I’m delighted to share this fascinating interview with Carl Richards with you. Carl writes a weekly essay for The New York Times “Your Money” section and has been a Certified Financial Planner for 15 years. His witty sketches have appeared in numerous publications, including the Wall Street Journal, Morningstar and The New York Times.

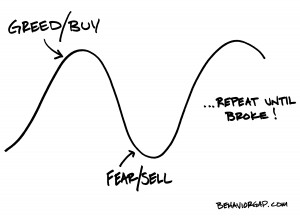

Over the years, he noticed that the actual real-life returns the average investor gets are dramatically lower than the return of the average mutual fund. He named this phenomenon the Behavior GapTM and began devoting his energy to explaining why the Behavior Gap exists and what constitutes smart investor behavior.

Carl recently shared his surprising insights, tips and strategies with me in an audio interview. I hope you’ll listen to it today – I know you will find it very helpful!

You can listen to the interview by pressing the play button below, or you can download the entire interview as an Mp3 and listen on your own player or iPod…

You can also download a transcript of the interview here.

Here’s what you’ll discover in this interview…

- Why 80% of all actively managed mutual funds and investment advisors underperform the overall market

- The #1 biggest mistake individual investors make over and over again… and why most will keep making it

- The keys to being a smart investor

- How to determine if you should be investing in equities at all

- The real key to happiness (it isn’t what you might think!)

- How to practice “radical self-awareness” so you control your money rather than letting it controlling you

- Why happiness is directly related to how much you focus on the things you can control

- How to increase your wealth and happiness by focusing your energy on three things you do have control over!

You can listen to the interview by pressing the play button below, or you can download the entire interview as an MP3 and listen on your own player or iPod…

You can also download a transcript of the interview here.

Improve Your Financial Picture…

To find out how much your financial picture could improve if you added Bank On Yourself to your financial plan, request a free Analysis. If you’re wondering where you’ll find the funds to start your plan, the Bank On Yourself Professionals are masters at helping people restructure their finances and free up seed money to fund a plan that will help you reach as many of your goals as possible in the shortest time possible.

People concerned about the declining value of the dollar have been asking us how that might affect the value of

People concerned about the declining value of the dollar have been asking us how that might affect the value of