously put a lot of time and thought into your comments, Steve. So I’ll take the time to address a few key points you made:

1. Your suggestion that the guaranteed growth on a whole life policy “is what should be compared to other investments” assumes you can somehow compare something that’s guaranteed with something that has no guarantees whatsoever (other investments).

You can’t. And, while dividends aren’t guaranteed, as you point out and as I’ve noted many times, these companies HAVE paid dividends every year for 100 years or more.

The ONLY way a policy owner could get only the guaranteed growth is if these companies suddenly stopped paying dividends – ever again!

2. You are correct – whole life policies currently do not itemize all costs and commissions. But what you do see when you look at the guaranteed growth, or the projected growth based on the current dividend scale, are the BOTTOM-LINE numbers AFTER all expenses have been taken into account.

I liken it to buying a couch or a TV – all the costs of sales and manufacturing are included in the price, which in this case, is the premium.

Compare that with mutual funds, for example. They never show you what you’ll actually have left after all the fees are deducted. And as John Bogle noted in “Common Sense on Mutual Funds,” some fees in some types of funds are not disclosed at all.

So, when you add in the fact that there are no guarantees at all, and the fees aren’t transparent, how can anyone say this way of investing is anything more than a wild guess and hoping and praying?

Which brings me to my next point…

3. Are you sure you read the same John Bogle book I was quoting from?

Because that book is not even close to primarily being about the problems with the way people invest in the market, and also the way portfolio manager invest. He has some excellent information and statistics on that, but it’s a small portion of the book.

Chapters 14 and 15 will make your hair stand on end.

And a number of chapters are devoted to showing the devastating effect of the compounded fees and taxes in mutual funds. Most investors are giving up HALF or more of the markets return to Wall Street Pirates. And another 25% to taxes.

I may have misled you by saying somewhere that you’ll pay around 8% interest on a policy loan. That’s because in many companies, the loan interest is a variable rate and it’s usually lower than market rates.

It’s been some time since it was 8%. Right now it’s closer to 5%.

But that’s a moot point. Because the interest you pay ultimately ends up back in your policy, as explained in detail on pages 100-102 of my best-selling book.

If you pay your policy loans back at the interest rate charged by the company, you’ll end up with the exact same cash value as if you didn’t use the policy to finance things (assuming your policy is from a dividend-paying, non-direct recognition company).

And finally, I invite you and anyone else who is still skeptical to take my $100,000 Challenge. Compare your best financial strategy against the advantages and guarantees of Bank On Yourself. If you’re the first person to match or beat Bank On Yourself, there’s a $100,000 cash reward waiting for you.

p.s. And no, whole life is not an investment, and yes, it really is life insurance with some pretty nifty added benefits.

“But whole life is not really life insurance.” ??? WHAT??? Of course it is life insurance. Where else can you spend a one time premium of, lets say $50,000.00 and the next year you die in a horrible accident and your beneficiary get close to $100,000.00 tax free? Maybe around $200,000.00 if you bought the Accidental Death Benefit rider? (which is very inexpensive) Or as I did 27 years ago: I bought a $50,000.00 Whole Life Policy that cost me $51.00 a month and protected my family if I died with enough money to bury me and pay the mortgage off tax free? Now, 27 years later, I have spent less than $17,000.00 and the cash value in my policy has grown to $25,000.00 and the death benefit has grown to $85,000.00.

I am already retired (on SS disability 9/97); now 66, poor health, very modest wealth). Too late for me?

It’s definitely NOT too late, especially because there is a good chance you could live to be 90 or beyond! We have many people starting to use Bank On Yourself pre-retirement and even post-retirement.

The best way to find out for sure what your bottom line numbers would be if you added Bank On Yourself to your financial plan is to request a free no-obligation Analysis here.

