Ted Benna is known as the “Father of the 401(k).” In the late ‘70’s, he worked as a consultant to business owners whose main agenda was “How can I get the biggest tax break, and give the least to my employees, legally?”

Tax nerd that he was, Benna discovered an obscure part of the tax code – section 401(k). Voila! By 2012, nearly 75% of all company pension plans had disappeared!

What does Mr. Benna say about his beautiful 401(k) baby today?

If I were starting over from scratch today with what we know, I’d blow up the existing structure and start over!”1

Uh oh.

Per the US Senate Committee on Health, Education, Labor, & Pensions: “After a lifetime of hard work, many seniors will find themselves forced to choose between putting food on the table and buying their medication.” The U.S. Census Bureau says the average value of 401(k) accounts of pre-retirees between 55 and 64 is only $170,645; the average value of their IRAs is only $147,345. And half of all those close to retirement age have less than $50,000 in these plans.

Something went horribly wrong. Actually, several things went horribly wrong, not only with 401(k)’s but also their kissing cousins: IRA’s, Roth Plans, 403(b)’s, SEP-IRA’s and so on.

And the problems with these government-controlled plans are in these five key areas:

- Predictability

- Control

- Liquidity

- Tax consequences

- Fees and expenses

Let’s take a look at these problems…

1. Conventional Plan Unpredictability

Before 1978, speculating in stocks was for the wealthy. They risked money they could afford to lose. But is the money in your retirement fund account money you can afford to lose? Didn’t think so.

Barry Dyke (The Pirates of Manhattan) wrote, “The 401(k), without any guaranteed returns, is a recipe for disaster. The 401(k) is a speculation bonfire – over 77% of the savings in these plans are invested in volatile equities and mutual funds – which dumps all of the investment risk on uninformed retirement savers. Tying all of retirement income to the stock market is insane.”

And what have our results been when we all jumped aboard the Insanity Express?

Let’s look at target date funds (TDF’s) for example, mixed-asset mutual funds that shift from higher-risk to lower-risk investments as participants approach their target retirement date (the most popular default investment chosen by employers). A 2011 report from the General Accountability Office (GAO) revealed that investors in the largest TDF funds lost as much as 31% of their money between 2005 and 2009… while the Dow Jones Industrial Average lost only 1.61%. Ouch!

What guarantee do you have that the market won’t crash – again – right when you planned to tap into it? Answer: NONE. In fact, the only guarantee Wall Street gives us is that they’ll get paid whether we win or lose!

Do any of us really need another hope-and-pray strategy in our financial plans?

In a Bank On Yourself plan, your money grows by a guaranteed and predictable amount every year. Your plan never goes backwards when the market crashes. And it’s guaranteed to grow by a larger dollar amount every year you fund the plan.

You can also use it to bypass banks and financial institutions to become your own source of financing. Gain access to capital when you want, for whatever you want, just by answering one question: How much do you want?

Request your FREE Analysis (if you haven’t already), to find out how big your nest-egg can grow – guaranteed – on the day you want to tap into your plan… and at any point along the way.

REQUEST YOUR

FREE ANALYSIS!

2. Out of Our Control

In our “legislators’ infinite wisdom” (now that’s an oxymoron!), we are too incompetent to manage our retirement accounts. So government-approved retirement plans have more strings than Pinocchio before he became a real boy.

Most of these plans regulate how much you may put in, what you can and cannot invest in, how much you can borrow and how you pay it back, how long you must wait before you can access your money, when you must withdraw your money and how much you must withdraw. Penalties can be huge.

Your company can change your 401(k) plan’s rules and participation rates with little or no notice, throwing years of your careful financial planning into chaos. And the government can pop in new regulations any time it wants.

Hold it! Isn’t that your money they’re fooling around with?

3. Lack of Liquidity

Here’s the key question: How quickly can you get money from your retirement account when you really need it?

I don’t mean raiding our nest eggs every time the latest 50” 3-D plasma flat screen TV comes out. But face it: Stuff happens.

With conventional plans, you typically have to sell the investment if you want to get your money out. If it’s a bad time to sell, you’re out of luck and have to bite the bullet and take a huge loss.

And if you need money, you may or may not be able to borrow money from your plan. If your plan permits borrowing, government-imposed limits regulate how much you can borrow, how long you can borrow, and how often and in what amounts you must make loan payments. In most cases you’re required to pay your loan back in full with interest in 30 to 60 days, or you’ll have to pay income taxes on the money you borrowed plus a 10% penalty.

Borrowing from your IRA is a no-no. The value of your entire IRA immediately becomes taxable. Even using your IRA as collateral for a loan triggers taxes.

