There’s one surprising thing Walt Disney, J. C. Penney and the Pampered Chef have in common – they all used the Bank On Yourself method to start, grow and/or finance their businesses!

Walt Disney borrowed from his life insurance in 1953 to help fund Disneyland, his first theme park, when no banker would lend him the money.1

Following the 1929 stock market crash, famous retailer J. C. Penney borrowed from his life insurance policies to help meet the company payroll.2 Had he not had ready access to capital, the company probably would have been forced to close its doors, adding even more people to the unemployment line.

In 2002, Doris Christopher sold her kitchen tool company, the Pampered Chef to Warren Buffett for a reported $900 million. Seven years earlier, she launched the company with a life insurance policy loan.3

Foster Farms was founded in 1939 when Max and Verda Foster borrowed $1,000 against their life insurance policy to buy an 80-acre farm near Modesto, CA.4

Senator John McCain secured initial campaign financing for his presidential bid by using his life insurance policy as collateral.3

So-called “permanent” or cash value life insurance (versus term insurance, which is like renting insurance) builds up cash value that policy owners can use in difficult times as a ready source of money to cover personal or business expenses for emergencies and even to cover insurance costs.

Almost every day, I receive grateful emails and calls from folks who use the Bank On Yourself method about how they used their equity to get them through a job loss, disability or other family emergency.

That’s as important today as it was in America’s Great Depression, when whole life policy loans helped save thousands of homes, businesses and family farms.

Keep in mind that Bank On Yourself-type policies are dividend-paying whole life policies that incorporate little-known riders or options that turbo-charge the growth of the cash value in the policy, especially in the early years of the policy. A properly designed policy could have up to 40 times more cash value in the first years than a traditionally designed whole life policy (the kind Suze Orman, Dave Ramsey and 99% of all financial “gurus” talk about).

It’s a virtual certainty that the policies owned by the famous business owners profiled above were not the super-charged version. But clearly these policies can be lifesavers for the policy owners.

If you haven’t already done so, take advantage of a free Analysis now. It will show you how Bank On Yourself can give you the peace of mind that comes with having a cash cushion to see you through tough times. It will also show you how it can help you take control of your financial future, along with revealing the bottom-line numbers and results you could have if you added Bank On Yourself to your financial plan.

An interesting fact is that there was $116 billion in life insurance loans outstanding at the end of 2007.5

Life insurers have $4.3 trillion invested in the U.S. economy, making them one of the largest sources of capital in the nation.6

And life insurers paid more than $19 billion in federal, state and local government taxes in 2007. That figure doesn’t include taxes paid by all the people the industry employs or business that supply the industry with services.7

In short, the life insurance industry is a key driver of our economy!

While access to credit and capital remains tight for both businesses and consumers, those who use Bank On Yourself have been able to have access to the money in their plans by answering just one question:

How much do you want?

You never know when you’ll have a family emergency or hit a rough spot. Unfortunately, it’s part of life.Unfortunately, most Americans don’t have much of an emergency cash reserve to fall back on in tough times. 71 percent of all workers surveyed recently said they’d have trouble meeting their current financial obligations if their paycheck were delayed by even one week, according to the American Payroll Association.

If you don’t have a liquid cash cushion, you’ll typically have to use credit cards, ask friends and family to help out, or you’ll have to sell some of your investments to raise cash.

None of these options is ideal. And if you do have cash you can get your hands on quickly in a money market or savings account, the moment you withdraw your money, you’re earning ZERO interest on it.

One of the most important lessons about money and finances I’ve learned in recent years that’s not taught in most economic courses is this:

You finance everything you buy!

That’s because you either pay interest to someone else when you use their money… OR you give up the interest and investment income you could have earned, had you kept your money invested instead.

So, even paying cash has its drawbacks.

But Bank On Yourself is a way of managing your money that’s actually “Better than Debt Free.”