[…] whole life policy grows by a guaranteed and pre-set amount every year. In addition, the growth is exponential, meaning it gets better (more efficient) every single year you have the policy, simply because you […]

[…] total hold up process grows by a upon trial as well as pre-set volume each year. In addition, the expansion is exponential, definition it gets improved (more efficient) each singular year we have a policy, simply since we […]

[…] whole life policy grows by a guaranteed and pre-set amount every year. In addition, the growth is exponential, meaning it gets better (more efficient) every single year you have the policy, simply because you […]

Convince me this isn’t a scam. This looks like the multi-page better-than-sex get-rich-quick ads I get in the mail all the time. If this method is so great, then just tell us the details. It looks like a black box the way it is described. My scam-alert meter is maxed out.

Huh?!? This is a proven strategy that’s been around for over 100 years – actually more like 200 years.

Sounds like you’re just skimming the surface and looking to find fault.

Take a little time to read my best-selling book or browse the pages of this blog and website and you’ll have all the facts and proof you need.

Hi Pamela – I have been studying IBC for about 6 months now. I have read Nelson’s book 3 times and read countless other articles on the topic. Admittedly I have not read your book yet; however, I have read your website, blog posts, etc. Much like you I was skeptical at first and have tried to poke holes in it but have found that it holds up in every scenario I have thrown at it. Having said that I would be interested to get your thoughts on the following Man A vs Man B comparison:

* Assume Man A & B are identical males age 42 with preferred rates

* Assume Man B purchases a $1 million dollar banking policy at roughly $16k per year premium

* Assume they are both in the same tax bracket of 30%

* Assume Man A invests his $16k per year into his 401k (pre-tax, tax deferred) at a rate of $1333.33 per month and he has a standard 401k match from his employer (I’m not sure how much that would add, do you?)

* Assume Man A buys a $1mil term policy in case of premature death (cost needs to be factored in to be fair)

* Assume Man A diligently invests in a S&P 500 index fund and it provides the S&P historical average return of 9.5% per year over the next 23 years (assuming an age 65 retirement)

* Assume Man B purchases the $1mil policy and uses the $16k (after tax money, which would require almost $21k before his 30% tax) for his premiums

* How would they compare at their retirement age?

What if Man B uses banking and buys a new car worth $35k every 5 years, how much does this change the outcome?

I realize the above comparison may need to factor in some additional variables and it’s not an either or scenario necessarily but wanted to ask if it is possible to calculate something like this.

Thank you in advance for your response.

RCS

The problem in your example is contained in this phrase: “…and it provides the S&P historical average return of 9.5% per year over the next 23 years…”

Let’s overlook the fact that no one gets the historical return. And let’s ignore all the reasons why that’s true.

The biggest problem is that you’re trying to compare something that’s guaranteed (Bank On Yourself) with something that’s not (the stock market). Comparing apples to oranges doesn’t work.

Hi Pamela – I understand what that it is not an apples to apples comparison. However, as you state several times in your blogs, dividends in a BOY program are not guaranteed either but historically mutual companies have always paid them. Thus I think it is fair to say the S&P 500 has historically provided a 9.5 compounded average growth rate (not just annual ROR). Nonetheless, everyone has a limited amount they can put into their BOY plan, IRA, 401k, or whatever vehicle they are using to save or invest for retirement. Is their some way to make a relevant A/B comparison using real data points?

Thank you,

RCS

A Bank On Yourself Professionals could probably do this assuming they felt it was going to be of value to someone to do it. You’re obviously a financial representative – why don’t you run this comparison yourself?

[…] Investor Trap #2: You could get a 25 percent “average annual return” for years and still not make a single dime or even lose money! This is due to the smoke and mirrors the Wall Street illusionists have been using to pull the wool over your eyes for decades. Don’t take my word for it – I exposed the mutual fund “rate of return” myth” here: /whats-the-rate-of-return-on-a-bank-on-yourself-plan.html […]

As I’ve read many books on the subject, my question is not one of if this works or if it’s better than other alternatives, but rather the type of policy to use issue…as in the question and statement below.

