Because the Bank On Yourself wealth-building method lets people bypass Wall Street to grow wealth safely and predictably every year – regardless of “whether the market goes up, down or sideways”™ – we’ve taken a lot of nasty flak from financial “gurus” and investment advisors over the years. That seems to be heating up as individual investors continue to flee the stock market in droves, which is having an impact on many advisors’ livelihoods.

Allan Roth – a financial planner and blogger for CBSNews.com MoneyWatch – has written an article about why he believes this tried-and-true strategy is “snake oil.” But Allan Roth is not an investigative reporter. Allan Roth is an investment advisor with some very strong opinions. Of course, we understand that Mr. Roth is entitled to his opinions, however, his article about Bank On Yourself is filled with numerous misstatements of fact and misquotes. When I sent a detailed accounting of his blunders to the legal department of CBSNews.com, it got routed to an editorial “executive producer” who refused to correct the record.

Allan Roth – a financial planner and blogger for CBSNews.com MoneyWatch – has written an article about why he believes this tried-and-true strategy is “snake oil.” But Allan Roth is not an investigative reporter. Allan Roth is an investment advisor with some very strong opinions. Of course, we understand that Mr. Roth is entitled to his opinions, however, his article about Bank On Yourself is filled with numerous misstatements of fact and misquotes. When I sent a detailed accounting of his blunders to the legal department of CBSNews.com, it got routed to an editorial “executive producer” who refused to correct the record.

Therefore I am taking this to the court of public opinion and giving you the facts so you can decide for yourself. We really want to hear from you, so we’re going to pick 10 of the most interesting or insightful comments made on this blog and award posters valuable gifts. (Details at end of this post.)

I’ll address just one of Roth’s misstatements in this post. In a nutshell, Allan Roth’s argument is that using a Bank On Yourself policy to finance something like a car and following the strategy laid out in my best-selling book is a losing strategy. But the “logic” Mr. Roth uses is flawed: Allan Roth was comparing the total cost of purchasing a car and financing it through a Bank On Yourself-type policy to the total cost of not buying a car at all!

How did he arrive at the “well, duh” conclusion that at the end of the day you’ll have more money if you don’t buy things than if you do? And how did Allan Roth completely miss the boat on what Bank On Yourself is all about? Read on to find out…

After a number of Roth’s clients asked him about adding more guarantees and predictability to their financial plan with Bank On Yourself, Roth contacted one of the Bank On Yourself Professionals to determine if the book’s claims were true. Roth was particularly interested in knowing if the process described in the book for becoming your own source of financing for major purchases worked as claimed.

Here’s a link to the article Mr. Roth wrote.

Roth writes that the projections “seemed magical”

The advisor Roth contacted provided him with several illustrations showing how he could borrow from his policy to purchase cars, and how that would impact the income he could take from the policy during his retirement years. Roth wrote in his article that the projections “at first glimpse… seemed magical. By year 12, when I had planned to use the insurance policy to live on, I had more money under the scenario where I borrowed to buy a car than in the one where I didn’t [use the policy to] purchase a vehicle.”

But later Roth pointed out that by following the Bank On Yourself method of financing his automobile purchase through his policy, he would have paid an “additional” $12,000 to the insurance company, and he wanted to know where that money went. The advisor explained it to Roth at least six different ways, but Roth never seemed to understand. Finally the advisor gave up.

That’s when Roth came to me. I painstakingly answered the same question two different ways. The bottom line is that the illustrations and projections provided to Allan Roth – the ones he himself called “magical” – were correct. There was no software malfunction. We simply used arithmetic to show Allan how his $12,000 was in his policy and had grown to $13,748.

You can see that arithmetic in my verbatim first reply to Allan Roth. Here is the proof that the financial promises in the Bank On Yourself book DO add up.

But Roth wasn’t convinced, so he went to the insurance company that provided the illustrations and asked them to verify his conclusions. They, too, explained the flaw in Roth’s logic.

All along, Allan Roth’s confusion and conclusions were based on comparing buying a car through his policy versus not buying a car at all! Roth ignored the fact that you have to compare apples to apples, meaning you have to assume you were going to buy the car one way or another.

No wonder he concluded he’d “be out even more than 30 grand” if he used the policy to finance a car!

Well, duh! Of course you’d have more money if you didn’t buy a car!

And nowhere in my book do I say you’ll come out better by financing a car (or anything else) through your policy than by not buying it at all. Throughout the book, I explain I’m going to compare financing a car the traditional ways against financing a car through a Bank On Yourself policy.

For example, on page 5, I talk about how you can have a bigger nest egg “by buying cars… the way I reveal in chapter 2 and 6, rather than by financing or leasing them.” And on page 17, I note, “But please understand this is about a different way to pay for things…” And on page 20, I wrote, “To understand the power of it, let’s go back to our example of buying a car… but instead of borrowing $30,000 from a finance company, you’re going to borrow it from your own Bank On Yourself plan.” And there are numerous other similar mentions in my book. (I wonder if Roth even read my book?)

It seems pretty clear, doesn’t it? To have the most money in your pocket, don’t buy a car! Take the bus.

But if you are going to buy a car, I haven’t found anything more financially savvy than banking on yourself, using a Bank On Yourself policy loan.

Roth claims that when he went to the insurance company to ask them to verify his conclusions, the insurance company did just that. But that’s not what happened.

The insurance company verified that the ILLUSTRATIONS he received were correct, as were some numbers (for example, “6.9% Ret”) that Roth wrote on the illustrations. But the CONCLUSIONS Roth came to on his own were correct ONLY if you insist on comparing buying a car through the policy versus not buying a car at all!

Roth left out some critical details…

In his article, Roth didn’t mention that the second time he spoke with the insurance company, they brought in someone who is an expert at evaluating insurance illustrations and how these policies work when you use them for financing. This expert explained to Roth the exact same thing I tried to explain twice and the advisor tried to explain six times: you can’t compare buying a car through a policy with not buying a car at all!

Poor Allan. He still couldn’t understand, and this pains me greatly. For the last ten years, I have devoted myself to my mission of educating people about the wealth-building advantages of specially-designed dividend-paying whole life insurance policies, on which the Bank On Yourself concept is based. I know my efforts have gone a long way toward taking a strategy that was historically the domain of the wealthy, the too-big-to-fail financial institutions and Fortune 500 companies, and making it more accessible to the rest of us.