Wondering where you’ll find the money to start a Bank On Yourself policy? Bank On Yourself Professionals are masters at helping you restructure your finances to free up seed money. There are at least eight places they look. Don’t count yourself out. Request a free Analysis to find out what’s possible.

Bank On Yourself beats financing, leasing or even paying cash for things by a long shot. Here are 7 reasons why:

1. You can access your equity in the policy any time you want and for any reason you want

2. No nosy credit applications are required, you don’t have to beg for money or pledge your first born to get it.

3. You can pay back your loan on your own schedule, not someone else’s

4. If you hit a tight spot, you can reduce or skip some payments, and no collection agencies will call, no goon squad will come to repossess your stuff or foreclose on your house, and you won’t get a black mark on your credit report

5. While you do pay interest on policy loans (at a rate that’s often less than rates available from financial institutions), the interest you pay ultimately ends up back in your policy, as described on pages 100-102 of my best-selling book

6. If your policy is issued by one of the handful of companies that meets all the necessary requirements, when you take a policy loan, your policy can continue growing as though you hadn’t touched a penny of it! You’ll continue to earn the same pre-set and guaranteed cash value increase every year AND you’ll receive the same dividends as if you had no loans against your policy

While dividends aren’t guaranteed, Bank On Yourself Professionals use companies that have paid dividends every single year for over 100 years – including during the Great Depression.

7. Policy loans are not taxable as long as the policy remains in force

Bank On Yourself: The ultimate financial security blanket?

Let me ask you a question. How long do you think it will take for the Dow – which has dropped below 10,000 yet again – to get above the 13,000 level and STAY there?

Do you think it could be one year? Two years? Five years? Maybe even ten years?

Let’s be honest – none of us really has a clue!

But are you wondering what’s so important about the 13,000 level?

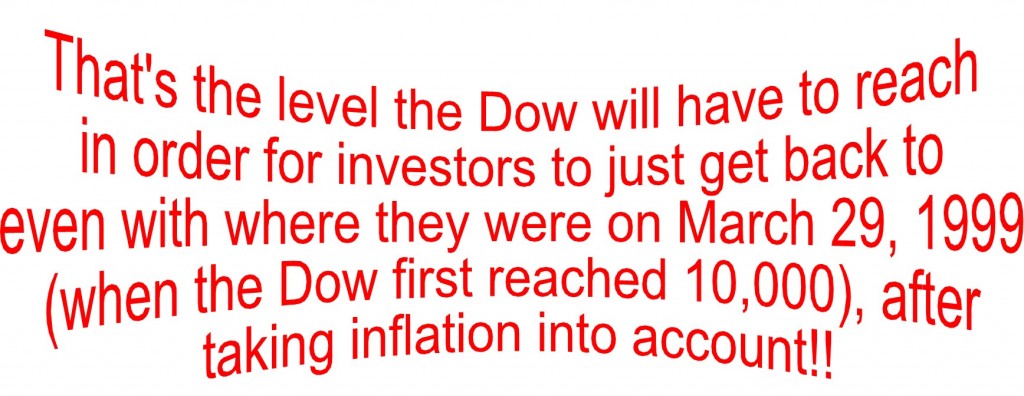

Actually, the Dow will have to reach and stay above 13,127 to get you back to where you were more than 11 years ago!

That’s based on inflation of over 31% over the past 11 years and 2 months.8

What do you have to show for all those years other than sleepless nights and broken retirement dreams?

But it doesn’t have to be that way!

Hundreds of thousands of people use the Bank On Yourself method, and not one of them lost a penny in their plans when the markets crashed.

Their plans have ALL continued growing safely and predictably, just as they have for well over a century.

