Oh what a roller-coaster year this has been! Our entire financial system and economy almost fell off a cliff.

And while there are some hopeful signs of new life in the economy, this year has also brought us:

- Massive bailouts

- A tripling of an already-bloated federal deficit

- A falling dollar

- Rising foreclosures (and likely to spike as billions of dollars in ARM’s are now coming up for adjustment)

- Major banks and investment houses taking on three times (!) the risk they were before the collapse

So what do you think next year has in store for us?

No one really knows for sure. (Well, except maybe the folks at the Psychic Hotline.) So how do you prepare for a very uncertain future?

Here’s a quick quiz that may reveal an answer for you…

What’s the one financial asset that increased in value during the market crash of 2008? And in 1929? And in every period of economic boom and bust in between?

Answer: The product used for Bank On Yourself: Cash-value life insurance.

As I’ve mentioned, my husband Larry and I now have 18 Bank On Yourself policies. I’ve picked one of them to show you how a dividend-paying whole life policy like this can grow over time – even when the markets are plummeting. It’s a great example of how Bank On Yourself gives you the peace of mind that lets you sleep at night.

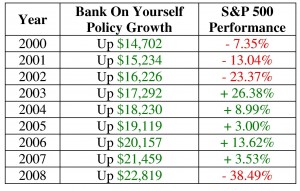

Here’s how much this plan has grown each year since the beginning of 2000, a period that includes not one, but TWO devastating market crashes. In four of these years, the S&P 500 was down for the year, as you can see in this side-by-side comparison:

If you had put $10,000 into an S&P 500 Index fund at the beginning of 2000, how much do you think it would be worth today?

Take a guess before you read on.

Based on where the S&P 500 has been trading this past week (week of December 7-14, 2009, it would be worth only about $7,488! That doesn’t even factor in inflation over that period, which would slash the value of your investment by about another 27% – to $5,466!

Have you considered that maybe – just maybe – return OF your principal is at least as important as return ON your principal?

If you could turn back the clock, where would you rather have put that $10,000 – in stocks, mutual funds and real estate? Or in an asset that has only one direction – up – and where all your principal and gains are locked in?

If you look at the chart above again, you’ll notice how this policy – like the rest of our other 17 Bank On Yourself policies – has increased in value each year by more than it increased the previous year, even though our annual “contribution” never increases.

I’ll be getting my next annual statement for this plan soon, and – like every other year – I can’t wait to see it! Can you imagine looking forward to receiving every account statement, because they always contain good news and never any ugly surprises?

Of course, I already know how much growth I can count on receiving this year (and every year). The growth in these policies is both guaranteed and exponential – with no luck, skill, or guesswork required to make that happen.

But there’s also the potential to receive dividends. Dividends aren’t guaranteed, but the companies used by Bank On Yourself Professionals have paid dividends every single year for more than 100 years – including during every market correction, every bear market, and even during the Great Depression.

So, let’s fast-forward 7 years. That’s when I’ll be 64. (Yeah, I know a woman isn’t supposed to tell her age.) Suppose I want to retire at 65? How much will the Bank On Yourself policy I used in the example above grow that year?

This particular policy is projected to increase by $47,709 that year, based on the current dividend scale. I also know for sure the minimum guaranteed annual income I can take from this policy in retirement. And I can access that income stream with no taxes due on it, under current tax law.

I have NO idea how much my mutual funds will be worth nine years from now. Or 30 years from now. And I have no idea how much income I can count on receiving from them. Same goes for my home value. Do you?

And that sums up the problem with traditional investing and retirement planning methods. They never have been – and never will be – anything other than a crapshoot.

It explains why, sadly, so many Americans are wondering, “Will I ever be able to retire?” and “What will I have to give up to be able to do that?”

But it doesn’t have to be that way! Not when you Bank On Yourself. Since I love what I do, I probably won’t quit when I’m 65, but it’s nice to know I’ll have a choice.

REQUEST YOURFREE ANALYSIS!

