With much fanfare, the White House has announced the highlights of what they are recommending to help you save for a secure retirement. Will it help you… or hurt you?

Let’s take a look at the major provisions…

1. More Americans will be herded into a retirement plan system that most experts agree is broken

According to a newly released White House Fact Sheet, the administration wants to force many of the 78 million working Americans not currently covered by employer-based retirement plans into them. They will do this by requiring employers to enroll their employees in automatic direct-deposit IRAs, unless the employee opts out.

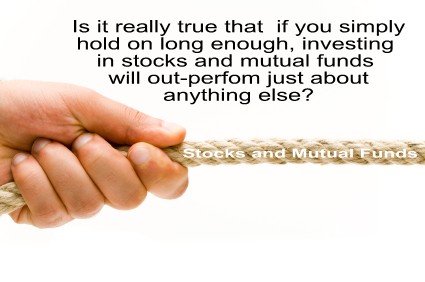

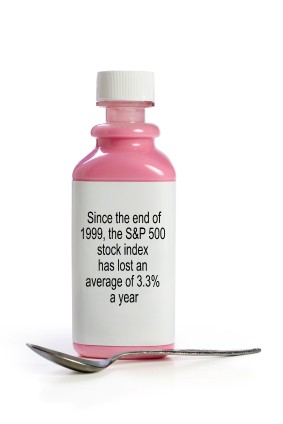

Experience shows most employees do not opt out. The result? Many more people will be relying on the same investment strategies that have lined the pockets of Wall Street and dashed the retirement hopes and dreams of millions of Americans.

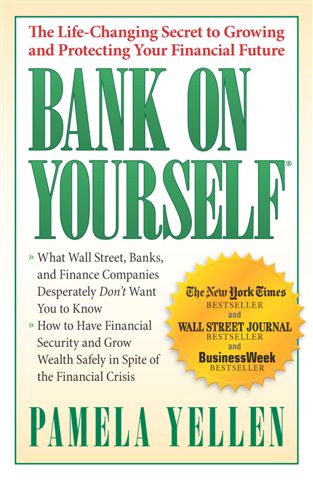

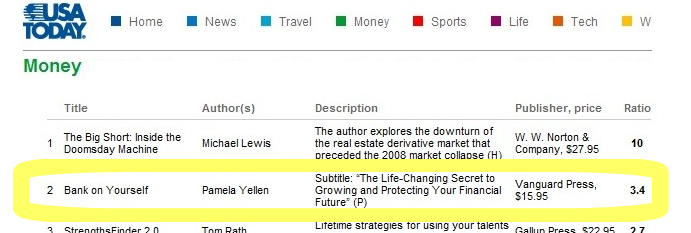

On the other hand, those who use the Bank On Yourself method have been able to move closer to their financial goals and dreams each and every single year. To find out how you could turn your back on the stomach-churning ups and downs of stocks, real estate, and other investments, request a free, no-obligation Analysis today.

2. Proposed tax credits for retirement savings contributions mean you will be paying for other people’s investment mistakes!

Even millions of Americans who pay no taxes will receive these credits, under the administration’s proposal.

3. Employers will be expected to do what even the experts can’t

Employers who offer so-called “target-date” mutual funds will be expected to “evaluate their suitability for their workforce.”

These funds, which automatically shift assets over the individual’s lifetime to lower risk as the person approaches retirement age, failed miserably to accomplish that goal during the 2008 crash.

In addition, studies consistently show that 80% of all investment advisors and 80% of all mutual funds underperform the overall market1. Yet employers with no training or experience will somehow be expected to determine which funds will do well.

4. The government wants to “promote” the availability of annuities and other forms of guaranteed lifetime income in 401(k) plans

Unfortunately, the growth and returns of some of these products may not even keep up with inflation.

5. Beleaguered small business owners will face new costs and administrative burdens

According to the National Small Business Association, 64 percent of small business owners surveyed said revenues declined in the past 12 months.

When small businesses are struggling to stay afloat, we oppose mandates such as this that stand to create a new administrative burden” – Molly Brogan, vice president of public affairs for the NSBA

6. The government controls your money in retirement plans, not you

The government determines when and how much you can take out of your retirement plan, and can change the rules any time they want.

Proposals to do just that have already been floated through Congress.

And if the government wants to force you to buy Treasury debt with part or all of their retirement plan money, because China and Brazil won’t take the risk any more, they can do it.

7. While expert after expert agree that the current systems of saving for retirement are broken, few offer any viable alternatives

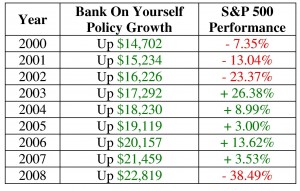

Yet hundreds of thousands of people who use the Bank On Yourself method did not lose a penny during the market crash of 2008, or during the “lost decade” of the 2000’s.

Their plans have all continued growing – safely and predictably, and without the risk or volatility of stocks, real estate and other investments. Which may explain why my offer to pay $100,000 to the first person who uses a different strategy that can match or beat Bank On Yourself remains unclaimed.

Bank On Yourself isn’t a magic pill. It takes a little patience and discipline. But if you have those traits, it pays a lifetime of benefits.

To find out what your bottom-line numbers and results could be, and how much income you could count on at retirement, just request your free, no-obligation Analysis.

REQUEST YOUR

FREE ANALYSIS!

If you take the first step now, you could start taking back control of your money and your future financial security in as little as 60 days!

1. Hulbert Financial Digest, The Motley Fool