I realize that the Bank On Yourself wealth-building method goes against all the conventional wisdom about saving, investing and financing, and I guess I just wish more people would keep an open mind. I take it as a personal failure when even one person speeds past the Bank On Yourself concept, either because of a closed mind or because of my inability to explain the concept in a way that makes brain-dead simple sense to them.

And it particularly pains me that I was not able to communicate the value of Bank On Yourself to Allan Roth, who wrote in his article lambasting my book…

On a personal level, I am really seeking refuge from the volatility that has whipsawed the markets and frayed investor nerves.”

I truly feel Roth’s pain! As I write this, in early December 2012, the Dow has increased by less than 1% per year – for the last 13 years. The S&P 500 is actually below where it was at the end of 1999. And during that same period, inflation has eaten away about 35% of the value of your money.

But Bank On Yourself provides a wonderful solution, and it’s a shame Mr. Roth didn’t realize he was literally holding it in his hand: One of the illustrations Roth received showed how, in the 13th year of the policy (when Roth would have stopped paying premiums), he could have a net cash value increase of $18,817.1 That represents a 5.1% annual return on his $367,715 cash value of the year before. And that 5.1% is AFTER all fees and expenses. Best of all, it comes without the risk or volatility of stocks and other investments.

Can you tell me what’s not to like about that? Mr. Roth was so close, yet he sped right past the “refuge” he said he is seeking. And that his clients are clearly seeking, too.

Furthermore, because it’s possible to access both your principal and your gains in these policies with no taxes due under current tax law, you would have to get at least 6% or 7% every year in a taxable or tax-deferred account to equal the 5.1% return of the Bank On Yourself policy that was custom-tailored for Roth.

Plus, there is a death benefit of almost $753,000 available for Roth’s family’s peace of mind – a fact Roth totally ignored.

Where else does Roth think he can safely get that kind of return and protection?

Please note: No two Bank On Yourself plans are alike. Yours would be designed to help you meet your specific long-term and short-term goals and objectives. To find out what your plan would look like, request your FREE Analysis here, if you haven’t already.

And keep in mind that a Bank On Yourself-type policy keeps getting better and better every year you have it – no luck, skill or guesswork required.

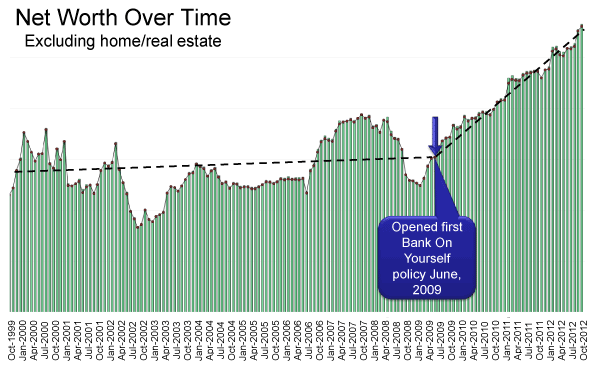

Not long ago, we interviewed Bank On Yourself policy owner Dan Proskauer who told me he wanted to “shout from the rooftops” about how his net worth had grown steadily after he started his first Bank On Yourself policy 3½ years ago, compared with his Wall Street roller coaster ride previously. Proskauer used Quicken to visually display the growth in his family’s wealth over the last 13 years.

A picture is worth a thousand words, isn’t it?

Can anyone tell me what’s wrong with results like this?

As Dan Proskauer pointed out when I talked to him, Bank On Yourself only makes it easier and a lot more fun to save, knowing you don’t have to worry about when the market is going to crash again, taking your hard-earned money and dreams of a worry-free retirement down with it.

It should also be noted that Dan (who now has nine policies) has used policy loans numerous times to make major purchases. In fact, at the time this picture of his net worth was taken, Dan had a large outstanding policy loan he had taken to buy a boat. But the continued upward march of his net worth is unmistakable, confirming from real-world experience that using a Bank On Yourself policy for financing purchases is not the losing strategy Roth portrayed.

Am I being naïve?

Some people have told me I may be too naïve, and that maybe we didn’t fail to communicate the benefits of Bank On Yourself to Roth. Maybe Mr. Roth had an ulterior motive for insisting on comparing how much money he’d have if he bought a car through a policy, against not buying a car at all – especially after the flaw in his logic was explained to him nine different times by three different people.

They point out that Mr. Roth:

- Boasts that he does not have an insurance license and has never sold an insurance product. Yet apparently he’s enough of an expert on life insurance to have written an “exposé” on every cash value life insurance-based concept that attracts the attention of his clients

- Roth appears to have created a second job for himself publishing articles on his CBS News MoneyWatch blog criticizing financial experts ranging from Rich Dad, Poor Dad best-selling series author Robert Kiyosaki, to legendary bond fund manager Bill Gross, demographic trend expert Harry Dent and others. (I guess that puts me in good company!)

- Roth has NEVER met a cash-value life insurance product he likes and insists you should buy “only the insurance you need and make sure it’s low-cost term insurance.” And for only $350 per hour, he will be happy to help you invest the money you “save” in the stock market, although he says he’s looking for an alternative to the volatility of the stock market

Roth fancies himself as an expert in “behavioral finance,” which looks at why people – including the experts – keep making the same money mistakes over and over again. It’s a fascinating field, and one that has intrigued me for years.

Roth teaches people they should buy low-cost index funds and then avoid buying and selling emotionally. That sounds like good advice, but if it’s that easy, why do 80% of all mutual funds and investment advisors underperform the markets?2 And why does the typical investor consistently and significantly underperform the market?3

Roth keeps hinting that there are “techniques” which both large and small investors can use to “invest their assets in a much more logical, non-emotional manner.” But he himself admits his “techniques” don’t work! In a 2008 article he wrote…

I can’t seem to resist the human urge to find the next hot stock. If I can’t resist that urge, how can I possibly expect my clients to do it? I can’t!”4

Perhaps Roth should take a page from Carl Richards, one of the few financial experts Roth has anything good to say about. Richards wrote a book on behavioral finance, and when I interviewed him for my blog in April 2011, Carl said, “ I’ve determined that the solution is to take the sharp power tools away.” And that’s one thing Bank On Yourself policy owners say they love—there’s no luck, skill or guesswork – or will power – involved.

