With something as vitally important as your retirement security, you need to be aware of 401(k) problems. And you have to ask yourself, “Do I really want to have to deal with all this? Are there good alternatives to 401(k)s?”

Let’s take a look at the drawbacks to 401(k)s and good alternatives to them. The 401(k) drawbacks include:

- Unpredictable market performance, which means the very real possibility of losing a significant portion of your nest egg

- 401(k) rules and limitations which can cripple your options and lock your money in a virtual prison

- Fees, both visible and hidden, which can devour one-third or more of your hard-earned money in the plan

- Tax deferral, which can siphon off another one-third or more of your income during your retirement years

Four Major Issues You Face When Planning for Retirement: Safety, Restrictions, Fees, and Taxes

Safety comes down to risk versus reward. Great potential gain brings with it great potential loss.

Investopedia sums up risk and reward this way: “Investing requires a degree of risk, and the bigger that risk, the higher the gain should be.”

The bigger that risk, the higher the potential gain should be—and the greater the potential loss will be.

What will you do if you don’t have enough to live on because of lackluster performance, restrictions, enormous fee, taxes on your income—or a major crash just before you planned to retire?

Will you work until you’re too ill to work, or you need to quit to take care of a relative, or you’re replaced by some kid one-third your age? (Nearly half of all retirees are forced to retire sooner than planned for just these reasons, according to the Employee Benefit Research Institute.)

Will you go on welfare or be shuttled back and forth between your children? Will you live under a bridge?

You can’t afford to lose your retirement nest egg, any more than you can afford to lose your next paycheck. And if you can’t afford to lose it, you can’t afford to risk it.

Yet government-controlled plans assume you want to invest your money in some endeavor with the hopes of making a profit. But investing, by its very definition, includes the concept of risk.

And the investment doesn’t need to be sketchy to involve risk! Investments in companies as “solid” as Blockbuster Video … Borders Books … Pan Am Airlines … Sharper Image … Enron … Polaroid … even Bethlehem Steel … have led to the downfall of millions of investors who thought they were being cautious, wise, and conservative.

Trillions of dollars have evaporated from 401(k) plans due to market fluctuations alone.

The U.S. Securities and Exchange Commission is blunt about the risks of investing:

All investments involve some degree of risk. If you intend to purchase securities—such as stocks, bonds, or mutual funds—it’s important that you understand before you invest that you could lose some or all of your money. Unlike deposits at FDIC-insured banks and NCUA-insured credit unions, the money you invest in securities typically is not federally insured. You could lose your principal, which is the amount you’ve invested. That’s true even if you purchase your investments through a bank.”

Rules and Regulations That Strangle Your Access to Your 401(k) Money

Government-approved retirement plans have more strings attached than Pinocchio before he became a real boy. It’s like your money is locked up in a maximum-security prison where someone else calls the shots—and you barely get visitation rights!

Contribute to a 401(k) plan and you’re contributing to a plan that tells you the maximum amount you can put in.

Your plan will also dictate what you can and cannot invest in.

You’ll learn that you can only borrow a relatively small amount, and you must pay it back on a strict schedule—or you can’t borrow at all.

These restrictions may seem normal, but not if you know the 401(k) alternatives.

The government tells you how long you must wait to access your 401(k) plan money—your own money! You’ll pay penalties for taking virtually any distributions before you’re 59½.

Uncle Sam will tell you when you must access your money, and how much you must withdraw (and pay taxes on) each year. You’re forced to start taking distributions when you reach 72—whether you want to or not.

Don’t get suckered into believing you control the money in your 401(k). Your plan is only tax-deferred because the government created it that way. And what the government created, the government controls.

The government can—and does!—change the rules any time it wants! The prison warden has your money under lock and key, and while your money’s in the slammer, he can impose any new restrictions or regulations he comes up with—and you have no recourse.

Do all retirement planning strategies come with those kinds of rules and restrictions? No! There are 401(k) alternatives that we’ll discuss soon.

The Fees You Pay with a 401(k) Plan Compound Against You

Virtually every investment plan and most savings plans have fees or potential fees of one kind or another.

In 401(k) plans the compounding of fees works against you. It doesn’t matter whether you win or lose in the stock market, your stockbroker or the financial representative managing your money will still get paid.

The impact of 401(k) fees is colossal. According to an exposé on 60 Minutes, fees “can eat up half the income in some 401(k) plans over a thirty-year span.” Yikes!

You really do need to know in advance exactly what effect fees will have on your balance. But just try to find out from your plan administrator or financial planner!

