Paying for college without spending your life’s savings is one of the biggest challenges faced by families today.

The traditional ways of paying for college, such as 529 college savings plans, UGMAs, UTMAs, and student loans all have serious drawbacks. So we put together a video that reveals:

- Seven important questions to ask yourself when choosing between college saving methods plus a chart that compares them side-by-side

- A better way to save and pay for a college education for your kids or grandkids – or for yourself – one you probably aren’t hearing about

- How the Bank On Yourself method can double as a safe college savings plan AND a way to provide you a guaranteed income in retirement that can last as long as you do

This video is a little longer than others we’ve done (it’s 10 minutes) because this is a critical topic and making the wrong decisions can drag down your financial picture for decades. A full transcript of the video can be found below as well. Enjoy and let us know what you think in the comments box below!

Bank on Yourself: A Better Way to Save and Pay for College

Watch this video to learn how a specially designed dividend-paying whole life insurance policy from a Bank On Yourself Professional may be the safest and best way to save for college tuition to meet the rising costs of education.

Here’s the full text of the video…

The Boomerang Generation”

That’s what many experts are calling today’s crop of young adults.

All too often they go off to college, they graduate, then they return home, sometimes for years. Blame it on the cost of college.

More than a quarter of graduating college students with student loan debt say they’re planning to move in with their parents after graduation.1

Experts predict that excessive borrowing for an education will be a dark cloud hanging over this generation for decades.

And student loan debt is something that is extremely difficult to wriggle out of by declaring personal bankruptcy.

Imagine being ready for retirement but still making payments on a student loan. It’s happening. More than 10% of those loans are delinquent. As a result, it’s not uncommon for Social Security checks to be garnished, or for debt collectors to harass borrowers in their 80s over student loans that are decades old.2

The most common methods used by families to finance college involve restrictive, often counter-productive government loans and college savings programs:

529 College Savings Plans, gifts to the student under the Uniform Gifts to Minors Act and, Uniform Transfers to Minors Act (often called UGMAs and UTMAs), and student loans.

Is there a better way? Absolutely: Bank On Yourself

With Bank On Yourself, you’re using a financial vehicle that has increased in value every year for more than one hundred years – a specially designed little-known type of dividend-paying whole life insurance policy, that comes with a twist:

Special features that very few financial planners or insurance agents have been trained in – riders that will turbo-charge the cash value growth of your policy up to 40 times faster – especially in the early years – than the policies Suze Orman, Dave Ramsey and others talk about.

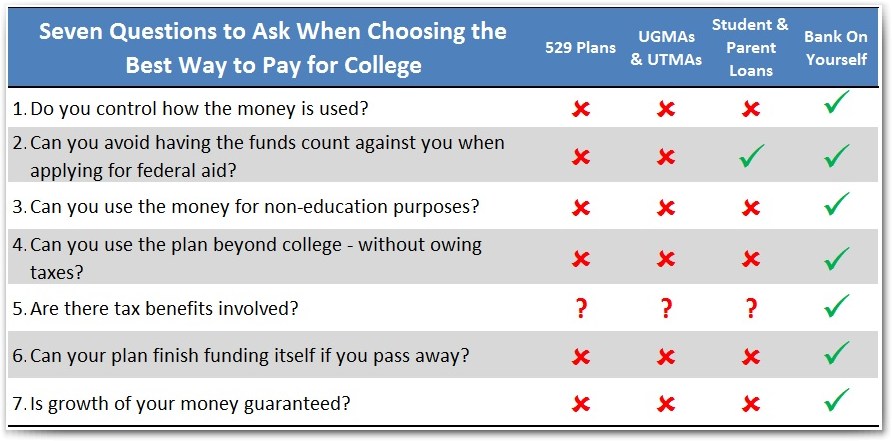

Compare Traditional College Savings Methods to Bank On Yourself

When choosing between college savings methods, there are seven important questions you should be asking. Let’s compare the three most widely used methods against Bank On Yourself by asking those seven questions. See which method makes the most sense for your family.

Question #1: Do you control how the money is used? 529 Plans and Bank On Yourself plans are the winners here. With these plans, you control how the money is used. With UGMAs and UTMAs you lose all control the day your child turns 18. And with student loan proceeds, the money is paid directly to the college, so you never have control.

Question #2: Can you avoid having the funds count against you when your kids apply for student aid? Excellent question. In most cases, the more resources a family has, the less aid the student will be offered. So who wins this one? Only student loans and Bank On Yourself plans.

