There have been three recent surprising revelations I urge you to pay close attention to, if you have any money invested in the stock market and/or you have an IRA, 401(k) or other government qualified retirement plan…

1. The ugly truth about the stock market’s new record highs

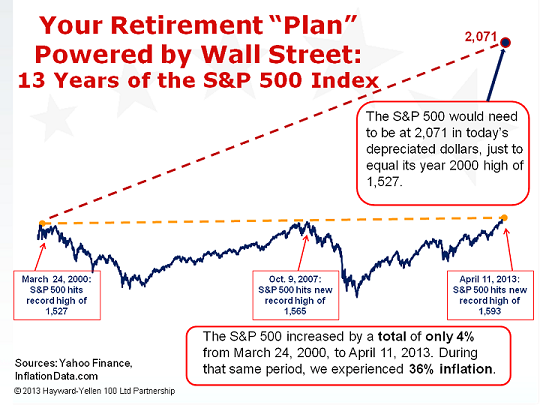

Take a look at the chart below which reveals how, when measured in real purchasing-power terms, the S&P 500 Index is nowhere near its March 2000 high. In fact, the index would have to increase by another 32% today, just to get you even (in real dollars) with where you were more than 13 years ago:

Even if you look at the total return of the S&P 500 (including reinvested dividends), the real (inflation-adjusted) purchasing power of your investment remains negative after 13 years. And this assumes you have no fees, commissions or taxes, which, of course, will take another big bite out of your savings.

2. Long-term investors received only HALF the return of the S&P 500

That’s according to the new study just released by the well-respected independent analysis firm, DALBAR.

The study examines real investor returns in various types of mutual funds for the last 20 years ending December 31. Investors in equity mutual funds averaged only 4.25% per year – a little less than half the return of the S&P 500. (Was that worth the roller coaster ride and sleepless nights?)

Investors in asset allocation funds got only 2.29% per year, and fixed-income fund investors got less than 1% per year… for the past 20 years!

All of which makes it clear that investors are only fooling themselves if they believe they are growing real wealth in the Wall Street casino, when the reality is that they are digging themselves deeper and deeper into a hole they may never be able to climb out of.

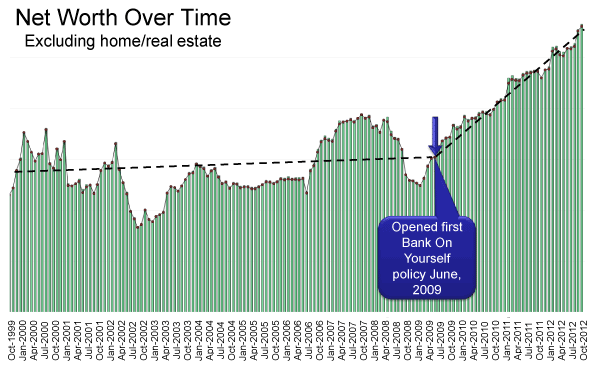

Now take a look at another chart:

This chart was sent to us by one of our subscribers to demonstrate how much his net worth had grown since he started his first Bank On Yourself policy and got out of the stock market in 2009, compared to the previous ten years.

That’s what happens when you take the volatility and randomness of the market out of your financial plan. Bank On Yourself lets you get back control of your money and finances and stop worrying about the bad news of the day.

You can listen to or read the interview I did with this subscriber, as well as see a more detailed version of the chart above. There are at least three insights shared in this interview that could be worth a million dollars or more to you.

Would you like to find out how much your own financial “picture” could improve if you added Bank On Yourself to your financial plan? It’s easy to find out when you request a FREE Analysis, if you haven’t already done so.

3. The government wants more control of your retirement plan!

The latest proposal to control your IRA, 401(k) or other government qualified retirement plan came in Obama’s new budget plan that was announced last week. It would limit how much a person can accumulate in and withdraw tax-free from an IRA or 401(k).

The government’s rationale for such a move is that, “Some wealthy individuals are able to accumulate… more than is needed to fund reasonable levels of retirement saving.”

Why are government-sponsored retirement plans such an attractive target for government control and ownership? For the same reason notorious holdup man Willie Sutton gave when he was asked why he robbed banks: “That’s where the money is!”

Because the government sponsors these plans, they know where your money is and how much you have there. And they can change the rules any time they want.

The money in your Bank On Yourself plan isn’t reported to the government or IRS. Learn more about the tax advantages of Bank On Yourself here.

Knowledge is power, so I hope you found this helpful.

Would you like to find out how much your own financial “picture” could improve if you added Bank On Yourself to your financial plan?

If you’ve already started to find out how the Bank On Yourself method can help you grow your wealth safely and predictably every single year – congratulations! If you’ve been putting off, make today the day you take action.

REQUEST YOUR

FREE ANALYSIS!

Request a free Analysis that will show you the bottom line, guaranteed numbers and results you could have if you added Bank On Yourself to your financial plan. It’s based on an asset that’s increased in value every year for more than 160 years.

You really have nothing to lose… and a world of financial security to gain.

Speak Your Mind