Every situation is different, and no two Bank On Yourself plans are the same, so your numbers won’t be the same as mine. Each plan is custom tailored to fit your unique financial goals and dreams. So if you want to find out what your bottom-line numbers and results could be if you added Bank On Yourself to your financial plan (if you haven’t already done so), you can request a free Bank On Yourself Analysis here.

Key Concept: Unlike investments like stocks, mutual funds and real estate, where your gains aren’t locked in unless and until you sell them, all the growth you get in a Bank On Yourself policy is locked in! It doesn’t vanish because of a market correction.

Not only will you never have to worry about buying or selling at the wrong time, you will benefit from the continuous compounding of an ever-increasing base.

This also gives you some built-in protection against inflation

Can you see how, when you Bank On Yourself, you can shut out all the noise about the whip-sawing stock and real estate markets and other investments? The peace of mind it brings you is indescribable.

We are only a few short weeks away from a new decade. How confident are you that this next decade will give you a smoother and more predictable financial journey than the decade now coming to a close?

If you’re tired of hoping and guessing what the future may hold, and you’re ready to have a financial plan you can predict and count on, why not take the first step now? Request your free Analysis and get a referral to a knowledgeable Bank On Yourself Professional who can show you how a custom-tailored plan can help you reach as many of your short-term and long-term goals and dreams as possible!

These Bank On Yourself Professionals are also masters at helping you restructure your finances to free up money to fund your Bank On Yourself plan.

Hey Pam!

Just thought I’d share my recent experience with the B.O.Y. program.

I bought a policy at the beginning of last summer (2009) and funded it with my 2008 tax refund. I paid my first monthly premium in July. In August, I turned right around and borrowed as much as I could from the policy – $1800.

I used the $1800 to pay off a personal credit card. That was a good feeling.

I was able (though, of course, not required) to pay the policy loan back by October (with interest, of course). That was a good feeling.

In November, I requested a second policy loan of $1900 which I intended to use for Christmas and for paying down another personal credit card, but Ooooooooooops! A couple things happened.

First, although I knew my wife’s 60th birthday was coming up in December, I didn’t decide until late that I would do a surprise catered party for her with thirty guests. Also, I didn’t know I was going to have to replace the dishwasher all of a sudden.

Long stories short, I did both of those AND still have enough for Christmas AND am still able to pay down that credit card, all with my latest B.O.Y. policy loan with absolutely NO stress and without having a creditor banging on my door with his hand out! That was a good feeling.

It’s so nice to know that moving into January I’ll be paying myself back at a healthy interest rate rather than someone else! And all this has taken place within the first six months of purchasing my first policy! That is a good feeling.

I plan to take my 2009 tax return and STUFF IT into my B.O.Y. plan which will give me additional borrowing power to further reduce debt while paying myself back instead of others.

Thanks so much for introducing me to this program. It’s truly amazing.

Next time you’re in Seattle it would be fun to have dinner again and compare notes!

Merry Christmas!

Hi Brad,

What a terrific story! You have reaffirmed why I am so passionate about Bank On Yourself.

I enjoyed meeting you in Seattle and hope we get to do that again soon!

I like the concept of the BOY plan but my problem is that since being laid-off and having to start all over again, I have gotten behind on bill payments. Starting all over having to pay for expenses dosen’t leave much profit let alone adding a new payment when sometimes there is no money left over. Lots of times I run in the red and have to be subsidized by my wife, bless her heart. I do expect to eventually catch-up and would like to invest in this.

I guess my questions are: What is the minimum amount to start and if a payment can’t be met what are the penalties? Also what is the interest on a loan?

Thank you.

Hi Enrique,

Sorry to hear about your getting laid off and I wish you well getting back on your feet soon.

Although you can start a Bank On Yourself plan at whatever you’re comfortable with, I would suggest you hold off until things aren’t so tight.

If you can’t pay the premiums in the first year, you could lose much of what you put into the policy.