As Independence Day approaches, consider how Bank On Yourself can give you independence and freedom from…

![]() The stomach-churning ups and downs of stocks, real estate and other investments

The stomach-churning ups and downs of stocks, real estate and other investments

![]() The control that banks, credit card companies and other financial institutions have over you

The control that banks, credit card companies and other financial institutions have over you

![]()

Wondering and worrying if you’ll ever be able to retire and what you’ll have to give up to do so (Bank On Yourself lets you have a guaranteed income stream you can predict and count on, giving you peace of mind for retirement planning

![]() You control your money, not the government (government-sponsored retirement plans have more strings attached to them than a puppet)

You control your money, not the government (government-sponsored retirement plans have more strings attached to them than a puppet)

So, if you haven’t added Bank On Yourself to your financial plan yet, request a free, no-obligation Analysis now that will show you how you could reach your goals and dreams – without the risk or volatility of traditional methods.

REQUEST YOUR

FREE ANALYSIS!

I urge you not to put it off another day. You have nothing to lose and potentially much to gain!

I have an life insurance policy that has cash value with a rider that I can put more into the policy. Is back on yourself the same thing?

Thanks Jimmy

If it specifically states “Paid-Up Additions Rider,” not just “Paid-Up Additions,” it probably is one of the riders used to turbo-charge the growth of the policy.

But how you actually USE the policy is the key piece, and what can really turn it into a screamer. Please read chapter 6 of my book for more details.

[…] This post was mentioned on Twitter by Pamela Yellen and Pamela Yellen, Karen. Karen said: Tagged a site http://su.pr/27PR3d […]

Uhhhhh…life insurance dividends are a return of overcharged premium (that is why they are not taxable). The premiums are extremely high – you talk like you get all these benefits for ‘free”, while in reality, the actuaries have it all figured into the premiums, making sure the company makes a healthy profit. And on and on. Many of your claims are “half-truths” that are taken out of context, like your comment that your death benefit does not rise in a term insurance policy. First, your death benefit does not rise in a while life policy, unless it is designed to rise by way of dividends and PUAs. This cost is, again, added in by the actuaries – you don’t get it for “free”. (If dividends were not part of the plan, the premium would simply be less…the insurance company does NOT do you any favors.

Not, if you take a term insurance company with a SIDE fund, and define “death benefit” as the amount of money your beneficiary receives on death, then your death benefit DOES rise! Stated another way, if you take your exorbitant whole life premium, buy term insurance, and put the balance into a side fund each month (like an annuity from the same insurance company), your death benefit DOES rise, using the same money! In fact, your “cash value” is positive the FIRST MONTH! Why? Because all the high mortality fees and sales commissions of whole life are NOT coming out of your term and annuity premium. You are only paying the small mortality fees and commissions of those products, so you will always come out on top.

I am sorry for all this. I have been a “scholar” of life insurance for 35 years, and I get so tired of the half truths. That is why it would be impossible to win your $100,000 challenge…you have your own definitions. For instance, you will claim that your “plan” has increasing death benefit. Then you would say that my “term insurance” does not have an increasing death benefit. specifically, you are right. But, taken as a whole, my plan will not only provide an increasing “death benefit” (as defined by the amount of cash paid to the beneficiaries at death), but it gets a head start on “cash value” because the fees are MUCH lower. And, in my plan, all the cash values are MINE! I will NOT lose my insurance if I decide to take my cash value, unlike your plan. And yes, I will pay taxes on my profits, JUST LIKE YOU WILL! The only reason your will likely NOT pay taxes is because you will likely NOT have a profit (unless you have been building cash value for a very long time!)

I could go on and on, but you will just “tear me apart” with half-truths and out-of-context statements.

Sincerely yours.

Uhhhh… this seems to be the week that 30+ year industry veterans who pride themselves on knowing all about life insurance products reveal the gaping holes in their knowledge.

“Paid-Up Additions” (PUA’s) are NOT the same as a “Paid-Up Additions Rider” (PUAR) incorporated into a dividend-paying whole life policy at the time it’s issued.

There IS cash value in the first month, which grows up to 40 times faster than a traditionally designed policy (the kind you and 99.99% of all insurance agents and financial representatives talk about).