The money in your 529 plan is counted as your asset, while UGMAs and UTMAs will be treated as your child’s assets. Either way, this may penalize your child when they apply for need-based financial aid.

Question #3: What if your child earns a full scholarship or they’re the next Bill Gates, and decides to be an entrepreneur instead of going to college? Can you use the money for non-educational purposes? With 529 Plans, there’s a definite “Gotcha.” The money must be used for qualified post-secondary education expenses. If not for your child, then maybe you want to go back to school. Or your spouse. Or someone else. But if you don’t use the money for qualified education expenses, you’ll have to pay income tax on your gains – if you even have any gains – plus, you’re going to owe a 10% penalty on those gains if you take money out before you are 59½ years old. … Unfortunately, UGMAs and UTMAs can be used for whatever the student wants – and you have no control.

To kids, this is like free money, and we’ve all heard stories about students using their “windfall” money to buy all kinds of things, from entertainment systems to fast cars, to who-knows-what. The bottom line with UGMAs and UTMAs is that you cannot use the money for non-educational purposes, without your child’s permission.

Student loans are only for college.

Bank On Yourself plans are the clear winner here: Want to use the money for something other than college? As the owner of the policy, that’s entirely up to you.

Question #4: Can you use the plan beyond college? With 529 Plans, there’s that same “Gotcha” of taxes and penalties.

And with UGMAs and UTMAs, again, the money is not yours to use. It’s your child’s, and they can use it for whatever they want.

Student loans extend beyond college, but only in a bad way. As we’ve already seen, these loans can haunt the student for decades.

Only Bank On Yourself is the obvious winner here. You or your student, if you choose, can continue to use the policy for the lifetime of the person the policy is based on.

Question #5: Are there tax benefits involved? With 529 Plans the answer is maybe. Maybe you’ll get a state income tax deduction for your contribution, depending on where you live and the plan you have chosen. And if the money is used exclusively for college, the gains in your plan – if there are any gains – can be tax-free.

Gains in UGMAs and UTMAs can be taxed at the minor’s tax rate instead of yours, so that may save you some money.

And with student loans, there may be a state income tax interest deduction, depending on your income. It all depends.

But with Bank On Yourself, the answer is “Yes!” You can take money from a Bank On Yourself plan at any time, and for any reason, and it’s possible to do that with no taxes due, under current tax law.

Question #6: Can your plan self-complete if you pass away? That is such an important question. And, unfortunately, it’s a question most families fail to ask. Only a Bank On Yourself plan comes with a death benefit that can make the plan “self-completing.”

And Question #7 is also vitally important: Is growth of your money guaranteed? In a 529 Plan, absolutely not.

With UGMAs and UTMAs, probably not, since most families put the money at risk in the stock or bonds markets.

With student loans, the only thing guaranteed to grow is the debt, if interest payments are deferred.

But with Bank On Yourself, growth of your principal is both predictable and guaranteed.3

REQUEST YOUR

FREE ANALYSIS!

Comparing College Funding Methods at a Glance…

Bank On Yourself College Savings Plan Example

Now, let’s see how Bank On Yourself can play out in the real world, and how it can double as a safe college saving plan and a way to provide you an income you can count on in retirement.

Michael and Jennifer Johnson are 35 years old. Their 10-year-old daughter, Madison, plans to go to college and live in the dorm when she’s 18.

Tuition and other expenses are about $22,000 per year.

The Johnsons are a two-income family bringing in $75,000 a year, and they’ve been socking away 5% of their income into savings for 10 years.

They are willing to use $40,000 of that money for their Bank On Yourself college savings plan.

Their Bank On Yourself Professional has shown them how a Bank On Yourself specially designed dividend-paying whole life insurance policy on Michael will let them contribute $20,000 each year to their daughter’s college education, with only slight changes in their monthly spending habits. With a part time college job, that should cover Madison’s expenses.

They’ll fund the policy with the $40,000 they’ve saved.

In addition, they’ll contribute the $312 per month they’ve been putting into savings, plus $108 per month they’ll save by eating out once a month instead of once a week.

When Madison starts college in eight years, the Johnsons will take out a $20,000 loan against their policy each year to cover most of Madison’s expenses.

Then Michael and Jennifer plan to pay back the loans to their policy – which is like paying themselves back – at $875 a month, an amount they feel they can comfortably handle at that time.

Bank On Yourself Policy Loan Advantages

Michael knows that Bank On Yourself policy loans have two great advantages you can’t get anywhere else.

