I just came across these four surprising new facts that affect your money and finances…

Fascinating Fact #1: 61% of boomers fear outliving their money in retirement more than they fear death

That’s according to a new study.1

Maybe you’re one of them. It appears that lots of boomers should be scared out of their wits – almost half of them could run out of money in retirement, according to a new study by the Employee Benefit Research Institute.

In fact, most employees recently surveyed – regardless of age – say they aren’t saving enough money for retirement.2

Many people are  adjusting to “the new normal” by postponing retirement.

adjusting to “the new normal” by postponing retirement.

But you may not have a choice: Nearly four in ten retirees say they were forced out of work earlier than they’d planned, because of layoffs, poor health, or the need to take care of a loved one.3

And, for those already retired, 60% say they have been forced to do without things they had taken for granted, to make ends meet.4

Things like meals out, new books and movies, travel, new clothes and home improvement projects.

Can you live without those things? Sure.

But why should you have to, after a lifetime of hard work and sacrifice?!?

Can you imagine how different things would be if you knew you would have a guaranteed and predictable income in retirement – one that does not depend on the roller coaster ups and downs of stocks, real estate and other investments?

While the “experts” lament that there’s been “no place to hide” during the financial crisis, none of the hundreds of thousands of people who use Bank On Yourself lost a penny in their plans when the markets crashed. Their plans have never skipped a beat and continue growing every year by a guaranteed, predictable and exponential amount.

However, no two policies or plans are alike – each is tailored to the client’s unique situation. To find out how much your financial picture could improve if you added Bank On Yourself to your financial plan, how much income you could take in retirement (guaranteed) and to get a referral to a Bank On Yourself Professional, simply request a free, no-obligation Analysis here, if you haven’t already done so.

Fascinating Fact #2: Social Security may be in far worse trouble than we thought

By law, the Social Security’s trustees’ annual report is supposed to be published by April 1. This year, however, the trustees have postponed it indefinitely!

Why does the program’s financial condition continue to remain hidden from public view?

Could it have something to do with the fact that the trust fund is nothing more than a bunch of IOU’s… and the run on revenues has turned into a stampede?

In my opinion, Social Security is the biggest Ponzi or pyramid scheme ever conceived!”

To make matters worse, a new AARP survey revealed that 50% of those age 50 and over say Social Security is or will be more important to their retirement than they expected when they were younger.

And 25% say they rely, or plan to rely, on it for most of their retirement income.

Shockingly, only 12% of people over 50 expect to be able to rely on savings and investments for most of their income.5

Good luck with that!

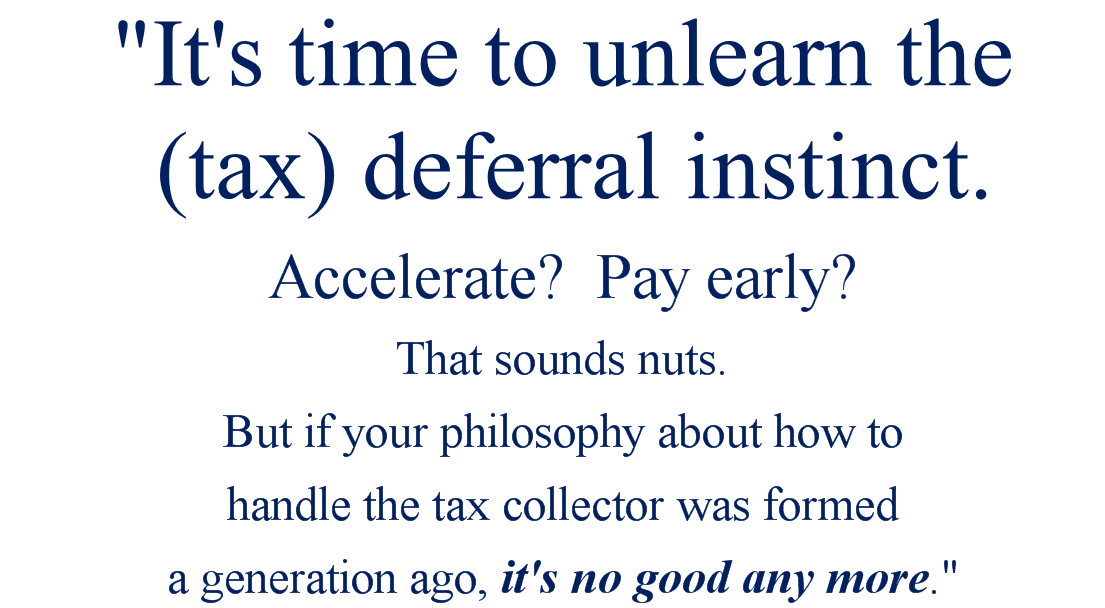

Fascinating Fact #3: Deferring your taxes is one of the worst financial moves you can make

I’ve explained in my best-selling book and elsewhere why the notion that it’s a good idea to use 401(k)’s and other “tax-qualified” retirement plans to defer your taxes is just one more example of how dumb the “conventional wisdom” about money and finances is.