Read more about what the financial “gurus” think they know about Bank On Yourself policies that just ain’t so. You’ll see actual policy statements that PROVE how these policies are different.

I also dispel the myth there that the insurance company “keeps” your cash value when you die, contrary to your claim. And you obviously don’t have a clue about the tax laws that apply to this and how it’s possible to access your equity and substantial profits with no tax consequences. It’s too bad for your clients.

I also own a couple of annuities. They can be a great product for certain situations. However, my Bank On Yourself policies are kicking the stuffing out of my annuities and my death benefit is already many times greater.

It’s not all your fault – this isn’t taught in any of the standard industry training programs.

But just because you don’t know about or understand it doesn’t mean it doesn’t exist. And it’s no excuse for not opening up your mind and doing a little research to get the facts, rather than assuming I’m making stuff up.

Jeff,

What happens when that term expires? Also, you might want to look more into the whole life policies and how they allow you to spend more efficiently in retirement. I’m assuming you are coming from the Dave Ramsey school of thought with your “buy term, invest the rest” theory. Less than 2% of term policies ever pay out. Are your clients happy paying into something that, most likely, they will never use and are just throwing that money away? Or, maybe you work for a company who isn’t as financially strong and your whole life products aren’t as competitive as others.

I saw your answer saying “Paid-Up Additions” (PUA’s) are NOT the same as a “Paid-Up Additions Rider” (PUAR). Could you please explain the difference?

Thanks,

Mike

Most or all dividend-paying whole life policies have a “Paid-Up Additions” (“PUA”) feature. You can choose to leave your dividends in the policy to purchase additional coverage, called “paid-up additions.” These are small policies requiring only one premium and then no further premiums are required. They are “fully paid-up” immediately.

These will typically show up on a policy statement under a column labeled “dividend accumulation” or “dividend additions.”

The “Paid-Up Additions RIDER” (“PUAR”), on the other hand is an EXTRA option added on to the policy WHEN IT’S ISSUED, and a portion of your premium is directed into that rider. This is what turbo-charges the policy significantly.

A Bank On Yourself Professionals will typically structure a policy so that 50-70% of the total premium is going into the PUAR. And approximately 94% of the PUAR premium goes to work building cash value for you immediately. It will typically be shown in a SEPARATE column labeled “Paid-Up Additions Riders” or something similar.

Professionals are paid virtually no commission on the premium going into this rider, which probably accounts for why so few financial representatives and agents know about it or use it.

I’ve seen you write a few times that you “get back the full purchase price of large purchases”. Can you use a car as an example and explain how someone is actually getting the purchase price of the car back?

Also, is it accurate to say that Bank On Yourself gives you a process or vehicle to pay yourself back the purchase price? It’s not that you are getting a free car, it’s that you are taking a loan from yourself and then paying yourself back for the loan, right?

– Mike

Good questions, Mike!

I explain this in detail with specific examples in my best-selling book in Chapter 2 and on pages 53-57 and 100-104.

I heard Tom Martino on 630 KHOW talk about meetings or seminars. People can talk & ask questions. I was in my car & couldn’t write the phone #. Could I get more info please? Thanx

Consumer Advocate Tom Martino endorses this concept. However, the seminars mentioned on his show are not lead by Bank On Yourself Professionals and we have no affiliation or connection with them.

Anyone who refers to term insurance policies as “renting” insurance and whole life policies as “permanent” insurance is selling you something. Term life insurance is pure insurance– the cheapest and best way to buy insurance. Permanent “whole life” policies are nothing more than term insurance with a bundled investment, usually at INCREDIBLY low net earnings rates (after policy expenses).

Why bundle them? There is NO advantage to it, other than the high commissions that go to the insurance agents or the profits to the insurance companies. Buy term insurance and invest separately and keep it under your control. No load mutual funds are an easy and better way to invest the difference than to buy permanent life insurance. And THAT’s a fact!