If you want to see the full explanation of how Allan Roth’s $12,000 grew to $13,748, you’ll find it here, in my first reply to Roth.

Note: There are numerous other inaccuracies in Mr. Roth’s article that I’m not going to address here. I think you get the point.

Roth takes issue with my sound bites

Roth’s biggest complaint with me and my book may be the sound bites that appear on the book’s cover and in the chapter titles related to getting back or recapturing the money you spend on major purchases.

Sound bites are designed to cut through the clutter, and we needed all the help we could get, since we’re going against Wall Street and conventional wisdom. Perhaps I could have used different sound bites on my book cover and in my chapter titles.

But Roth is hardly one to point fingers. His main sound bite is that a second grader can beat Wall Street. Yeah. And so can monkeys throwing darts.

I expand on the “get back every penny” concept at length in my book as a process of first saving up for major purchases in a carefully crafted dividend-paying whole life insurance policy, then borrowing from your policy (not from a finance company), and then repaying your policy loans, so your money is available for you to use for subsequent purchases and/or to fund your retirement. This avoids the traps of conventional financing methods and the volatility and unpredictability of traditional investment strategies.

My book contrasts the Bank On Yourself method with conventional financing methods

Example: If you finance a $30,000 car with a bank loan, the interest you pay goes to the bank and you’ll never see it again. All you’ll end up with is your car, worth whatever its trade-in value is. If you lease the car, you turn your car back in at the end of the lease and you’ll have nothing at all to show for your payments.

If you save up money in a savings account and then take the money out to pay cash for the car, the bank won’t continue paying you interest on the money you withdraw.

However, if you use the method described in my book to buy a car, when you’ve paid off your loan you have your car, and the money you paid for your car is now in your policy, available for you to use again. On top of all that—if your policy is from one of the handful of companies that offers this feature – you continue to receive the exact same dividend on ALL of your money – as if you’d never taken it out to buy the car!

Finally – and this is VERY important—the interest you pay on the policy loan is recouped through the full dividend you receive – unreduced even though you have a policy loan. Again, not all companies offer this feature. (Learn more about how Bank On Yourself policy loans work here.)

Why put your money where you need to

cross your fingers and hope?”

Bank On Yourself is based on logic and real actuarial science – and an asset that’s increased in value every single year for over 160 years.

What other strategy or product gives you all these advantages?

Keep in mind that Allan Roth is an investment advisor who tirelessly promotes investing on Wall Street, who happens to be a blogger. He is not an investigative reporter. For the record, we worked with a Pulitzer Prize-nominated investigative journalist who spent more than a year investigating Bank On Yourself and reviewed Roth’s article and all of his correspondence on this matter. The result of that in-depth investigation? This investigative journalist bought a Bank On Yourself policy for his family!

But at least now, when Allan Roth’s clients ask him about having the guarantees and predictability in their plan that Bank On Yourself provides, he can send them his article and tell them, “Oh, I already exposed that.” And then pray they don’t discover the truth.

We want to hear from you!

We really want to hear from you! What is your experience with Bank On Yourself, whether your journey started from reading my book or from any other source? Has Bank On Yourself given you the “refuge from volatility” Allan Roth says he’s seeking? Have you used your policies to finance major purchases and what has your experience been with that? Have you had an experience where having money safe and available to you in your Bank On Yourself plan saved your butt? Do you have a great way of explaining how making major purchases through a Bank On Yourself policy works better than the alternatives?

We’ll pick the 10 most interesting or insightful comments made on this blog by midnight, Monday, December 10… and give those posters their choice of a $25 gift certificate for a restaurant in your area, or a personally autographed copy of my best-selling book. (Just in time for the holidays – this could make a nice gift for you or someone you care about!)

Here are the simple rules to participate:

- You must be a US resident over the age of 21.

- Your post must be made on this blog in the comments below no lather than midnight on Monday, December 10th. You must include a valid email address to qualify.

- The 10 winners will be notified no later than Wednesday, December 12th and must respond within 24 hours with a valid street address in the U.S. for shipping, if you choose an autographed copy of the book as your gift and wish to receive it before December 25, 2012.

- You may post more than one entry if you wish and there will be only one winner per household.

- Gifts will be awarded based on how meaty, informative and insightful the comments are, as determined by the Bank On Yourself team and comments others may make on your comments. But please keep your comments focused on your Bank On Yourself experience. We have to hope Allan Roth has understood where his analysis fell short, so, there’s no need to cover that ground again.

- The decisions of the Bank On Yourself team are final and, by participating, you agree to hold Bank On Yourself and its principles, employees and related companies harmless. Any posts deemed inappropriate by Bank On Yourself may be edited or deleted.

- The list of winners will be posted on this blog before December 31, 2012. All entries become the property of Bank On Yourself and by submitting an entry you give permission to Bank On Yourself to quote from or publish your comments.

(Please note that the link to Allan Roth’s article is a static link, rather than a live link, just to make sure that you have all the facts and information as they existed before this rebuttal was published.)

- Based on the current dividend scale. Dividends are not guaranteed and are subject to change. Bank On Yourself Professionals use companies that have paid dividends every year for at least 100 years

- Hulbert Financial Digest, July, 2009

- DALBAR’s 2012 Quantitative Analysis of Investor Behavior

- “Core and Casino,” September 1, 2008, FinancialPlanning.com

Dear Pamela Yellen,

To simplify a response to the myths presented….Purchasing a car with the funds accrued in a B O Y policy does not allow a dealership to make additional money on the transaction through financing. Most people finance a vehicle through the dealership plus interest. The B O Y policy holder pays themselves back with interest and bolsters the value of their policy which would allow the policy holder to borrow more funds at a future date. This strategy creates a win/win scenerio for the B O Y policy holder. If more people paid cash for their cars earning interest on the transactions, more people would find the money they need when they need it ….

“If more people paid cash for their cars earning interest on the transactions, more people would find the money they need when they need it ….”