You and Nelson Nash, Doug Andrews, Patrick Kelly, Brett Anderson, Marion Snow, Terry Laxton, (hope I didn’t leave out any I’ve read out, ) have all done a great job of persuading me of using life insurance instead of the alternatives) but although I have obviously read much material I have yet to find a convincing case for using WL instead of UL, or EIUL (I have reasons for not using VUL as it is basically using mutual funds)

(The commission question is not the issue as in any minimum face maximum policy the agent reduces his/her commission, and neither is the captive agent issue as although it appears that the advisors promoting the BOY concept are not captive you have suggested by your statement (No other life insurance product comes with as many guarantees as whole life, and it is the only one recommended for Bank On Yourself.) that to be an advisor with BOY the agents must use a WL policy and likely from a specific company (or a very limited number of companies) so although technically they are not captive they have effectively made themselves captive. [sort of like going steady].

So if a UL or IUL or VUL policy was compared to a WL policy for a past period of time (I realize past performance is no guarantee of…etc) however as the validation of the WL policy is that “these policies have paid a dividend for over 100 years”… is used, a comparison of the past performance of different types of policies over say 20 years would seem to be reasonable. (I am aware that UL VUL and EIUL have not been in existence as long as WL so the comparison could be for as long as they were in the race [UL longer than IUL], and whatever guarantees the WL policy has that are referred to below [that might affect the financial outcome] could be incorporated in the comparison.

If the WL policy did not perform as well or better than say the EIUL it would be OK to say so… if you included what the benefits were that one was giving up. Such as in the cash value in early years of a policy to a 401k. with the policy you get the death benefit with no addition out of pocket expense, and as the 401k can’t be touched without taxes and penalties before 59 ½ the value of the account is an illusion.

You go into great length to disprove the contentions of the other alternative proponents – and with great success I might add – but UL, VUL, and EIUL are just as much an alternative consideration as Mutual funds, 401k, etc., so to dismiss other types of polices with a flick of the wrist statement as in “No other life insurance product comes with as many guarantees as whole life, and it is the only one recommended for Bank On Yourself.” does not answer the question.

So how about an answer to – WL vs UL, EIUL- that finally clarifies the issue, as you do regarding Insurance vs the other alternatives?

Thank you for the opportunity to finally clarify the issue of why I prefer Whole Life to Universal Life and Equity Indexed Universal Life. After reading these two articles, I believe you will understand:

Equity Indexed Universal Life versus Dividend Paying Whole Life

Whole Life Insurance vs. Universal Life Insurance

Your response did not address the question that I asked in the manner I asked for.

So if a UL or IUL or VUL policy was compared to a WL policy for a past period of time (I realize past performance is no guarantee of…etc) however as the validation of the WL policy is that “these policies have paid a dividend for over 100 years”… is used, a comparison of the past performance of different types of policies over say 20 years would seem to be reasonable. (I am aware that UL VUL and EIUL have not been in existence as long as WL so the comparison could be for as long as they were in the race [UL longer than IUL], and whatever guarantees the WL policy has that are referred to below [that might affect the financial outcome] could be incorporated in the comparison.

The article that you wrote concerning UL vs WL assumed that this was not an apples to apples comparison:

1. That if the agent would not properly structure the policy by using the wrong test for premium

2. That if policy loans would be larger than they should be to sustain the policy

3. That if agent would project interest at a rate that could not be sustained

4. That if the client would not manage to fund the policy as they would the WL policy

What I asked for was a history comparison for the last 20 years that assumed this was an apples to apples comparison:

1. The agent used the correct test for premiums

2. Policy loans would not be taken in an amount that would cause the policy to lapse

3. The interest rate would be what was historically credited

4. The client would fund the policy just as they would the whole life.

So unfortunately there is no conclusion that can be drawn from your article and I have no valid reason to believe that a properly structured, maximum funded, correctly managed UL or EIUL would not perform as well or better than a WL policy.

Thanks Anyway

I think you missed the key points made in these two articles. I did not write them. The Vice President of a top company that sells both universal and whole life wrote them and he has no vested interest in one over the other. It’s by far the most objective overview of how these two types of policies compare that I have ever seen.

I am not going to reiterate the many valid points made in these articles. I would simply encourage you – and anyone else who wants to know the facts (as opposed to the hype) – to park their preconceptions at the door and review these two articles several times.