You obviously haven’t taken the time to learn how Bank On Yourself-type policies are different. You’re also ignorant of the problems with term insurance and woefully misguided if you think most people actually invest the money they save by buying term instead of whole life. And you fail to account for the FACT (yes – the FACT) that NO ONE who uses the Bank On Yourself method lost a penny when the markets crashed, their plans grow exponentially (no luck, skill or guesswork required) and they all know the minimum guaranteed income they can take in retirement. That’s something that will NEVER happen for you or anyone else by following the conventional wisdom.

Although I’m sure you won’t take the time to check out the facts about this method somebody else reading this might. This website is loaded with proof of what I’m saying. Here’s a good place to start.

Pamela,

You are explaining everything so well. Some people are just ignorant. The whole “buy term and invest the rest” is such a false theory. How many people think, “Oh, the premium for whole life is $150/mo and the premium for term is $25/mo, so I can invest $125/mo!” That is pure ignorance. I’ve only been in the life insurance industry for a few years, but I know enough to understand what works and what doesn’t. I also took Financial Peace University a few years ago, so I know all about the Dave Ramsey school of thought.

You can’t look at a whole life policy and worry about a “rate of return”. That’s not going to impress anyone. It’s the death benefit of a permanent policy that allows you to spend money (most likely from investments and other retirement accounts) more efficiently during retirement.

If people are so concerned about life companies making profits off of insurance, then why even by term policies? Less than 2% ever pay out, which means all of that money is pure profit for the life company. Term policies are basically the company betting that you won’t die during that term, and 98% of the time, they are correct! Go read “The Pirates of Manhattan” and then tell me that whole life policies are a waste…

Good points, Mike!

Less than 2% of term policies ever written have paid a death claim. It’s cheap for a reason. That reason is profit. Stock-owned companies need that profit, so they can lure stockholders. Dividends from a stock-owned company are just the “what’s left” after the stockholder’s are satisfied. Still feel insured with your term policy? Buying the STOCK of a stocked-owned company (MetLife, Prudential, John Hancock, Jefferson Pilot, Genworth) is smarter than buying a policy from them. When’s the last time you had 2 co-workers die in the same decade? Any guess why group insurance at work is the cheapest?

I love how some people THINK they know insurance in these replies to the article. I have a bank on yourself policy. There are 2 things I need to get off my chest from the idiotic replies. First Whole Life is NOT term insurance. Term insurance is for a “Specific period”. Whole Life is written for UNTIL YOU DIE.

Now the 2nd thing is for the “buy term and invest the rest” crowd.

I have personally seen people Lose HALF their value during the down slide of the stock market. If you want to play with your money like that you can go right ahead. when you turn 65 and go to sell your investments for income..and your portfolio is down 25 percent 2 things are going to happen. You are going to sell those shares at a loss and pay income tax on the sale. Now do you think taxes are going to go up or down in the next 40 years? They are going to go up and so is everything else. Not to mention buy selling those shares you are losing opportunity cost which is even hurting you worst. When the fund goes up in value that money will not be in it benefiting you.

Whole life is not expensive if you do it correctly. Buy what you can afford as early as you can afford it. I have a policy that started at 111k last year June 2010 A year later it is at 119k ( 7 percent policy increase) and 1k in cash value I can take a loan out if I need. ALL of this will increase every year guaranteed at 4 – 4.5 percent.That’s not even including dividends.

in 1982 the S&P index was 112 or so. People who invested all during the period from 1999 ( date noted somewhere above) through today are well ahead of the returns of a whole life policy. Nothing wrong with this form of investing other than its expensive. Dont lie or misslead just tell people the truth. You wont get the returns of the equity market over time but you wont get the volatility either. Nobody ever got rich investing in life insurance.

Part of the problem is that most people did NOT stay invested the whole time. The statistics show the average mutual fund is held only 3-5 years. Also people – and even most experts – consistently buy and sell at the wrong times.

That’s why the Dalbar study shows the typical equity mutual fund investor has only managed to eke out a 3.83% annual return for the past TWENTY years, barely beating inflation!