Did you really intend to be so harsh on yourself for using your own money?

4. The Tax Man Cometh

With the exception of Roth plans, money you put in a government-sponsored retirement plan isn’t taxed when you make your contributions, which is a huge part of the appeal of these plans.

Deferring taxes might sound good but it’s like putting off a visit to the dentist. The problem only gets worse. And you don’t know what surprises the tax man has in store for you when you retire.

Raise your hand if you think tax rates will be decreasing between now and when you start withdrawing from your retirement plan. Yeah, me neither.tist. The problem only gets worse. And you don’t know what surprises the tax man has in store for you when you retire.

Okay, the money you put in is tax-deferred. Over time, you hope that money grows. (Sadly, it may not grow much and you may lose it all, but you’ve still got hopes!) Later, you’ll pay tax on everything you withdraw from the plan. “Everything” means every single penny you take out.

And when the tax man eventually comes calling, he won’t ask you what your tax liability would have been if you’d been paying taxes all along. He’ll tell you what your tax liability is at the time the taxes are due.

Which means you’re sitting on a tax time bomb.

5. Fees that Compound Against You

This “flaw” really gets in my craw because people don’t realize it! Fees in these plans are hidden in microscopic print that’s tinier than Bible verses on a grain of rice! But these fees have been scrutinized:

According to an exposé on 60 Minutes, fees “can eat up half the income in some 401(k) plans over a 30-year span.”

According to AARP, “What an investor pays in 401(k) fees could add up to significant costs over the life of a 401(k) plan. For example, for an employee who has been working for 35 years and contributes an estimated $5,000 per year to his/her 401(k) plan, with an annual return of seven percent and no fees, he would earn about $469,000 over the 35-year period. However with an annual fee of 1.5 percent of the account balance, the employee would earn only $345,000 in a 35-year period.”

Poof! There goes more than 26% of your hard-earned dollars! Somebody made good money and it wasn’t you!

And if you think you’re exempt from losing a big chunk of your nest egg because you have an IRA, think again.

A 2013 Government Accounting Office report blew the lid off the myth that IRA fees are low. (They’re often higher than 401k fees). And beware if you’ve left a job and are rolling over a 401k into an IRA. The GAO found half of the largest IRA providers incorrectly stated there were no fees to open or maintain an IRA.

Wouldn’t You Rather Bank On Yourself?

Hundreds of thousands of people just like you have used a little-known option called Bank On Yourself to safely and predictably grow their retirement accounts.

REQUEST YOUR

FREE ANALYSIS!

Not a get-rich-quick scheme, Bank On Yourself takes some patience and discipline. In return, you get guarantees, safety, liquidity, and control. Your money grows by a guaranteed and predictable amount every year, and that growth gets better every year you have it.

I have more money in my Bank On Yourself policy in six years than from funding my 401(k) for 20.”

— Dan Olson, retail store manager. Minnesota

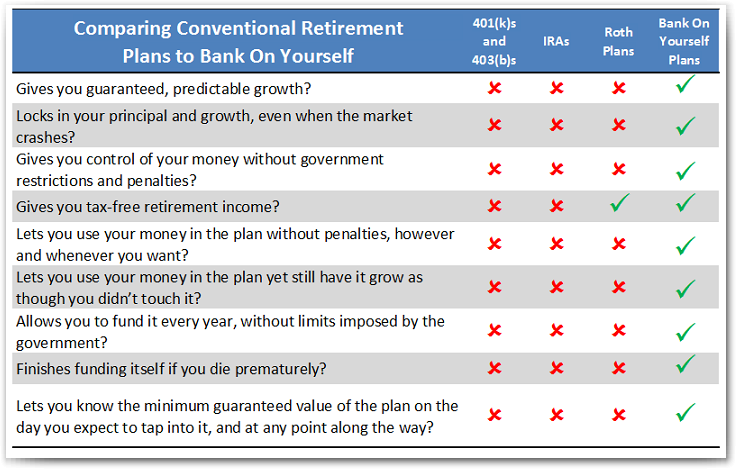

The chart below compares traditional retirement plans against Bank On Yourself in ten critical areas. And it doesn’t require a Stanford MBA to understand:

Would you like to find out what your bottom-line guaranteed numbers and results could be if you added the Bank On Yourself method to your financial plan? It’s easy to find out when you request your free Analysis here.

REQUEST YOUR

FREE ANALYSIS!

1http://www.marketplace.org/topics/sustainability/consumed/father-modern-401k-says-it-fails-many-americans

I feel that most current retirement plans like 401k’s or IRA’s are out of date and aren’t meant to function probably with our current economy. They need to be revised so they adjust to our tax structure and should be adjusted based upon the consumer price index.