You keep asking for “an apples to apples” comparison of these two different products. However, they are NOT the same, for all the reasons mentioned. That’s a key point you seem to be missing. In my experience, financial representatives who tout the benefits of Universal Life over Whole Life don’t truly understand how dividend-paying Whole Life actually works. Once they do fully understand the inner workings of Whole Life, they soon quit recommending Universal Life.

And if they ever clamp down on how Universal Life policies are allowed to be illustrated, I predict sales will plummet.

The effect of taking policy loans from an Indexed Universal Life policy can be devastating, as explained in Point #3 in this article. This is why Universal Life is particularly inappropriate for anyone who wants to use their life insurance policy to become his or her own source of financing.

[…] dividend-paying whole life policy grows by a guaranteed and pre-set amount every year. In addition, the growth is exponential, meaning it gets better (more efficient) every single year you have the policy, simply because you […]

Very interested in your information, especially as it might apply to guaranteed income stream for retirement. How is BOY different from a good annuity? With the markets as jittery as they are, can we be assured that these companies will still be around in 20- or 30 years? I remember once being told that GM was a great bond to buy because they would never go under!

It’s WAY different from an annuity – or any other product. The Bank On yourself method has 18 advantages and guarantees and I encourage you to compare your best or favorite strategy (including annuities) against these to learn the differences.

And to find out why these companies are likely to continue to be around forever, read why Bank On Yourself is a strategy for ANY economy.

I am a little confused on the policy loan issue. If I take a loan against the cash value of my policy and the insurance company is charging me interest on that loan, aren’t they charging me interest on my own money??? How does that make sense?

Yes, they are charging you interest on your own money (they’d go out of business if they didn’t do that – why would any policy owner want that to happen?). However, what you totally missed is the fact that, with a Bank On Yourself-type policy, the interest you pay ultimately benefits you, the policy owner. As I discuss in detail on pages 100-103 of my best-selling book, you’ll end up with the exact same cash value if you borrow from your policy and pay it back at the interest rate charged by the company as you would if you never borrowed a penny. So who benefits from that interest if not you?

This is quite unbelievable. The messages I read on here are very full of misinformation. This is just one which I could not believe my eyes. My responses to this thread to follow.

You State —- Yes, they are charging you interest on your own money (they’d go out of business if they didn’t do that – why would any policy owner want that to happen?). However, what you totally missed is the fact that, with a Bank On Yourself-type policy, the interest you pay ultimately benefits you the policy owner…

My RESPONSE — HOW DOES interest which I pay to someone else benefit me. If I go to a bank and get a loan, lets say for 10,000 at 6%. I pay it back after exactly one year paying the bank 10,000 + 600(their interest). If I have a WHOLE LIFE contract I ask the insurance company for the same loan at 6% and I make the same identical transaction and pay the loan back at the end of 1 year, I pay the 10,000 + 600(interest back to the insurance company).

I am not “paying myself back” the 10,000 since it was the insurance companies money which was borrowed by collateralizing the cash value of my life insurance contract. So how is this any different than borrowing from the bank?

I know in the BANK ON YOURSELF methodology youre supposed to pay yourself back at 10% therefore taking more money from your own CASHFLOW to DUMP into the life insurance policy as PUA’s. But I can do that while borrowing from the bank and just sending the extra cash I would have paid to the bank to the life insurance company and place it towards PUAs. So how exactly does it benefit the owner of the policy?

What If I took a loan out at 1.5% tax deductible (libor 6 month rate) collateralized by my portfolio of bonds(muni,gvmt,corporate etc.) I would only pay 1% net after tax on the 10,000 or $100 in interest and save the $500 which can go towards my PUA purchase. Wouldnt that be a better deal to make then to borrow from the life insurance company? Please explain how that is not a better way of doing it. What if it were an equity line against my home at 4%(tax deductible) it would still be a better deal. So please explain how it benefits the policy holder to borrow at a higher interest rate, NON tax deductible from the life insurance company.