_______________________

Bingo! IMO, financing a vehicle is a serious mistake & I have a real simple rule — if I can’t afford it with the cash in my pocket I don’t buy it. I worked in the car/truck business for a good while & if you knew how much $$$ you were losing financing a new vehicle every few years you wouldn’t do it.

I have been using Bank on Yourself Designed policies for over 8 years. Purchasing my first policy on my one year old son. The insurance was cheap on him and I could test out the waters of the concept. Well, 8 years later, I have 5 other policies now, so 6 in total. My young family of 4 is all insured and we do exercise those policies and pay them back. They continue to be a source for us to fund major purchases. This last year, we remodeled a portion of our home using policy loans. We also used policy loans to fund the down payment on an investment property. We have formed a real estate LLC and plan to purchase a new home every couple of years to add to our wealth building. Getting the mortgage loan people to understand where the money was coming from for our downpayment was a bit of a hurdle, but worth every email and conversation I had to have to explain the source of the funds. We plan to add a new home to our next egg every couple of years. These are income generating and tax saving investments, all possible due to our life insurance, and we are all covered!

Hello Mark Stanley. I just read your write up on the Bank on Yourself ideas and I would live to know more about how you convinced yourself to try it over what Dave Ramsey suggests as safe mutual fund investing. I almost signed up for a Bank on Yourself policy a few years ago, but we decided to wait until we were debt free. Now we are, so we are thinking about following through this time. But, we still have that little lingering doubt. I like the ideas and the stories, but I know of noone who has used this and I keep hearing how dangerous this type of whole life insurance policy is over a term life insurance policy. Any suggestions on next steps to research before I jump in with the BOY plan? Thanks! Kerry

Kerry, a good place to start is on our Suze Orman and Dave Ramsey: Let’s Debate blog post, where we prove with actual policy statements that the whole life policies Suze and Dave love to hate are TOTALLY different from Bank On Yourself policies!

Then check out the Bank On Yourself reviews and success stories.

I can empathize with Mr. Roth. It is hard to perceive how purchasing a car through Bank on Yourself (BOY) would be better even than paying cash for something. When you think about it in the near term, it doesn’t look very pretty:

Option 1 – I pay cash for my $10,000 car. Its mine fair and square.

Option 2 – I take out a loan from my BOY Plan and use it to pay cash for the car. Then I pay back the loan. It “feels like” I just paid $20,000 for the same car. Yeouch!

In Option 2 – I had to save for the car in my BOY plan, just like I had to do in my savings account. Sure, its nice that the plan keeps growing after I’ve loan the money out, but now over the next 2-3 years I make payments equaling $10,000 + interest I charge myself to pay off the loan. Did I just pay $20,000+ for a $10,000 car, just to earn a little interest while my money was loaned out?

— That’s the blinders I see Mr. Roth wearing. The best thing to do is to think LONG RANGE. In Option 1, I save then I spend. Do I ever get to see that $10,000 again? Nope! But in Option 2, it seems to me that I DO see that original $10,000 I used to capitalize my BOY plan…when I retire!

Upon retirement, my wife and I will pull out every single dollar we put into our policies, plus we’ll pull out the gains we made over the years. Unless putting it in a savings acct to spend once, its like we’re recycling our money – over and over for the many cars we’ll buy over our lifetime, and finally we’ll pull the money out at retirement.

Its the difference between recycling and throwing your money away after only one use. Sorry Mr. Roth, you’ve gotta think long range!

Plus, you left out the best part, Mark. If you take 10k out of your savings, it’s gone. When you take the 10k out of your BOY plan, it keeps earning the same interest rate as if it was still there! So it’s a double bonus!

Mark, you’re so right in your analysis!

…and here’s another reason why “you’ve gotta think long range”, as you say…

Life insurance companies never have to pay a death benefit on 99% of term life policies issued.

So, most people are going to live much longer than they might think. Therefore, if one thinks that paying premium to build cash value, and then borrowing against that cash value to make a large purchase, and then paying the loan back, is like paying twice as much for the purchase…then they either plan to die soon, or they aren’t thinking this through.

With a BOY-type policy, you benefit big-time if you live a normal life span or beyond, and your loved ones benefit (tax-free) if you don’t. What other plan can make that promise?

I personally have not yet started a policy with Bank on Yourself. I heard an advertisement on the radio and then subscribed to get the information. I read the material and found that it made sense what Bank on yourself was all about. But I honestly put it aside because I had never heard of such a thing but that does not mean I did not believe it was real. When I am curious about something I usually do my research. I bought your book recently so that I can get more information and learn exactly how it can benefit me. Well not to long ago I was studying to be an insurance agent and in the training there was information about what you talk about. So that alone solidified my instincts were right. I do not have a policy yet but I will jump on board because I have plans to use some of the money to start my own business. Anyway, I read the article and the guy appears to be close minded. He thinks the only way to make money is through stocks…It is his meal ticket and some people believe so deeply in what they do that they are blinded by other great opportunities. I also think he wants to keep his following. I think his conclusion is confusing and makes no sense. If there was something truly wrong I think he would have (and many others) would have pointed out clearly for people to understand and you would have had to explain yourself and perhaps change how you promote Bank on yourself letting people know of the risk he pointed out…but he did not. My conclusion? You have something worth trying here and although I don’t have a story on actual experience I can say that based on my research I will be on a policy and recommending it to my family!

Pamela – has said it best in plain english. To throw my two cents in the mix – that when I buy my expensive items in my life such as a car – I very much enjoy having my Car, my policy has the cash, and I have earned 36 months of growth on my capital in my policy. It sure beats the alternatives – such as – I have my car and the dealer / lender has the cash and no compounding growth. Which way would you prefer?

You can’t save them all Pamela!! Thank you for holding your ground and educating the masses.

My husband and I are in the process of getting our first BOY policy. There should be responsibility in the advice Mr. Roth is giving to anybody that read his blog. If you haven’t tried how do you know it works? He should try and disprove the BOY first before he can say it doesn’t work. The reason I said this because we have tried stocks and many other investment strategies we can afford with every little money we have and none gave us anything back. NONE!!!!! We have read and “seminared ” ourselves out to make a future for ourselves and our children and spend “every penny” (no pun intended) we have and NONE worked. I challenge Mr. Roth to try it and see for himself, like some of us. Put your own money on the line before you can say it doesn’t work and be humble to say you are wrong if it works. If I advice people about anything that pertains to spending their sweat and blood on something , I will make sure I have all the scenarios covered. It’s people’s lives, Mr. Roth, have some guts to truly help. If BOY works and you don’t advice people to try it, then you fail them miserably and the future of others that rely on them.