Pam,

in the above post you compare the bank on yourself plan to saving up and then buying your major purchase with cash. You said when you pay cash you lose the investment income on that money, however with the bank on yourself plan you can use the money in the plan for you purchase and continue to capture the investment income. It seem that that only happens if you borrow from the plan and pay interest on the loan. How is that different than keeping your saving in an interest earning vehicle and borrowing the money to buy your purchase. In both cases (Bank on yourself and separate saving vehicle) you are getting our investment income and are paying interest on your loan.

Thanks in advance for your reply.

Hi Dave,

If you were to save up $25,000 in an interest-earning savings account or a money-market account, and you pull it out to pay cash for a car (for example), how much interest will you be earning on that $25,000 the day after you pulled it out?

You’ll be earning ZIP, of course – and you’ll only start earning interest again incrementally, as you start putting money back into your savings account.

However, when you borrow $25,000 from your Bank On Yourself policy, you will continue to receive the exact same guaranteed annual cash value increase as you would if you had never borrowed a dime.

You would also receive the exact same dividend in any year a dividend is paid (if your policy is from a “non-direct recognition” company). Dividends aren’t guaranteed, but have been paid every single year for more than 100 years by the companies used by the Bank On Yourself Professionals.

In addition, you practically need a magnifying glass to see the return you’re getting on savings and money market accounts these days.

You’d need to get a 7-8 ½ % return in a taxable savings account to equal the average return you get in a properly designed Bank On Yourself policy (and you get that without the risk or volatility of stocks, real estate, and other investments).

There are many more reasons why using a savings or money market account to finance things doesn’t hold a candle to financing them through a Bank On Yourself policy – and the $100,000 cash reward I offered to the first person who can show they use any other financial product or strategy that can match or beat Bank On Yourself still remains unclaimed.

But I always encourage skeptics to take the $100,000 Challenge themselves.

I don’t think you answered Dave’s question above and I have the same question. If I keep my $25,000 in my (savings, mutual fund, government bond) account, and use that as collateral to get a bank loan or put it on my HELOC at say 6-7%, how is that different from BOY? My $25,000 is still earning interest and I am paying interest on the bank loan–just like in the life insurance policy. Is there some other advantage that I am missing?

Yes, you’re missing something. For starters:

1. The money in the savings account is taxable.

2. Savings accounts, CD, T bonds are paying less than 3%.

3. The market was negative for the last ten years.

4. The Whole Life policy will average about 5% non-taxable (under current tax laws). That’s about 7% taxable.

5. There can be a substantial Death Benefit for your loved ones or church or favorite charity if you die.

6. Your income could potentially be tax-free at retirement.

To compare any financial strategy against the many advantages and guarantees of Bank On Yourself, I encourage you to take my $100,000 Challenge. There’s a $100,000 cash reward for the first person who uses a different strategy that can match or beat Bank On Yourself.

I’m curious. If you and your husband have 17 of these policies, aren’t you paying in excess of 60k in premiums each year? Even if it’s 30k, if I had that much extra cash each year I don’t think I’d be too worried about saving for retirement. How could that be? This may not be for the average middle income family.

Plus, if I have enough money in my policy to take a loan, I now have an increase in my monthly expenses (i.e. policy premiums + the loan payment) correct? That would be something to consider.

Lastly . . . if I understand WL correctly, I would never have access to 100% of the cash value will I? I mean I could cash it out, but then there would be tax implications, correct?

Thank you for your time.

D. Wilkerson

One great thing about Bank On Yourself is that you can start at whatever level you’re comfortable with, and you can get amazing results even with small premiums – I’d urge you to read Chapters 6 – 12 of my best-selling book on Bank On Yourself to see specific examples of this, and pay particular attention to Chapters 8 (“Eliminating Debt and Increasing Savings”) and 9 (“Never Too Rich or Too Cash-strapped to Bank On Yourself”).

