UPDATED October 2019

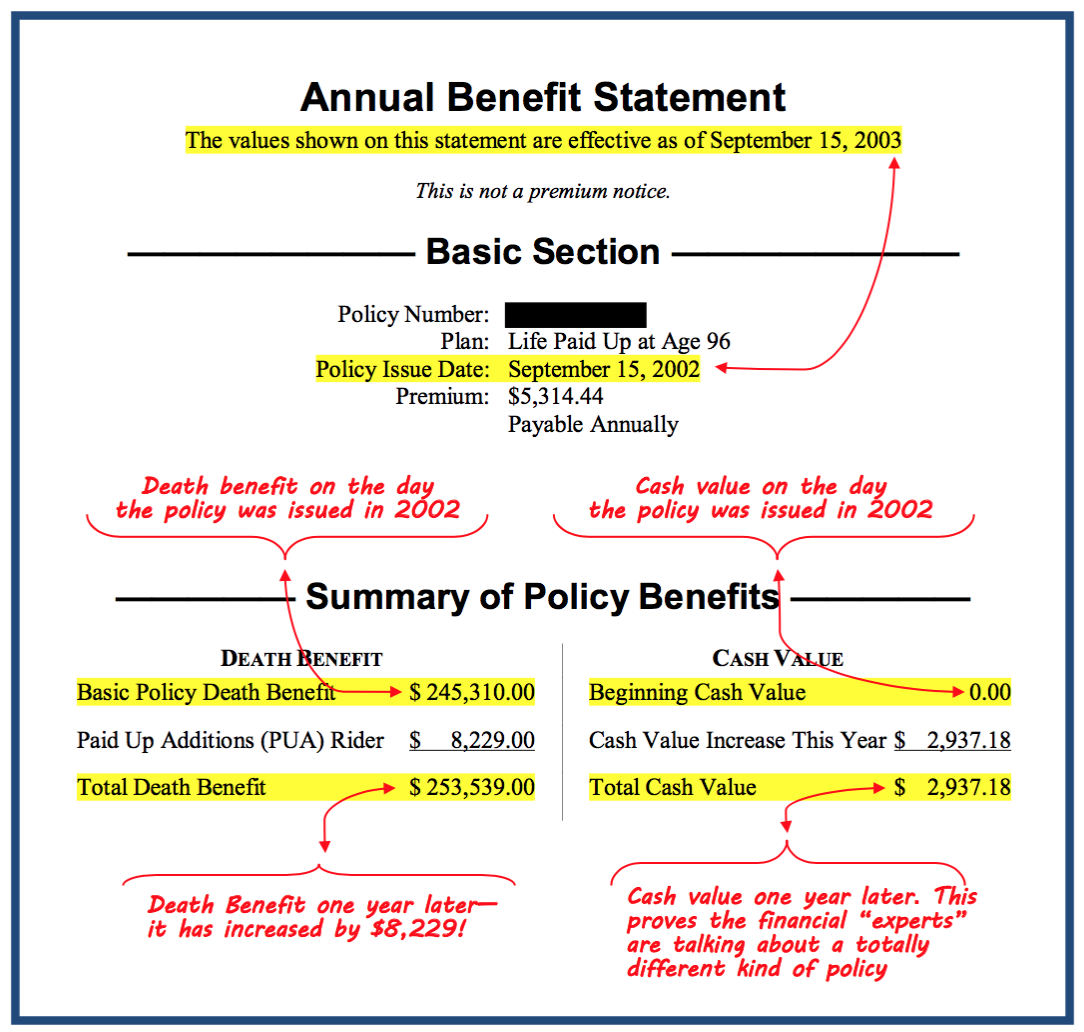

I came across an online article by a blogger who ignorantly claimed that the only good purpose for whole life insurance was as a rich man’s Roth and only for individuals whose high incomes made them ineligible for the tax-saving advantages of a Roth IRA. He’s dead wrong — you don’t have to be wealthy to benefit from the incredible advantages of whole life insurance.

Let’s look at how a Roth IRA works vs. a dividend-paying whole life insurance policy.

How Does a Roth IRA Work?

A Roth Individual Retirement Arrangement (Roth IRA) is an IRS-approved strategy that allows you to invest money you have earned by making contributions to a Roth IRA plan you have set up. You are not allowed to take a tax deduction for your contribution as you are with a traditional IRA. However, any earnings you withdraw from a Roth IRA aren’t taxed — as long as you’re at least age 59 1/2 and you’ve had the Roth IRA for at least 5 years.

How a Roth IRA differs from a traditional IRA

Roth IRAs are quite different from traditional IRAs.

With a traditional IRA, your contributions are tax-deductible. However, when you withdraw money from your traditional IRA—and you must withdraw specific percentages annually, beginning soon after your seventieth birthday—you must pay taxes on everything you withdraw—at whatever the tax rate happens to be at the time.

See the table for a summary of the key differences between a Traditional IRA and a Roth IRA. [Read more…] “The Truth About Whole Life Insurance and Why It’s More Than a “Rich Man’s Roth””