I got a gift of $500 from my grandparents when I graduated college in 2007. They suggested that I invest it with their financial adviser to get some experience in the market. Since I had been hearing the “normal” strategies in classes and from my family, I thought I would add another $500 myself. So, after talking to the very successful financial adviser, i wrote him a check for $1000, and after reviewing my risk tolerance, he invested my money in some emerging market funds. About a year later, I needed the money and cashed it in for $600 (40% loss), and if i had left it invested for an additional 3 years to present it would be worth $592. (I leave it up on my home-screen to remind myself). I will never follow the “conventional wisdom” of that financial adviser or Allen Roth ever again, because from my own life experience, it lost me money (but did put a small amount of money in the adviser’s pocket). Roth says he is looking for a safe place to put his money, but when one stares him in the face, he bashes it, with the proof staring him in the face… I would have been better off to put my $1,000 under my mattress, or better yet, in a Bank On Yourself policy.

The good news is that you learned this lesson at a young age. That can spare you the grief and financial insecurity so many people in their 40’s, 50’s and 60’s are experiencing. They sweated and saved money for DECADES with little or nothing to show for it.

His reasons were not valid, as you said, and he missed the point of BOY, which is safe, long term retirement investing. Being your own banker is just the icing on the cake. The cake itself is steady growth of retirement income that you and your family can count on.

The old adage “There’s no such thing as a free lunch” is known by most but understood by few. There is a cost for any service or product received that is not exclusively the product of your own efforts (and even your own efforts could be conceived as involving an opportunity cost). People receive a tax refund or product rebate and consider it “free” money without recognizing that both involve direct costs. But the beauty of a BOY plan is that it is the vehicle for the cheapest lunch around. You set money aside in a policy where it earns interest and dividends at a dependable rate. You have access to a large portion of the money you set aside, and the interest/dividends earned, to purchase things while that same money continues to earn uninterrupted compounded returns. You pay interest on the money you use but that interest also adds to the interest/dividends you receive. So if you assume you will purchase stuff, how can you beat a savings plan that allows you to spend saved money without interrupting the earning power of that same money? Your only cost is a reasonable interest rate which contributes to your compounding financial return. Nope, that “lunch” is not free. But clearly it is the closest to free you can find…and it can be used over and over! Mr. Roth does not want to accept it so he will not. It is not in his professional interest to lend credence to BOY. But the absurdity of his refusal to accept the truth only makes the BOY approach look the more credible. We currently have one plan and will be adding more as cash flow warrants as our primary savings vehicle.

Pamela,

Thanks for all the good things you are doing. I am working with Aurael to

set up my third policy and I am so appreciative of her guidance and

expertise. She has been tremendously supportive.

The real “snake oil” is all of the purported advice about savings and

investing we have been fed by the “experts” in the past. Aurael will tell

you how fired up I get by the advice to invest with before tax dollars into

401k’s or 403b’s ( the Fed Thrift Saving Plan for government and military).

I am now over 65 years old and faced with withdrawing funds from these plans

and now have the added burden of paying taxes on them. In addition, once I

reach age 70 and 1/2, I must begin taking minimum withdrawals so that the

IRS can get their hands on the taxes they know I’ve avoided paying all those

years. I wish that not only I had learned about BOY, but that the concept

could be taught to the masses when they are young enough to really benefit

from it.

Here is why I say that. I think of all of the purchases I’ve made through

the years where BOY would have been a much better means to fund them. As an

example, my sons college expenses which I paid every cent based on selling

stock and mutual funds and a loan from a 401k. Needless to say my son

received a great education (to his credit) but dear old Dad has nothing to

show for it. If I had been funding a BOY policy (or policies) because let’s

face it, I had to put money into the stocks, 401k, and mutual fund, so I HAD

the resources at the time which could have been so much more powerful in a

BOY policy! It’s as simple as that. And now I would still have the policies

which would have even more value.

I am depleting an IRA to fund the third policy and to help fund policies one

and two so that I will be tax free ( I will have to pay tax on the

withdrawals) by the time I turn 72. I just hope I live long enough to see

it.

This is just one persons view, but I belive it is pretty clear what the

advantages of BOY are.

Thanks, best regards, Merry Christmas and Happy Holidays,

Bill Williams

Well put, Bill! Your post also proves that folks in their 60’s can benefit from starting Bank On Yourself plans.

People can learn more about how Bank On Yourself works for people between the ages of 60 – 85 on these two videos.

Mr. Roth & many of my my close friends just don’t get it; and I admit, it took me several months to digest and accept that B.O.Y. was truth in action. Even with our recent results at the polls, and the looming fiscal cliff which will drive the harshest critic crazy, there is one thing that brings balance to it all: I’ve just celbrated 3 years with Bank On Yourself and I have NO REGRETS. I’ve purchased home appliances, paid off an Equity Line Credit, helped my son buy a house, and most recently purchased my wife a new car. Knowing I can sleep at night for the next 15 years before retirement eliminates my worries about what Washington might do! And as for the taxes, pre-tax or post-tax on your retirement planning…..listen to the news.

Derek P. Logan

….and I would add to this,

“I bet Mr. Roth did NOT collect on your $100,000 offer.” 🙂

Keep up the good work!

Derek is referring to our $100,000 Challenge. We interviewed Derek – who is a corporate accountant/controller – about his Bank On Yourself journey. You can check it out here.

Pamela,

I read Mr. Roth’s article and looked at his numbers pretty close. There are several interesting things about them. First he says he paid 12k extra for the car. On a 30,000 loan for four years that’s almost 18% interest!!! Second he says the cash value only increases by $8,759 or as much as $9,832. What about the car? He still owns it and using the average depreciation for a $30,000 car for four years it’s still worth $15,813!!! If you add that to his numbers he has $24,572 or as much as $25,645 more in assets than if he didn’t finance the car.