I’ll answer your second question with a question: Let’s say you were going to borrow money because you needed to buy a car. Had you financed the car at the dealership instead, you’d have a monthly loan payment, wouldn’t you?

Would you stop putting money aside from your retirement, or would you stop funding your 401(k) because you now have a car loan payment?

One big difference is that YOU would control your repayment schedule – not the bank or finance company. You get great flexibility you simply canNOT get from traditional financing sources.

Finally, you can get access to around 90% of your cash value, without surrendering your policy. No one who truly understands this concept would ever “cash out” the policy – that’s like killing the golden goose!

I hope this helps!

Do you put a fixed amount in every year or can you vary the amounts as long as they are over a certain number?

The minimum you would pay is whatever your “base premium” amount is. Over that, there’s a great deal of flexibility, because of the PUA Rider. Some companies have very flexible PUA Riders, and these are the companies used by the Bank On Yourself Professionals.

Why not get a referral to one of them and a free Analysis that will show you the bottom-line results you could get with Bank On Yourself?

The way I understand it is this:

When you set up a whole life policy, you can choose a fixed rate on any loan you take out. In my own personal case, it’s 8%.

In this simplified example, let’s say my cash value is $10,000 and I take out a loan for $5000. The rate of return in my policy is 6%. I’m still earning 6% on the whole $10,000 despite the loan…so the real cost of the loan is 2% because the cash value hasn’t changed.

This is why it’s better than a 401k loan because when you pull money out of a 401k, it’s taken away from the balance and you stop earning interest on it. Same as Pam’s example about a regular savings account.

I know this is a simplified example, but I think it’s closer to the “real world” result you can expect.

“BOY” isn’t some magic bullet, or scam. It really is useful, and a great way to protect and grow your money.

It is not, however, a way to “get rich”.

Hi Matt,

You have a good grasp of how this works. Most companies used for Bank On yourself-type policies have a variable loan interest rate that is usually lower than commercial finance companies can offer.

I have often said that Bank On Yourself isn’t a magic pill – there aren’t any, although many people continue to search for one with disastrous consequences.

That said, over time, my Bank On Yourself policies have outperformed EVERY investment I have ever made and I have invested in many things.

Most people who’ve used the Bank On Yourself method have found the same thing is true for them.

And maybe the best part is that this happens without the risk or volatility of stocks, real estate, and other investments.

Thank you for your response. I appreciate it.

I guess if my entire retirement savings is going into a BOY plan(s), then no I wouldn’t stop doing that if I take out a traditional car loan from a dealership. But, I couldn’t imagine doing that. That means in all practicality, I would be increasing what I have to spend each month to keep funding the BOY plan and pay back the loan I took out to fund the policy along with my other retirement account.

There may also be a little flexibility in paying back that loan, but don’t forget the interest rate the insurance company will charge me for taking out the loan (6% or more?). Oh, and you want to make sure you keep paying your premiums so the policy doesn’t lapse. There isn’t much flexibility from that angle. I can always stop funding my IRA if things get tough, so there is some flexibility there.

If you also could get to 90% of your cash value, wouldn’t WL policies fund themselves much earlier than they do? It seems like they would.

My problem with some of the stories in the book is that it makes it sound so easy to start multiple policies. Most are going to cost 5k a year, so that adds up quickly. That’s also assuming that there aren’t additional expenses after underwriting is done. Someone with a few health issues will pay more.

Thanks again,

D. Wilkerson

Hi Dean,

I’m going to suggest you re-read chapters 3 – 6 of my book, where these questions are answered.

You do have tremendous flexibility both in paying back any loans AND in paying your premiums. Pages 106 – 108 in particular describe some of the many options available to Paul and Katie when life threw several curveballs at them.

Regarding how “easy” it seems in the real-life stories in the book to start multiple policies – most people are pleasantly surprised how much more seed money they can free up to fund a Bank On Yourself policy, after going over their situation with a Bank On Yourself Professional. These Professionals are masters at helping people restructure their finances to free up money to fund a plan. Here are eight of the most common ways to find money to fund a policy.

