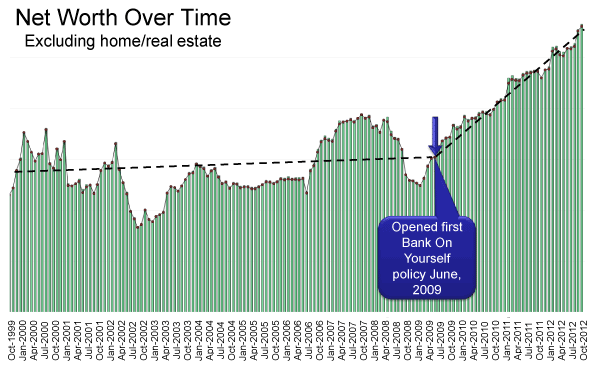

Dan Proskauer recently sent me a chart showing how his family’s net worth has grown since he started his first Bank On Yourself plan 3 1/2 years ago, and how that compares to the previous 10 years.

When Dan saw this chart on his financial tracking software program, he said his jaw dropped so hard it left a dent on his keyboard and that “we should be shouting about this from the rooftops.”

They say a picture is worth a thousand words, so take a look for yourself and note how you’ll see a more detailed version of the chart when you place your mouse over it…

Why would Dan be willing to reveal and discuss something as personal as his net worth for the whole world to see? Because, in Dan’s words…

If I can help a few people start Bank On Yourself this year, instead of next year or instead of never, then it’s well worth my time.”

I had interviewed Dan on this blog two years ago (“Bank On Yourself under the microscope“), and Dan agreed to give us an update on how things have changed now that he’s 3 1/2 years into the Bank On Yourself program.

Dan is Vice President of Technology for a major health care company. He’s extremely analytical and has spent literally hundreds of hours analyzing and “spread-sheeting” the concept and his plans. He says, “I had high expectations for Bank On Yourself… and they’ve really been exceeded.”

I think you’ll enjoy listening to this fast-paced interview with Dan (and/or read the transcript), which reveals:

- How Dan’s mindset about saving and investing has changed as he sees how Bank On Yourself has impacted his finances

- The BIG difference between “paper wealth” and “real wealth”

- How Bank On Yourself eliminates volatility and unpredictability

- The downsides to government-sponsored retirement plans like 401(k)s and IRA’s

How much better could your financial picture look when you Bank On Yourself?

It’s easy to find out when you request your FREE no-obligation Personal Wealth Analysis and get a referral to a Professional.

- Why Dan was surprised to see his net worth grow so dramatically, even though he’s still in the early funding stages of his Bank On Yourself policies

- How Dan now satisfies his urge to try for higher returns in the stock market

- Why Dan has nine different Bank On Yourself policies now… and why each one is unique

- How we’ve been brainwashed into believing we must accept risk to grow significant wealth, and why Dan now realizes that taking that risk isn’t necessary

- How having money safe and available to you in a Bank On Yourself policy increases your options rather than limiting them

- The value the Bank On Yourself Professionals bring to the table

Dan noted that his income has increased some in the last four years, as has the amount he saves each year. The difference is that now he has a great place to put that income (his Bank On Yourself plans), where he no longer loses any of it to the “randomness of the market”. And he’s convinced the picture you see above wouldn’t look anywhere near this good if he hadn’t discovered Bank On Yourself.

One thing we consistently hear from folks who use the Bank On Yourself wealth-building method is how much more fun and motivating saving money becomes when you don’t have to worry about losing it or what effect the events of the day in the U.S. or in some faraway place will have on your hard-earned money!

Check out Dan’s interview…

You can listen to the interview by pressing the play button below, or you can download the entire interview as an mp3 and listen on your own player or iPod:

You can also download a transcript of the interview here.

Let us know what you think in the comments box below! And if you want to share your net worth growth picture with us (without the actual dollar amounts listed to protect your privacy), we’d love to see it!

SUPER article and interview!!! The GRAPH says a lot about the impact of Bank On Yourself.

Dan said that his cash value did not yet equal the premiums that he put in. How did his net worth increase by 86% in 3 1/2 years?

Bob

Hi Bob. Great question. I’ll try to answer, but I also want to expand your question to include this, “If the cash value of Dan’s policies are only a portion of his net worth, why does he feel that the increase is due to BOY?”

The answer to both is twofold. First, I dramatically reduced my opportunities to lose money. Prior to BOY, every single method of saving and investing I was using was exposed to potential losses – and remember I was doing things “by the book” with diversification, asset allocation, dollar cost averaging, etc. When I began to shift my thinking thanks to BOY and realize that I did not have to take all that risk, I moved into savings and investment vehicles that were not exposed to risk of loss. The sad fact is that when you have so many opportunities to lose money, some of the time you will. That was was taking a bigger bite out of my results than I realized. Death by a thousand paper cuts as they say.

Second, BOY inspired us to save more. As I said in the interview, we did not make radical lifestyle changes, but with BOY – especially once I started to see the initial results – I felt we had a place to put our money that was both safe and high return over the long term. That led me to work closely with my authorized adviser to create some very customized policies. These policies had relatively low annual premium commitments, but relatively high limits for the total amount I was allowed to put in. That created a “stretch goal” for us, as well as a perfect place to put any kind of windfalls – with the knowledge that we could still access the money if needed. The result is that we have found ways to really save a lot more money then we were before, despite the fact that it doesn’t feel that way!