That’s pretty good when you consider if he financed the car from a bank and paid the same interest he would have the car worth $15,813 but he wouldn’t have the money. That means it cost him $26,187 to own the bank financed car for 4 years. (or less if he paid a lower interest rate but he still only has the car and not the money!)

So in the Bank On Yourself example why doesn’t he understand that he borrowed $30k and paid that back plus using his numbers $12k extra and now he has about $25k more than he started with? You could make the argument that the $30k was a wash… 30 out and 30 back in so the extra $12k created around $25 k in additional assets. That’s a little more than a 100% return on his extra $12k. Not bad in 4 years!

I really think you should Change the Well, duh! to a Well, double duh!!! (I’m thinking something a little less nice than that but it is getting close to Christmas…)

Mr. Roth ends his column with this line…”The greatest risk in swallowing the latest financial elixir is wanting to believe that it will work.” (Huh?)

I think the greatest risk in swallowing any elixir is that won’t work! I don’t see any risk in wanting to believe that it will work!

The takaway? I’ll take a big jug of that Bank On Yourself Elixir anytime I can get it!!! My greatest risk will only be whether or not I pay myself back when I borrow money from my policy.

Happy Holidays

Scott

Great points, Scott! The part about how Allan Roth would have the equity in his car, too, somehow never even occurred to me!

But for Roth to include that in his calculations would require him to stop comparing buying cars through the policy versus not buying them at all – and he wasn’t about to do that.

Was the Roth IRA named after Mr. Allen Roth?

As a bank on yourself consumer (for 8 years now) and business owner, I have been able to use my BOY policy to help me finance 2 new cars, new furniture for my home, landscaping work, braces for my kids, my daughters college semester in Venice, Italy and a few nice trips for my wife and I (and many more coming). Plus, I have been able to utilize my BOY plan for multiple business financing needs as well. I love it. I’m borrowing at simple interest but I set up my personal loans at 8% and my business loans at 10% and pay myself back monthly so I can profit from the compounding monthly payments (exactly the same way I use to pay the banks and credit card companies).

Recapturing the interest I would have paid on bank financing or credit cards was just the beginning. What’s always on the back of my mind is how now, I am able to increase the “velocity” of my money (just like the banks do) plus recapture my “lost opportunity cost” back for myself.

Being on the tail end of the baby boomer generation (born in 1963) do you think I want to try and build my retirement income security with all of these boomers retiring ahead of me and creating this massive headwind pushing stock values down (and thus pushing me backwards instead of closer to my goals) for what I can see as the remainder of my lifetime? What do you think is going to happen to the stock market values as more and more people reach retirement age and stop working and have to take an income for the rest of their lives from their IRAs?

Mr. Roth is a professional advisor and people surely pay him for his advice and insight. He set out to validate what he does and looked for ways to edify himself and justify his fees. He’s a money manager and will sing like a canary to the toon of the stock market. It is funny to me how some very intelligent people don’t get it or should I say, don’t want to get it. It’s common sense.

Cheers,

Peter Garcia

I was going to write a long story on how my BOY policy has saved me from some potentially big issues. Just quickly I was between jobs and had to move for a new job across country! My new employer was not going to cover this move, fortunately I was able to borrow $5000 which is a lot. I used my AMEX to get the points for all the costs, paid myself back with interest from my new job AND will be able to write it all off on my taxes as a job related move. Serisouly does it get any better? AND I was earning interest on the money while it was borrowed out.

I think of BOY like Recycling, Good for your finiacial environment and the right thing to do. Imagine if you could have replenished every penny you ever spent with furture earnings over you entire life while earning intrest on the money? WOW. Saving and spending is like putting water in a bucket with a giant hole at the bottom. Borrowing and spending is like standing in a water with your finger in an electrical socket. BOY plugs that hole your bucket.

For me, there’s no better way.

I have had a BOY account now for 8 years. We borrowed money to keep us alive during the severe 2008-present crash and personal burn. Not only was the policy exempt from BK courts, it has continued to earn dividends upon dividends. As the great Einstein once purported to say that “Compound interest was the greatest invention”, and if he didn’t say it, someone did and was it ever so true.

I have run the numbers over and over, done excel spreadsheets, and run many what if’s queries, only to find that BOY not only works, it does so amazingly. What is also interesting, that when it is set up correctly, you can and do actually earn money on your car, house, vacation or whatever you spent your money on using BOY. Yes, the company charges you for the money you borrowed against your account, but the dividends you earn offset those annual interest payments.

Also, what is never explained very readily is that, depending on your policy, company, or arrangement your BOY is written for, the loan you take on your policy, has a lien until it is paid off on the policy itself. Everyone forgets the death benefit and they think that the cash value should be in addition to the policy value, thus giving you more money than the policy says it is worth.

This is like telling a mutual fund manager, that you put, say 10K in a fund and though they charged you 1-2% on the fund value, that when you cash it out after 20 years, you are due the 20-40% that the fund manager took to run your particular portfolio. In real terms, it is NOT going to happen.

I tell so many people regarding BOY and the benefits, but something’s are not to believed and this is why there are sheep out there waiting to get fleeced, or in the vernacular, zombie meals.

Not only do my policies grow as expected and projected, I have them through my company, so I am getting an added benefit of the expense write off and as I pay back the loan, the expense write off of the interest I charge myself, thus making it a triple or even quadruple gain overall.

I think the US population is now so thoroughly dumbed down and don’t understand what the difference of steady earnings with double dividends (compounded interest) and the ability to have your own personal financial institution at your beck and call that they will continue to use 401K’s, 523 education accounts, etc and never realize that the US Government is actively working to keep YOUR money from you (even when you die).

Next step, to get my daughter her own account so that she will be financially sound by the time she is 35 yrs old.

you’re treading a very fine line here Pamela. You continue to use the phrase “borrowing from your policy” and “paying yourself back” these, in my opinion are the two phrases that should be eliminated from your rhetoric. Mainly because you are making this, as Roth puts it, sound too magical.

As a seasoned (aka much older than you) insurance professional you need to help people understand they are borrowing AGAINST their policy and paying THE INS. COMPANY back.

Don’t get me wrong you are doing a good job educating the public about a concept that can be very beneficial based on the situation but you are making it seem too good to be true and that makes people like myself shutter. You are tainting this very small niche with fairytales about recapturing your own money and borrowing from yourself.