A properly structured Bank On Yourself policy can beat that with a stick. It takes all the luck, skill and guesswork out of the equation.

Well said Jim

I’m just viewing thru old posts. Jim, I think a 7% return is…decent…on your $111K. Of that $8K profit you made in 1 year how much of it is taken out in fees and how much did you pay in premiums? Also, if inflation is 3’ish% a year then does that drop the return to 4% in reality and then fees are taken out of that? Also, you state you have a $1K cash value you can take a loan out on?- Why of a $119K policy you can only borrow $1K against that? Just investigating things.

Does the BOY policy allow you to invest more than the required premium? That is, could the owner invest more to accelerate the cash value?

Yes – in fact, that’s the basic design of a Bank On Yourself policy – the Paid Up Additions Rider is used to accomplish this. Please read chapters 4-6 of my best-selling book to learn more.

Mrs. Yellen Could you please respond to Mike’s comment regarding purchasing stocks directly from the insurance companies.

Mike is correct that only a tiny percentage of term life insurance policies ever pay a claim. That’s why Suze Orman says, “term insurance is designed to terminate before you do,” while still recommending you flush your money down the toilet by buying it.

Bank On Yourself Professionals only use dividend-paying companies that are in essence owner by policyowners, NOT stockholders. Any profits are then disbursed to policy owners in the form of dividends.

Bank On Yourself Professionals use only companies that have paid dividends EVERY year for at least the past 100 years (including during the Great Depression).

It’s better than buying stock – even in a company that sells life insurance – because you don’t have the risk or volatility that comes with stocks.

To get a referral to one of only 200 Bank On Yourself Professionals in the country, request a free Analysis and you’ll be connected with one.

Its amazing how closed minded people can be and because someone has decades in the industry of insurance they think they know everything and have it all figured out. The constant misunderstanding and narrow minded visions some of these people have is ludicrous.

I love it when I hear someone comment that term is cheaper than whole life because the premium is lower. Thats like saying a 30 yr mortgage is cheaper than a 15 yr mortgage because the monthly payment is lower. Or how someone constantly states that it takes years for the policy to have cash values when the BOY concept is not even addressing that specifc type of whole life policy design. Invest the difference? Where? the stock market? CDs?

Why is it so difficult for people to understand that BOY is not an investment that should or can be compared to stocks/mutual funds/treasuries, CDs, etc. Its a money management planning concept. You can still invest in all these investments if you so choose with using the BOY concept…Its not an either or!

But then again….”their way” has just done so well for people as they pay high interest to credit card companies, finance companies,lose 40%, 50% or more in the stock market and earn less than 1% in the bank. Thank you all for your phenominal advice all these years..its worked sooo well (sarcasm intentionally intended ofcourse ;))

Here’s a brainstorm…since your ways just don’t work and don’t bring anyone financial freedom…how about opening up to new ideas???? Remember, contrary to (your) popular belief…the world is NOT flat it is ROUND!!!!

Well put, Mark! We’ll keep chipping away at the ignorance and misinformation.

Pamela,

Who are those 100 yr insurance companies you are referring to?

thank you

I’m not a licensed financial representative, I’m an educator. As such, I’m not legally allowed to recommend or even list specific companies.

Keep in mind that just knowing which companies to use isn’t enough. Your financial representative must ALSO know how to properly structure the plan or it will grow much more slowly, lose the tax advantages, or both. A properly trained financial representative also coaches their clients on the best ways to use the policy to maximize the growth.

I can tell you, however, that the Bank On Yourself Professionals only use companies that rank in the top 3% of all insurance companies in terms of financial strength. And they have all paid dividends every year for at least 100 years.

When you request a free Bank On Yourself Analysis, you’ll get a referral to a knowledgeable Bank On Yourself Professional who will make a recommendation based on your specific situation, and encourage you to do your due diligence into any company they recommend for you

If you’re a financial representative who’d like to apply for the Professional training program, you can find out more about it here.