First, you can pay back your loans on your schedule, not some bank’s schedule.4

Second, if your policy is from one of a handful of companies that offer this feature, you continue earning the same interest and dividends, even on the amount you borrowed. (To make sure your policy has ALL the features needed to maximize the power of this concept, be sure to work with a Bank On Yourself Professional.)

If Michael continues to make the same monthly contributions to his plan after Madison graduates, then when he retires at age 69, his plan will give him $25,000 (with no taxes due on it) each year in additional retirement income until he’s 107 years old. Plus an income-tax-free lump sum for his family when he dies.

How to look forward to Graduation Day with more happy anticipation, instead of financial fear…

Whether you have one year or twenty years until your children start college, regardless of your family size, and regardless of how much or how little money you make or have, it’s very likely that a Bank On Yourself Professional can customize a plan for your family, so you can look forward to Graduation Day with more happy anticipation, instead of financial fear.

To find out what your bottom-line, guaranteed numbers and results would be if you added Bank On Yourself to your college savings financial plan, request a free, no-obligation Analysis now, if you haven’t already done so.

REQUEST YOUR

FREE ANALYSIS!

If you’re wondering where you’ll find the money to fund your plan, keep in mind the Bank On Yourself Professionals are masters at helping people restructure their finances to free up seed money to fund a plan. Here are the eight most common places they look.

1. David Shapiro, senior vice president for Western Union, quoted in “Student Loan Debt Piles Up,” Credit Union Times, June 4, 2012

2. Research by the Federal Reserve Bank of New York, reported by the Washington Post in “Senior citizens continue to bear burden of student loans,” April 1, 2012, at http://www.washingtonpost.com/business/economy/senior-citizens-continue-to-bear-burden-of-student-loans/2012/04/01/gIQAs47lpS_story.html?wprss=

3. All guarantees are subject to the claims-paying ability of the insurer

4. Policy loans accrue interest and lower policy values until repaid. Excess loans may terminate a policy with potential tax consequences.

Hi, I will like to get an illustration of Michael and Jennifer Johnson’s example quoted in the article. Can you send me a complete illustration of their whole life policy? Thanks.

Regards,

Sam

This college funding plan was designed by one of the Bank On Yourself policy design specialists who mentor and work with the 200 Bank On Yourself Professionals. These specialists have each designed literally thousands of policies.

The policy designs and illustrations are proprietary for Professionals. It’s not enough to know how the policy was designed, anyway. You also need to know how to custom tailor it for a clients situation and the client needs coaching on how to use the policy and pay back the loans for maximum growth and minimum taxation.

I take it from your questions that you are probably a financial representative. Bank On Yourself is looking for a few experienced financial representatives at this time. Only about one of every 20 applicants is accepted, but if you’re interested in seeing if you qualify, you can apply here.

AWESOME video Pamela….your best yet!

Thanks, John! We spent months investigating and researching this. Everyone should know the pros and cons of the popular college financing methods.

Excellent video, Pamela.

Thanks

Harry

I was a little late to the party because I did not have a plan like this to get me through college…BUT…its not the end of the world, because now that there is a little thing called IBR (income based repayment) I can (according to current legislation) Pay a fixed amount usually less than needed, and depending on my profession get it forgiven in 10 to 25 years….of course depending on the job there might be an IRS tax time bomb waiting in 25 years, BUT…..thats where B.O.Y. comes in…the extra gets funneled into that for that tax bomb….plus hopefully due to the compounding effect of money…. there’s extra left over…..and here I thought it was going to be hard to get out from under my debt load because of a slow job market….heck this means I can be a Janitor (like some 5,000 according to the BLS) with a PhD and still have a better retirement………OH THE POSSIBILITIES….LOL 😉

Everything about Bank On Yourself looks so great, I went out and bought the book. It was a great read but, I still have a few questions. 1. Can anyone transfer money from an IRA/401k to fund a BOY policy without penalty or is that only for those 59 and over. 2. Is it better to overfund one BOT or put half the money into two BOY’s. Besides the extra death benefits of having 2, what is better?

Thank you!

There is a way to take withdrawals from a 401(k) or IRA before you’re 59-1/2 without owing a penalty. It’s called a “72(t)”. Take another look at chapter 7 in my book for ideas on how several Bank On Yourself clients handled this.

The decision of whether to fund one or two policies really depends on your situation. This would be a good time to request a FREE Analysis and get a referral to one of the Bank On Yourself Professionals who can give you specific answers to these questions related to your specific situation.

This is very helpful information. thank-you for all this wonderful advise your site has given me. I have a one- year old at my house, so even if I never get a change to go back to college, at least I’ll be glad that I obtain this great information so i can use it to put him threw college for when get older.