Someone with health issues won’t necessarily pay a higher premium. They also have the option of using someone else (family member or business associate) as the insured on the policy.

I’m wondering about qualifications to enroll.

Since this method is based on the purchase of a life insurance policy, is the cost based on a sliding scale from young to old?

Don’t such policies typically have a lifestyle and health screening process to protect them from enrolling people with high risk behavior practices and applicants who are already diagnosed with serious health issues?

If so, how is that addressed in your plan?

Hi Dereck,

Although the premium is generally less for a younger person, all other things being equal; the efficiency of growth varies from policy to policy.

And yes, there’s a lifestyle and health screening process. If someone doesn’t qualify due to health, or age, etc. they have the option of using a family member or business associate as the insured and they still have full control of the policy. It’s done all the time.

There’s only one way to find out how a policy custom-designed for you will perform and that’s by taking advantage of a free, no-obligation Analysis.

Pamela,

After reading your book, I still have several questions regarding B.O.Y investment strategy:

1.) What would it happen if someone is not able to pay the basic premium due to some difficulties along the road? Will the plan lapse and you lose all the money you put in before?

2.) If I have to pay back the loan with interest every time I take money out of my plan, how can I use it as my retirement income since I have no other financial source at that time?

Thanks.

Junhui

Hi Junhui,

Keep in mind that dividends can be used to pay premiums, if you should be unable to pay them out of your own cash flow.

If you rely on this way of paying your base premium too much during the first year or so, it could cause the policy to lapse. (If a policy lapses, you’d receive the cash “surrender” value of the policy.)

The idea is that you don’t repay your policy loans when you’re drawing retirement income.

Hope this helps!

What are the age restrictions?? I am 62.

What about health conditions restrictions?? I have no major diseases and am in pretty good health.

Hi Peggy,

People do this up into their 70’s and 80’s. If you’re in “pretty good” health, there’s an excellent chance you could live another 30 years, so you want to make sure your money doesn’t run out before you do.

To find out how you could benefit from a custom-tailored program, request a Free, no-obligation Analysis to take the next step.

So that I understand correctly, I could use money from my pension(profit sharing) to fund BOY hopefully without tax penalties(I’m 40), continue making premiums from the same account without tax consequences(hopefully) and take out loans from BOY to be paid back by my same profit sharing account? That’s like too easy?!

I have oodles of debt(credit cards), car payments, rent, etc, but a profit sharing plan that if I touch comes with additional penalties. BOY would make life so much easier…

Yes, Bank On Yourself makes life a lot easier. When they sell you on these government-sponsored retirement plans, the tax-deferral is a great carrot.

But they never tell you about all the strings attached to it or discuss an “exit plan.”

You’re going to pay taxes if you take money out of your profit sharing plan at your age. But read chapter 7 of my book for ideas of how other people have handled this.

And get a referral to a Bank On Yourself Professional to discuss your unique situation.

I never read the book but am signing up as it sounds good to get rid of interest to car and house loans. to be able to get a boy loan faster can you put up say 15-20,000 to start? asking cause would like to save on my car loan which I owe 6,000 on.

plus, still have a home loan I could pay extra per month to reduce the overall cost till I can pay it off as well. The money I would use to pay it off is in an old 401k but the car loan interest is high so it would be more then good to take the penalty on the 401k as would save more from the car loan interest saved.

Every situation is different, as is every policy, but, yes – it is possible to do what you propose. And, in fact, my best-selling book profiles people who used Bank On Yourself to accomplish similar things.

But you should speak to a knowledgeable Bank On Yourself Professional, who can show you your options and go through the pros and cons.

You’ll get a referral to one when you request a free, Bank On Yourself Analysis.

Pamela, can you explain more about”not repaying policy” when drawing retirement income….thanks

It’s explained in depth in Chapter 6 of my book. You wouldn’t typically plan or expect to repay loans or withdrawals when taking retirement income.