Pamela, I have a BOY policy and I’m not really very astute to all the workings of insurance, and investing. All I know is I lost over $10K in commodities; it was a wild, exciting, and depressing ride to watch my investment double and triple, to absolutely crash to nothing in a few short weeks, due to my gullible ignorance. Then I lost $18K in the stock market crash 2008/2009. I guess if I know anything is I know how to lose and give it all to somebody else!

Since I opened my policy 17 months ago… my DB has increased, my loan value, and net cash surrender value have increased well beyond the cost of the policy, the PUAR and PUA have increased, and the dividend paid as well, no losses there, even while everything else out there is going up and down and all around.

I am concerned about the runaway (inflationary) aspects of our economy though. The value of the dollar is being driven down all the time, and inflation is going up, up, up, and away, etc.! You also hear things like you should have a (gold) backed IRA, and you should be buying and investing in gold and silver, for when the dollar crashes, etc. What happens to our policy values, cash values, and death benefit if the economy totally crashes? All the economists like Celente, the Stansbury Group, radio talk show pundits, and advertisements, etc., are preaching the end of, and the crash of the dollar, and the world financial system as we know it, and that you should be in gold and silver and have your guns and ammo, and your private garden, and generators, and solar, and goats for milk, etc. I know there’s a ton of gloom and doom being spun to sell you the next survival gadget and investment strategy, but in all reality, if the banksters and the financial elites manage to crash the dollar, change the monetary system to a new global currency, etc., do you know what would happen to our insurance policy? If the Federal Reserve continues the runaway inflationary policies and continual pumping of fiat money into the system this will cause inflation to go sky high. So what happens to the dollar in our policy? What happens if they switch to a new world global currency? Do the dollar values of the policy exchange dollar for dollar, or is it exchanged for the value of the currency trading index? Which could be significantly lower or higher I assume. What is Lafayette life invested in, bonds, gold, and silver? What happens to Lafayette’s holdings, investments, and our policies if the economy and the dollar crash?

I know these are a lot of questions, and I can’t find real answers to them. Can you shed light on the subject or direct me to the correct place that can answer these questions?

Sincerely, Robert

Thanks for all the background information, Robert. I know it can be confusing and overwhelming with all the “noise” out there.

I’ve answered these questions and more in these articles:

The Safety of Bank On Yourself

Is the U.S. economy headed towards financial doomsday?

Keep in mind that we can never 100% know what the future will hold. Trying to plan for every “what if” is a losing game. I’ll stick with the dividend paying life insurance companies that have under promised and over-delivered for more than a century. That includes many periods of high inflation, economic boom and bust, the Great Depression, and many other scenarios.

I hope this helps!

Pamela,

How does your plan compare to that of Doug Andrew in his “Missed Fortune” program?

Jerry

He recommends a life insurance product that does not have all the guarantees as dividend-paying whole life does.

Most people already take too much risk with their money. Why would you want to add risk and unpredictability to an essentially risk-free strategy?

If you’d like to see how a custom-tailored plan would look, request a free Analysis here.

In 1995 I borrowed $20,000 from the cash value of my life insurance policy to purchase a new service truck for my business. I charged the business 18% interest on the loan. Both principle and interest were a business expense and payable to Dan’s Retirement Fund. The loan was paid back in 4 years which means the total paid back was $40,000 (Rule of 72). Have done that several times over the years.

Way to go, Dan! I’ve used my policies MANY times for business financing. Business interest is also tax-deductible.

Here’s a video I did about how to become your own financing source for your business.

You’ve been doing this awhile, obviously. How do you counter the nay-sayers and financial “gurus” who insist that can’t be possible?

Hello, I was looking for details about how the policy turns into retirement income when you retire? What I’m trying to understand is how does the policy work when you retire? Am I still paying the premium into the policy after retiring and also receiving retirement income from the same policy? I’m not seeing how the policy turns into retirement income. Thank you, Theresa

When you retire and receive the retirement income do you have to pay it back like a loan?