You borrow from the ins. co. using your own cash value as collateral – that’s it. The ins. co. charges an interest rate which is historically equal to or slightly lower than the crediting rate on your cash value. I see it as a wash – or a loan at 0% that allows you the flexibility to pay it back on your terms.

please do us a favor and stop making this seem like more than it is. Anything that sounds too good to be true usually is and you are making it sound that way.

Thank you for your concerns. I make it very clear that you are borrowing against your policy and the money is coming from (and being paid back to) the insurance company’s general fund on pages 101-103 of my best selling book and also in my consumers guide to policy loans.

I think it’s precisely because you are borrowing against your cash value and using your death benefit as collateral for the loan that policy loans (especially from a non-direct recognition life insurance company), may well be the 8th wonder of the world.

I think there are many more reasons for that than you listed. And so do clients who’ve used their policies this way!

Also – who owns and controls the cash value in a policy? The policyowner, of course – and that’s contractually guaranteed.

So, if you’re borrowing from (or “against”) your policy and then paying the loans back, how is it inaccurate

to say you’re borrowing money from one of your “pockets” and paying it back to that “pocket”? Saying you’re not borrowing from “yourself” is really nit-picking, don’t you think?

I explain why I believe it beats financing, leasing and directly paying cash for things, and those who use their policy this way agree. Check out the comparison we did on using a savings account versus a Bank On Yourself policy to finance things. I’m willing to be convinced otherwise, but have yet to see any convincing arguments.

Hello – After reading this article and Pamela’s email reply to Allan Roth (a couple times to make sure I didn’t miss something), it seems as though you are in fact better off by $1,748 if you buy a car rather than not buying at all. Have I misread the above? Is one not better off by $1,748 over time via financing using BOY? Full disclosure: I have a BOY policy, but have never borrowed against it.

This appears to be Allans’ final comment on the topic. Frankly, I’m stunned he said this.

Mick, thank you for pointing out this comment Allan Roth made on his review of my Bank On Yourself book. We turned the link into a screenshot, in case Roth realizes how damaging his comment is to his reputation and edits or deletes it.

In Allan Roth’s comment, he acknowledges both that he has no effective strategy for helping people build substantial wealth… and if he did, he wouldn’t share it with anyone else, because he “could no longer get rich from it.”

I’ve had to get used to biased “exposés” of Bank On Yourself, because what really works goes against the conventional Wall Street “wisdom.”

Does anyone have any input on how a BOY policy compares to an Indexed Universal LIfe Policy?

No other type of life insurance product comes with as many guarantees as whole life insurance. The ONLY piece of a dividend-paying whole life policy that’s not guaranteed is the dividend.

I encourage you to read these two non-biased articles comparing universal life and equity-indexed universal life to whole life, and then come to your own conclusion:

Equity Indexed Universal Life versus Dividend Paying Whole Life

Whole Life Insurance vs. Universal Life Insurance

I hope this helps!

A few misconceptions in the above comments. First, you don’t earn interest on what you borrow from yourself. You are really borrowing from the insurance company. The cash value is just the insurance company’s security for the loan. so instead of borrowing from a bank, you are borrowing from a life insurance company. You could do better

keeping the same money in a bank and paying cash far a car. Then your only “cost” is the implied opportunity cost

of not having those funds. When you pay back the principal, with interest, to the insurance company, there is nothing to celebrate here. You lose the interest and pay back the principal, just like any other loan. One could pretty much do the same thing, without all the fees and costs of the life insurance policy, which even are expensively are front loaded, by buying municipal bonds in the state where you live, which are federal and state tax free. Yes, the bonds don’t contain life insurance, but most people re not buying these policies for that feature. also, if you want the life insurance, it is cheaper to just buy term insurance for that component.

You have some misconceptions here which can be cleared up by reading this article about how Bank On Yourself policy loans work. Municipal bonds?1? Seriously?!? There is more than one advantage of Bank On Yourself (life insurance) they don’t have – see for yourself when you take my $100,000 Challenge.

It seems to me that a central problem in Roth’s analysis and to a large degree in the discussion, is that we are talking about Life Insurance – LIFE INSURANCE – with long term benefits after having paid some consistent years of premiums; benefits which one probably cannot find elsewhere. Yet, we cannot help but focus on the Bank on Yourself angle because it is so unique and exciting. The truth is and where I feel things go off the rails is that the focus should be on protecting oneself, their family and assets through buying this particular type of Life Insurance. Everything else (the BOY concept, etc.) can be put in an “added benefits” column. But, too much focus is placed on the BOY part which confuses people, sounds unreal, and makes people like Roth endeavor to pick it apart. One should first decide upon whether or not this type of dividend paying life insurance is right for them vs other types. If it is, then that is really all that matters. The remainder of the discussion (BOY, etc.) is optional and an added benefit for using the insurance according to the BOY strategies but keep in mind, one can set up their plans and not take advantage of the BOY concepts and still have a great insurance policy. Nobody says you have to use the BOY concepts. It’s the Insurance vehicle unto itself that should be one’s primary basis for decision.

[…] had reviewed the author’s earlier book, Bank on Yourself, for CBS Moneywatch, which did not endear me to Yellen, a self-described financial security expert who says she has […]

[…] had reviewed the author’s earlier book, Bank on Yourself, for CBS Moneywatch, which did not endear me to Yellen, a self-described financial security expert who says she has […]

Why did you choose to use price returns for the S&P 500 and Dow Jones Industrial Averages instead of real returns, which would include dividends?

I DO discuss the impact of reinvested dividends right below my S&P 500 chart, as follows:

“Even when you include reinvesting dividends, the real purchasing power of your investment remains negative after 14 years! And this assumes you have no fees, commissions or taxes, which will take another big bite out of your savings.”

How did you manage to miss that, just like Allan Roth missed it? And if you and he missed something that obvious, what else did you both miss?

And then you have the nerve to compare me to The Beardstown Ladies on your post tearing me down on your blog on your AllFinancialMatters website? Based on my supposedly omitting something I clearly noted on BOTH my website and in my book?

I’ve come to expect that of Allan Roth. Hopefully you are a man of honor willing to admit when you are wrong.