The Truth About 401(k) Plan Tax Deferral

Whoever talked you into starting your 401(k) probably told you what a great advantage tax-deferral is. “You can deduct the money you put into your 401(k), and it grows tax-deferred. You don’t have to pay taxes on your growth each year!”

If you bought into that, you’re in good company. An overwhelming number of Americans—and Canadians, with their registered retirement savings plans (RRSPs)—are in the same boat you’re in.

Many folks haven’t stopped to consider that when they retire—or when they’re forced by the government to start withdrawing from their 401(k) plan—they’ll pay income tax at the going rate on every single dollar they withdraw.

They’ll pay tax on the money they originally contributed, because the government let them deduct that money from their taxable income. Now Uncle Sam is holding his hand out, palm up. And in his other hand, he’s holding a club.

And when folks withdraw from their 401(k) plan, they will also have to pay taxes on their earnings.

All those taxes were deferred—postponed—not cancelled!

Here’s what that could mean to you:

Let’s assume you’ve retired and you need $70,000 in retirement income annually to maintain your lifestyle and do some traveling.

If that income is from a 401(k) plan and you pay an average tax rate of 25%, your retirement plan will have to throw off $93,333—not $70,000—every year. You’ll need that extra $23,333 every year just to pay the taxes on your 401(k) income.

But tell me this: if your retirement plan could throw off $93,333 per year, wouldn’t you rather spend that extra $23,333 enjoying life more, rather than feeding Uncle Sam?

Why not pay your taxes up front while you know what they are, and then have income with no taxes due in retirement?

A Review of Some 401(K) Plan Alternatives

If you don’t like heavy-handed government-controlled plans, broaden your horizons. There are methods of saving for retirement that don’t depend on unpredictable market performance … that have very few, if any, government restrictions … that tell you in advance what your minimum account will be at retirement (and any point along the way)—after fees … and that don’t have any of the pitfalls of the tax-deferral trap.

Not every 401(k) alternative offers every one of these advantages. But there is one that does. It actually offers more advantages, as you’ll see. Let’s look at the five common 401(k) alternatives.

#1 IRAs and Roth IRAs

IRAs are like other government-controlled plans, with one exception: Roth IRAs. You fund a Roth with after-tax money (unlike traditional IRAs), and you can withdraw money from your plan in retirement without paying taxes, subject to various regulations and controls.

#2 Municipal Bonds

Municipal bonds are debt securities issued by government entities to fund day-to-day obligations and finance capital projects such as building schools and highways. Generally, the interest on municipal bonds is exempt from federal income tax.

#3 Gold, silver, and other commodities

Commodities are basic goods used in commerce. Examples are gold, beef, oil, lumber, natural gas, iron ore, crude oil, salt, etc.

#4 Real estate

Real estate may be raw land, or it may be improved with buildings, farms, homes, and so forth. You receive income from renting or leasing the property, and you may realize a gain when you sell it.