Even though the base policies themselves aren’t through the funding stage, some of the additional payments generate positive returns in a shorter time frame so we are already making money on those savings. Also, as Pamela noted in the blog posting, we have been fortunate that our income has gone up somewhat over this period. Again though, what BOY did was help us to immediately channel that increase to our policies where we are seeing it build steadily for our future.

I hope this helps. Believe me, when I first saw that chart I asked myself the very same question!

Dan,

That is a great answer to a common and fair question. I too have built multiple policies with achievable premium commitments but with the potential for additional savings. My wife and I work hard at hitting our maximum allowable premium each month. It has become addicting to say the least because we get immediate gratification knowing that those dollars are guaranteed to grow in value each year, they are available should we need the money, and we do not receive a 1099 at the end of the year for the growth. When we receive our annual statement all we see is an increasing “NET WORTH”. Had we sent the same dollar amounts to any other financial venue “except cash in the mattress” we would have had to hope that it would rise. And we are not going to rely on financial hope ever again.

We appreciate the process is life long and that we have the control of the values and we have the option to leverage the policy via loans.

I must say you really did a great service to all of us with your graph and interview! I am sure that it will help so many people understand that what they are currently doing looks just like your years prior to 2009.

Thank you,

Marc

Thanks Marc! It makes me feel so good to hear what you had to say!

I think you really hit the nail on the head when you said it is addicting. Maybe another way to put it is that it is a “virtuous cycle”. The positive reiforcement you and I receive in seeing the results and in seeing our financial future become more and more predictable and secure makes it even easier to find ways to save and fund the policies, thus increasing the result and starting the cycle all over again. What other financial instrument can claim something like that???

The ability to see the outcome of this with such a clearly different “before” and “after” view was just because I happened to be such a dedicated user of Quicken for so many years. I am so happy that it showed what it showed though – and remember, I basically had no idea what it was going to show when I cleared that date restriction! Sounds like Rose H. had the same experience, just without the fancy chart. 🙂

If there is any takeaway from all this, I think it is that BOY is an opportunity that ANYONE can take advantage of and everyone should learn more about. While it uses a complex asset class that has historically been the domain of the ultra-wealthy, too-big-to-fail financial institutions and fortune 500 companies, Pamela and the Bank on Yourself team have done us ALL a great service by making it more accessible to the rest of us in such a powerful way. No matter what your situation, income level or your current thinking of how much you can or cannot save, I encourage you to contact a Bank On Yourself Professional. It is free, easy, and really could change your life.

Dan – yes mine was very “low-tech” – I used to keep track of my net worth in a spiral-bound notebook, and update it every year or so with all the major assets/liabilities! It was quite a sad state (FAR in the red) before I started B.O.Y.. Definitely not as fancy as yours – your chart is great. 🙂 I’ve since upgraded to Mint for keeping track, which is great tool, but even better is the fact that I’m no longer “in the red” – and part of that is definitely due to Bank On Yourself!

Rose.

Great chart! I’m not surprised though – my own net worth has increased by over 200% since I started BOY 8 years ago. One of my policies is still catching up to premiums, but the first one is past the initial capitalization phase and I am constantly using it for financing things. It has taken me from thousands of dollars in debt, to just the opposite. The difference Bank On Yourself has made to my cashflow, savings, debt level, and peace of mind is pretty much priceless! Just adding my shout! 🙂

Rose.

Dan, you mention in one of your responses that you have created “some very customized policies”. I have 2 of these policies now with an authorized adviser, but am always wondering if the policies are as optimized as they could be. Might you be able to share some objective information if it’s not too personal (i.e., percentage to cash value in the early years, minimum premium versus MEC), etc.

Thanks in advance, and share what you are comfortable with.

Patrick

Hi Patrick. I wouldn’t want to suggest anything specific as your advisor would be in the best position to help there. However, I will give some of the broad parameters. I was looking to minimize the annual premium required to keep the policy current while maximizing the total amount of money I could potentially put into the policy with an improved return over some of our other policies. What we ended up with were two policies (one each for myself and my wife) which used the approach of blending in some term insurance. Pretty low annual base premium with the possibility of adding quite a lot more if we chose. The closer we come to maximizing what we put in gets us to returns that exceed other approaches. If we pay closer to the minimum, the returns are somewhat below other approaches.

This worked really well to achieve the specific objectives we set out to solve for. I hope this helps. My advice would be to think through what your goals are as best you can and to be as explicit as possible with your advisor. It is great to ask questions and to learn as much as you can about the various options available, but the team of Bank On Yourself Professionals has both experience and a lot of backup (working together) to help you to solve the problem specifically for you!

Dan

Did you have to pass a physical exam of an insurance company to establish a “Bank on Yourself” policy? I had once tried to apply for an “Infinite banking” policy which sounds just like the “Bank on Yourself” concept that you speak of and was rejected by the company (for a reason that didn’t even correspond to my actual health situation so it made no sense to me) but I am 70 and retired so where does one get the money for the annual premiums if one isn’t currently working?

You can have someone else—typically a family member—be the insured on a policy. You would still be the owner and control the policy and the money in the policy. At age 70, a “Bank On Yourself for Seniors” policy may make more sense. It involves a one-time lump sum premium payment. Learn more about it here: /bank-on-yourself-for-seniors

To find out which type of plan makes the most sense for you, along with suggestions on where to find the money to fund your plan, request a free Analysis, which will also get you a referral to one of the Bank On Yourself Professionals.