Now, an article on Forbes.com entitled, “Pay More Taxes Now!” confirms everything I’ve been saying…

As the article points out, we already know tax rates are going up. (Does anyone actually believe tax rates are going to go down over the long term?)

If tax rates do go up, and you’re successful in growing a nest-egg, you’re only going to end up paying higher taxes on a bigger number!

Even if tax rates remain the same, it’s estimated you’ll pay 10-20 times more in taxes over a thirty-year period!

My advice – and Forbes.com’s advice – is to pay your taxes now. At least you know what they are!

A Bank On Yourself policy is taxed like a Roth IRA. You pay your taxes up front, and then you can access the growth with little or no tax consequences, under current tax law.

But, you may be wondering, what if the tax laws change?

Of course, the tax laws could change. For that matter, they could change the tax laws on 401(k)’s, IRA’s and Roth IRA’s. But the tax advantages of Bank On Yourself are just the icing on the cake. Even if the tax laws changed for Bank On Yourself, you’d still have all the many other advantages and guarantees of this time-tested method, including:

The Bank On Yourself concept is based on an asset class that has increased in value during every stock market decline and every period of economic boom and bust for more than a century. That asset is dividend-paying whole life insurance

The Bank On Yourself concept is based on an asset class that has increased in value during every stock market decline and every period of economic boom and bust for more than a century. That asset is dividend-paying whole life insurance

Your money in one of these policies grows by a guaranteed and preset amount every year. In addition, the growth is exponential, meaning it gets better (more efficient) every single year you have the policy – with no luck, skill or guesswork needed to make that happen

Your money in one of these policies grows by a guaranteed and preset amount every year. In addition, the growth is exponential, meaning it gets better (more efficient) every single year you have the policy – with no luck, skill or guesswork needed to make that happen

A properly structured Bank On Yourself-type policy incorporates little-known riders which turbo-charge the growth of your equity (“cash value”) in the policy, especially during the early years of the policy. This enables you to use your policy as a powerful financial management tool from Day One

A properly structured Bank On Yourself-type policy incorporates little-known riders which turbo-charge the growth of your equity (“cash value”) in the policy, especially during the early years of the policy. This enables you to use your policy as a powerful financial management tool from Day One

Once credited to your policy, both your guaranteed annual cash value increase, plus any dividends you may receive, are locked in. They don’t vanish due to a market correction

Once credited to your policy, both your guaranteed annual cash value increase, plus any dividends you may receive, are locked in. They don’t vanish due to a market correction

Can you imagine how much brighter your financial picture would be if you still had every penny of principal you put in AND all the growth you’d received?

You have peace of mind for retirement planning, because you could know the minimum guaranteed income you can take in retirement, and for how long you could take it

You have peace of mind for retirement planning, because you could know the minimum guaranteed income you can take in retirement, and for how long you could take it

And that’s just a partial list of the benefits of Bank On Yourself, which is why the $100,000 cash reward I’ve offered to the first person to show they use a different product or strategy that can match or beat Bank On Yourself remains unclaimed.

REQUEST YOUR

FREE ANALYSIS!

There’s no cost or obligation to receive an Analysis that will show you how a custom-tailored program can help you reach your long-term and short-term goals and dreams – in the shortest time possible.

Fascinating Fact #4: Apparently, money can buy happiness

A Gallup survey – the largest of its kind – found that people almost universally agree that a lot of having a “good life” has to do with material prosperity.6

And not having to worry about whether your money will run out before you do significantly reduces stress and lets you focus on the more positive, fun things in your life.

Which is part of the reason most people say the only regret they have about Bank On Yourself is that they didn’t start sooner.

If you haven’t already added Bank On Yourself to your financial plan, now’s the time to make sure you never suffer another lost decade… or even another lost day.

When you request a FREE Analysis , you’ll get a referral to one of only 200 financial representatives who have taken and passed the rigorous requirements to be a Bank On Yourself Professional.

Tip: Ask your Professional if you can qualify to “turn back the clock” by up to six months to jump start your Bank On Yourself plan and turn your back on the stomach-churning ups and downs of the stock and real estate markets.

[…] This post was mentioned on Twitter by Miguel Evangelista, Pamela Yellen. Pamela Yellen said: /four-fascinating-facts-that-affect-your-finances.html […]

Can you help me to understand math for money gain formula?

If there is only ten persons, on the whole wide world, and each one has only $10.00 dollars, how is possible that one of them has more money than the others, and all of them still have $10.00 dollars???!!! Thank you. Dobbe.

Pamela, your information is great and relative. However, every individual household is not the same. Generically, yes, saving tax free like a ROTH IRA is a great alternative. But, there are many alternatives and Bank on Yourself, sorry to say, is not the only way to financial heaven.

Keep up the great informational highway you provide.

SJ

It absolutely is the only way to financial heaven. If you had any money in the markets in the past few years including through a Roth IRA you would have learned this. It is the only way because it does not depend on market performance, the growth is safe, guaranteed and predictable.