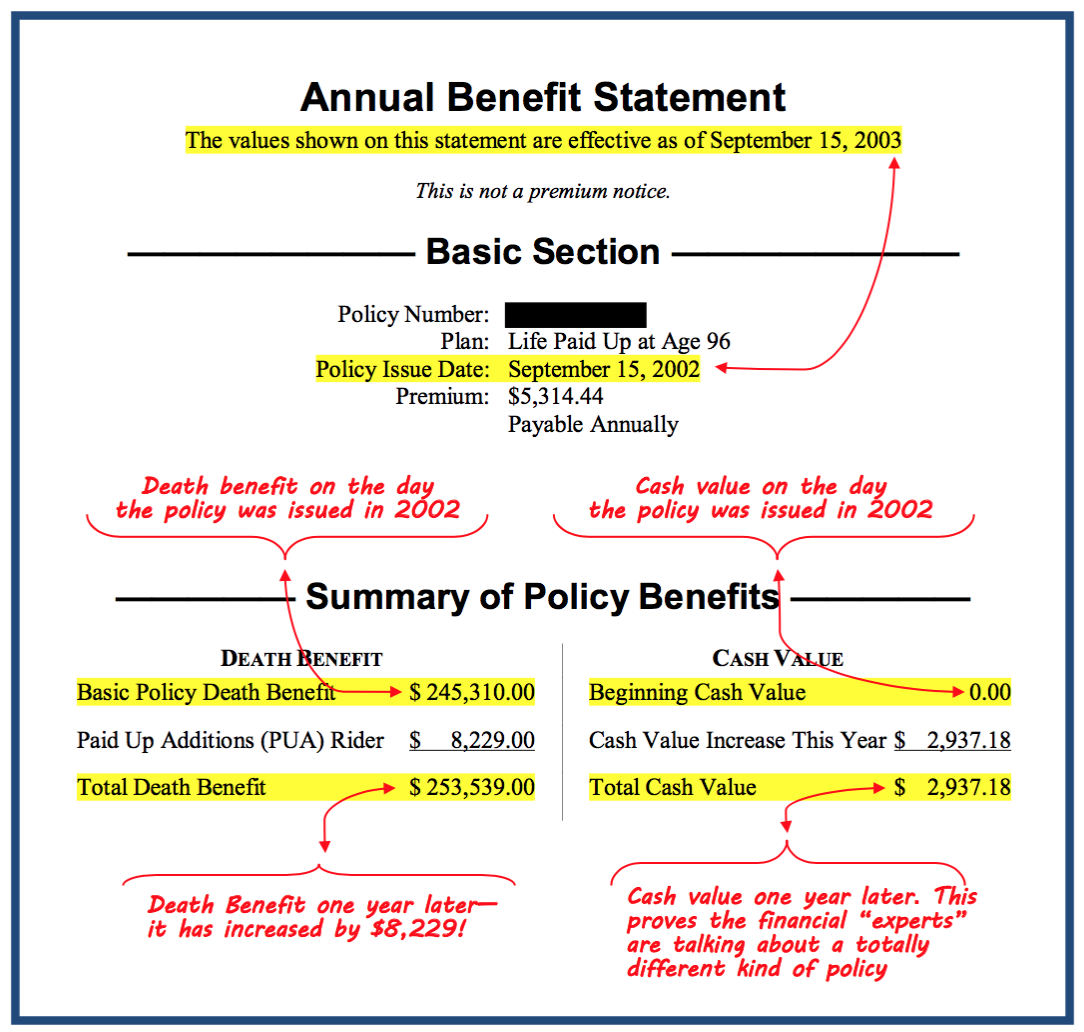

#5 Dividend-paying high cash value whole life insurance

Using life insurance as an alternative to a 401(k) plan may seem odd. But it’s not to the hundreds of thousands of individuals, families, and businesses, who are doing it every day. The cash value component of a dividend-paying whole life insurance policy can be used during the insured’s life to provide a guaranteed, predictable retirement income, and for other purposes.

Which 401(k) alternative is best?

What’s the best 401(k) alternative? The comparison chart below will help you decide.

Comparing 401(k) Plans with Alternatives

| Does the plan … |

401(k)s & 403(b)s |

IRAs & Roth IRAs |

Muni-cipal Bonds |

Gold & Silver |

Real Estate |

Dividend-paying whole life insurance |

| Give you guaranteed, predictable growth? |

N |

N |

N |

N |

N |

Y |

| Lock in your principal and growth, even when the market crashes? |

N |

N |

N |

N |

N |

Y |

| Give you control of your money or asset without government restrictions and penalties? |

N |

N |

Y |

Y |

Y |

Y |

| Give you tax-free retirement income? |

N |

Only Roths |

Y |

N |

N |

Y |

| Let you use your money or asset without penalties or the possibility of incurring a loss, however and whenever you want? |

N |

N |

N |

N |

N |

Y |

| Let you use your money or asset, yet still have it grow as though you didn’t touch it? |

N |

N |

N |

N |

N |

Y |

| Allow you to fund your plan every year, without limits imposed by the government? |

N |

N |

Y |

Y |

Y |

Y |

| Finish funding itself if you die prematurely? |

N |

N |

N |

N |

N |

Y |

| Tell you the minimum guaranteed value of the plan or asset on the day you expect to tap into it, and at any point along the way? |

N |

N |

N |

N |

N |

Y |

To learn more about a properly-designed dividend-paying whole life insurance strategy as a 401(k) plan alternative, and to find out what it can do for you, request a FREE Analysis. You’ll receive a referral to a Professional (a life insurance agent with advanced training on this concept) who will prepare your Analysis and answer all your questions about the concept.

![[this account] has become a tax shelter for the rich... it gives the affluent tax advantages far beyond those available to middle-income people through a 401(k) or IRA.](/wp-content/uploads/Wall-Street-Journal-life-insurance-pull-quote-from-2010.jpg) Want proof that’s what the Palm Beach Group is talking about? In the transcript of their long interview with Ted Benna, Palm Beach includes a quote, attributed to the Wall Street Journal. Note that they’ve removed the Journal’s identification of the product and replaced it with their own vague words, “this account.”

Want proof that’s what the Palm Beach Group is talking about? In the transcript of their long interview with Ted Benna, Palm Beach includes a quote, attributed to the Wall Street Journal. Note that they’ve removed the Journal’s identification of the product and replaced it with their own vague words, “this account.”