YOU SAY>>>you’ll end up with the exact same cash value if you borrow from your policy…

MY RESPONSE — THIS IS COMPLETE MISINFORMATION…YOU DO NOT borrow from your policy. Where is this stated in the life insurance contract? Please show me where this is stated in a life insurance contract? This is a VERY big mistake and could prove to be disastrous. One uses their life insurance cash values as COLLATERAL for the loan which the insurance company gives them. You are NOT “BORROWING FROM YOUR POLICY” YOU are borrowing from the insurance companies funds and using your cash values as collateral. This needs to be corrected ASAP as it could mislead everyone. If you do not believe this call any insurance company and ask.

YOU SAY — and pay it back at the interest rate charged by the company as you would if you never borrowed a penny. So who benefits from that interest if not you?…

MY RESPONSE — THIS IS ABSURD, the insurance company benefits from the interest you pay them. You DO NOT. It is obvious there is a lack of knowledge regarding the products you are speaking of. What you, the consumer who owns WHOLE LIFE benefits from, is the growth of the cash value in the policy. The cash values are not affected by the loan(depends on direct recognition). The loan is a contract between you and the insurance company which uses the CASH VALUES as collateral. There is much misinformation in the public regarding everything I have addressed here. Bank on Yourself or INFINITE BANKING when put to a TRUE TEST cannot work as it is sold and described. I have analyzed hundreds of these scenarios and NOT ONE works as described. Its too bad people(GOOD PEOPLE) fall for this stuff. I am sure you have fallen for it just like everyone else without true testing and verification of the facts.

If you please answer and respond to what I have stated above that you FACTUALLY can prove to be false since I for one would like to know where I am not seeing something that maybe you may be seeing.

I’m not sure why you want me to “answer and respond” when you have already made up your mind.

I will, however, point out briefly several errors in your post, all of which I have gone into in detail on the website and in my book:

The cash value in your policy is the policy owner’s money, not the insurance company’s. The insurance company is simply the administrator of the policy.

You do not use your cash value as collateral for a loan, as you stated not once, but TWICE! (And you’re telling ME I need to correct my information about this “ASAP”?!? You’re the one who needs to “call any insurance company and ask.”)

It is your death benefit that is used as collateral for any loans, which I’ve spelled out clearly here and in my book.

I’ve also given a clear example of how loans from dividend-paying policies work in this regard here:

/is-bank-on-yourself-too-good-to-be-true.html

You will end up with the exact same cash value whether you take policy loans and pay them back at the interest rate the company charges, as you would if you didn’t take any loans.

If you can get a lower interest rate from another source, that’s your choice. Personally, I have no love lost for banks and financing companies, and would prefer to pay interest back to my own policy (myself) than contribute to some banker’s next yacht.

And I can set my own re-payment schedule, too, and not worry if I have some emergency come up and have to reduce or skip some loan payments.

It is like taking ten dollars out of your own pigbank and putting back ten dollars plus interest…in your own pigbank. Now your ten dollars is that much fatter.

Thanks for the response. I was all set to start investing with a wealth manager in my area last year when my father in law gave me your book. Needless to say, it really made me stop in my tracks and research this concept. I met with an advisor and like most people, am still looking for “the catch”… When I brought this up to the wealth manager, just as you said, his response was that this “seemed gimmicky” and pushed the VUL policy. I still haven’t made the commitment to start a policy. The reason I didn’t start one was because I asked the advisor to refer my to some people who were currently doing BOY so I could talk to them. His immediate answer was no and I have also referred several friends and they all have had the same response from their advisors. Is there a reason for this? Thanks again..

Thanks for the feedback. There are a couple of reasons the Bank On Yourself Professionals don’t give out the names and contact information of their clients.

For one, almost 350,000 people visited the Bank On Yourself website in the past year. If only 5% of them ask to speak to Bank On Yourself clients, that’s almost 18,000 people who would be calling people and intruding into their personal time.

We used to provide contact information of clients who said they’d be willing to talk to people about their experience with Bank On Yourself. We asked the inquirers to please limit the conversation to 10 minutes, so as not to impose. However, we’d hear back from the clients that the conversation usually lasted an hour or more. That’s the second reason referrals are no longer provided.