UPDATED: March, 2022

I’m going to make a very bold statement that’s sure to get me some nasty blowback. But as a financial investigator who’s exposed the truth about the conventional financial wisdom, I’m used to that, so here goes…

401(k)s are a scam. Want proof?

Here Are Six Reasons Why 401(k)s Are a Scam…

Reason #1: The 401(k) Tax-Deferral Scam

In our immediate-gratification society, deferring your taxes by funding your 401(k) sounds so good, doesn’t it?

But when the tax man eventually comes calling, he won’t ask you to pay what your tax liability would have been if you’d been paying taxes all along. He’ll tell you what your tax liability is at the time your taxes are due.

Conventional wisdom says you’ll come out ahead by deferring taxes. After all, doesn’t that mean your entire contribution can go to work for you immediately? Unfortunately, like many assumptions about personal finance, this simply isn’t true. According to the Society of Actuaries, if tax rates remain the same…

“It doesn’t make any difference whether the taxes are taken away from you at the beginning (before you put the money in a savings vehicle) or at the end (tax-deferred). It’s the same fraction of your money that is left to you.”

If tax rates are lower in the future, you’ll come out ahead. However, most people, including most financial experts, believe tax rates must head higher, not lower, over the long term. And your retirement could last 20-30 years or more.

The reality is that you are probably sitting on a tax time bomb. Simply put, the government is going to need more money in years to come for several reasons. For example, let’s look at the numbers impacting Social Security and Medicare.

Today there are 62 million Americans using Social Security and Medicare. By 2045, 140 million – twice as many – Baby Boomers and Gen X-ers will be over 65 and requiring Social Security and Medicare. Where do you think the money to pay for that will come from?

Social Security and Medicare’s financial condition has deteriorated despite a long economic expansion. In fact, Social Security is already in a negative cash flow situation. What will happen to those funds in the next downturn?

And what about the national debt? Washington has not dealt with the government’s unsustainable debt and spending for decades, and as of March 2022, the national debt has ballooned to over $30 trillion – doubling in just the past decade! And it’s climbing at a head-spinning rate. (For a painful wake-up call, check out USDebtClock.org)

For all these reasons, the overwhelming likelihood is that tax rates will go UP over the long term, and when they do, then OOPS! There goes the whole 401(k) “tax-deferral” argument.

Reason #2: The 401(k) Employer Match “Free Money” Scam

[Read more…] “Six Reasons Your 401(k) is a Scam”

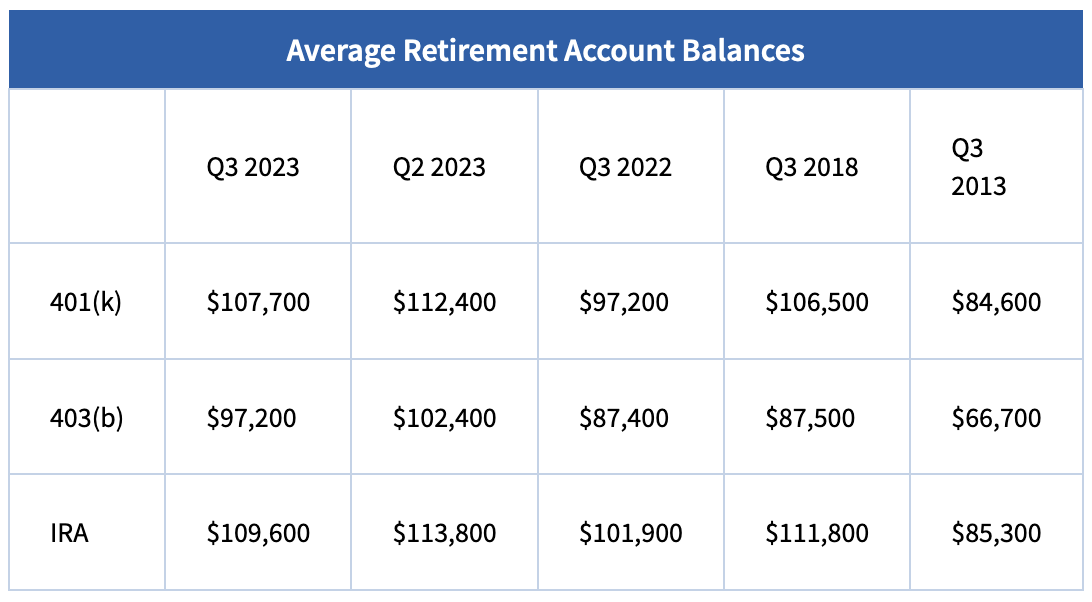

[Read more…] “Average 401(k) Balances Have Barely Budged in 5 Years”

[Read more…] “Average 401(k) Balances Have Barely Budged in 5 Years”