You know, Mr. JLP, it’s easy to write whatever you want – regardless of the impact it might have on others – when you hide behind anonymity, as you do. I doubt you could take the crap and abuse I put up with on a daily basis for even one day if you used your real name.

Thanks for the reply.

I still don’t understand why you just don’t use total returns for all your numbers. Why the difference? You clearly emphasize price returns over real returns, do you not.

The reason is simple, JLP – I write my books for the consumer, not financial planners and investment advisors. Most consumers don’t know what the phrase “total return” means and would never be able to relate to the total return numbers of the S&P 500 index, or any other index.

When you turn on any market watch report or read the Wall Street Journal, are they reporting the total returns of the indexes? NO!!!!!!!! So, if I did, it would only confuse people!

Besides, the point I’m making is that I DID spell out that the chart in my book and on my website did NOT include reinvested dividends. Isn’t that what really matters?

But you never did address the issue I brought up in my statement: Even when you INCLUDE the dividends, the returns did not even keep up with inflation!!!!!!

Now riddle me this:

Why do you and Allan Roth both ignore the fact that the stock market returns you are talking about are BEFORE fees and commissions, BEFORE retirement account fees, and if investing in a tax-deferred account like a 401k or IRA, they are also BEFORE taxes?

Then you turn around and have the gall to compare them against the return of a Bank On Yourself- type dividend paying whole life policy, which is shown AFTER fees and commissions, AFTER account fees and AFTER taxes!!!!!!!!!

But, somehow that’s okay, right?

The numbers in all the policy examples in my book are bottom line numbers after ALL costs and taxes are deducted. You’d know that if you bothered to read my book. At least you admit you haven’t read it and don’t intend to. Roth either only read 5 pages of the book, or just ignored the rest because it didn’t support his arguments.

It is the height of intellectual dishonesty, but it’s the only way you can make your strategy look good. And the cherry on top of it is that those following YOUR advice get the pleasure of worrying about whether the next crash will wipe out 50% or more of their nest egg again, right before they planned to retire.

So, the real question is this: Are Allan Roth and Jeffrey Pritchard of AllFinancialMatters misleading their followers?

Actually, I ran the numbers using Vanguard’s S&P 500 Index Fund. I adjusted the numbers for the monthly CPI index. It turns out you would have eeked out a paltry gain of .38% per year. Since these are inflation-adjusted returns and they are positive, a person would have kept up with inflation…just barely. I’m not here to tell you that the last 14 years have been great. They have not. But, that is only part of the story.

Let’s say we look at these numbers from a DCA perspective. It would be very rare for a person to invest all their money on March 24, 2000, right at the VERY PEAK of the S&P 500 Index. However, let’s say a person started dollar-cost averaging into Vanguard’s S&P 500 Index Fund on that date and adding the same dollar amount at the end of every month. Adjusting for inflation (if you would like my numbers, let me know and I’ll email you my spreadsheet), they would have had a personal rate of return (using Excel’s XIRR function) of 4.98% over the last 14 years. Not great, but not bad either considering how bad the market was over those years.

Well, I ran the numbers using the S&P 500 index numbers from Yahoo Finance and the inflation numbers from InflationData.com, rather than the numbers from a mutual fund, and there was no gain. And, given your demonstrated pattern of missing key data and reporting inaccurately, I am going to go with the numbers my team calculated, rather than yours. (But I can recommend a good reading comprehension course for you…)

But whether the gains beat inflation or not is interesting, but NOT the really critical issue, which you keep avoiding addressing. (I can’t imagine why…)

The KEY issue is that your numbers are BEFORE taxes and BEFORE all fees… and the Bank On Yourself numbers are AFTER all fees, commissions and taxes.

If you believe the taxes and fees are insignificant, you should be immediately stripped of any licenses you hold, as well as the “license” to run your AllFinancialMatters blog. (This is why most blogging isn’t writing. It’s graffiti with punctuation.)

Let’s say I give you the benefit of the doubt and assume you do know taxes and fees have an impact. Can you tell us how much a 1% annual fee over 30 years and a 25% effective tax bracket in retirement will reduce these returns?

I DO know the answer. Are you really as clueless as you appear?

Here’s a hint: According to the most recent 401k Averages Book, the average total plan cost for small plans is 1.46% per year per year. (FYI – IRA fees are usually higher.) Even the largest plans have fees that average 1%.

Fees that are added on, like 401(k) fees and mutual fund costs, compound AGAINST you. Deduct that 1.46% per year cost over a 30-year period. Or just run it with a 1% annual fee for 30 years.

Now let’s assume you’re fortunate enough to retire at “only” a 25% effective tax rate.

Tell me what’s left of your return?

Maybe 4.98% before fees and taxes “isn’t bad,” but it SUCKS after you account for fees and taxes.

Don’t just keep repeating yourself like a parrot! Run the numbers! And I DARE you to publish these comments IN FULL along with that result on your blog! (That’s assuming you could even calculate those numbers correctly – which is questionable.) In fact, I’ve noticed how you have conspicuously NOT included any of my comments on your blog. After all, they drive a hole as big as a Mack truck through your logic. And you’ve let the lies you originally published stand. Shame on you, Jeffrey Pritchard.

Additionally, isn’t it dishonest to pick the absolute market top as your starting point?

Why not be fair and pick the absolute bottom since March 24, 2000, run the numbers again, and compare results?

If I really wanted to slant the numbers, wouldn’t I have done the chart from a market top to a market bottom?

But I didn’t – I took it to another market high, ending the week my book got published. I suppose you would have me take it from a market bottom to a market top?

You have demonstrated that you are both dishonest and uneducable, Jeffrey Pritchard. I have a “3-strikes” rule on this blog – and you are now officially OUT. This conversation is over and you are now banned from this blog.

There were two scenarios in the car-buying that weren’t address that might give someone a reason to NOT use their

policy for a loan:

1)When buying with 100% cash (that you might have taken from your Bank on Yourself account) you can often negotiate

a big discount…..Paying cash rarely means paying full price for large purchases.

2)As far as leasing—if you can get a 0% lease and there is a possibility that having that car in another 3 years may not work for you, esp. with the rapid evolution in cars happening now, it’s better not to commit yourself to keeping it….