During retirement are you paying the premium and then paying back the retirement income ‘loan’ ?

This is what I am trying to understand.

You take retirement income through a combination of withdrawals of your dividends and loans against your cash value. If done properly, you can do this with no taxes due on it, under current tax law.

A Bank On Yourself Professional can show you how your retirement income might play out depending on whether you continue paying premiums using the policy’s internal values (as opposed to out-of-pocket) or by taking the policy “paid-up,” which means no further premiums are due.

That’s part of the value of working with a Professional. To get a referral to one and a free Analysis (if you haven’t already done so), you can do that here.

Whats the difference in having a “whole life policy” and having a “Custom Whole life policy; I know you have a paid premium for 20 years for whole life policy and you have a paid premium for 10 years for a custom whole life policy. Is that the only difference; what are the benefits other than just think invest for long term and use as needed and pay yourself back when you borrow from policy scenarial.

There is no set length of time you pay premiums into a whole life policy like 10 or 20 years. It all depends on how it’s designed.

A Bank On Yourself type dividend paying whole life policy has riders incorporated into it that grow your cash value much faster than a traditionally designed policy and give you more flexibility when making premium payments.

Are there any other famous people (besides the ones you mentioned above) that have used these policies for investment or political funding purposes?

“Buy Term and Invest the Difference” has proven to fail for 40 years now because people SPEND the difference. And with Whole Life, you are eliminating investment risk, and diversifying your entire portfolio.

When you use the Life Insurance Cash Value, you continue to receive your dividends, even on the amount you borrowed.

There are a multitude of reasons that this concept makes sense, but you need to commit to it because it gets MUCH better with age!

Good Luck!

I am a licensed insurance producer and recently became smitten by equity-indexed universal life (or just indexed universal life). I have also recently been running comparative case studies for HEALTHY people 45-60 years old, comparing term & non-participating whole life (i.e. final expense) vs. participating whole life & IUL’s. Observations;

1) As mentioned by Pamela, the insurance companies with 100+ years of dividend-paying history is CRYSTAL CLEAR to any agent that studies the industry. These companies and policies (participating whole life) when used for my comparative case study, resulted in 5-10X more death benefit AND CASH VALUE than non-participating. This is “FREE MONEY” that people are not aware of because they been victimized by agents and companies aggressively pushing inferior products (also adding fuel to Dave Ramsey’s fire).

2) “Buy term and invest the rest” is fundamentally what an IUL is, a renewable term policy with a side cash account. One additional IUL benefit (HUGE BENEFIT) is that the gains made in the investment are TAX FREE. The argument against an IUL strategy is the same argument from those that troll the participating whole life strategy, the upfront sales commission and premium loads prohibit early cash value growth – THAT IS NON-SENSE AND AN UNIFORMED ARGUMENT. The insurance company assumes the risk of “sales commission” as part of doing business, that cost is NOT PASSED ALONG TO CONSUMERS. 2nd, there is the cost of insurance AND in order for the consumer to take advantage of the immense favorable tax treatment, the policy must have a minimum amount of death benefit to remain in a “corridor” to maintain the favorable tax treatment – and there is a cost associated with maintaining that insurance!

Inevitably, the trolls arguing against these strategies are traders, self-traders, securities traders, mutual fund managers, accountants and people who are not well informed about these products – OR – are threatened by these strategies and products.

The money you put in Bank On Yourself policies is money you want to COUNT on and KNOW that it will be there, when you need it.

Whole life insurance policies come with more guarantees than ANY other kind. The ONLY moving part in a whole life policy that’s not guaranteed is the dividend. But the companies recommended by Bank On Yourself Professionals have paid dividends every single year for at least 100 years.

We’ve written a very important comparison of Indexed Universal Life (IUL) and Whole Life that I think you will find eye-opening.